Hertz 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

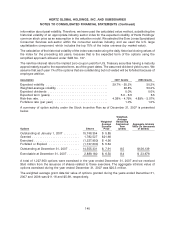

As of the adoption date, we had total unrecognized tax benefits of $20.3 million. As of December 31,

2007, we had total unrecognized tax benefits of $35.5 million, of which $8.2 million, if recognized, would

favorably impact the effective tax rate in future periods. The $27.3 million remaining balance of our

unrecognized tax benefits relates to pre-Acquisition items of $19.0 million and temporary difference

items of $8.3 million. To the extent that these items reverse, in the future, the pre-Acquisition items will

affect goodwill and the temporary items will affect current and deferred income tax expense in continuing

operations but will not have any effective rate impact.

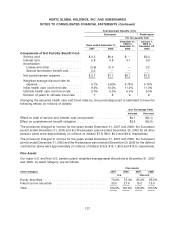

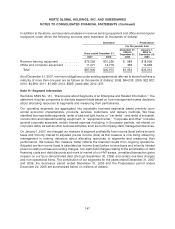

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in

thousands of dollars):

2007

Balance at January 1, 2007 ............................................. $20,281

Increase attributable to tax positions taken during prior periods ................... 6,465

Increase attributable to tax positions taken during the current year ................. 9,496

Decrease attributable to settlements with taxing authorities ....................... (693)

Balance at December 31, 2007 ........................................... $35,549

We conduct business globally and, as a result, file one or more income tax returns in the U.S. federal

jurisdiction and various state and non-U.S. jurisdictions. In the normal course of business we are subject

to examination by taxing authorities throughout the world, including such major jurisdictions as

Australia, the Netherlands, Brazil, Canada, France, Germany, Italy, Spain, Ireland, the United Kingdom

and the United States. The open tax years for these jurisdictions span from 1997 to 2007. A tax

indemnification agreement entered into with Ford on the Closing Date indemnifies Hertz from U.S.

federal and unitary state, and certain combined non-U.S. income tax liabilities for all periods prior to

December 21, 2005.

In many cases our uncertain tax positions are related to tax years that remain subject to examination by

the relevant taxing authorities. We are not currently under audit by the Internal Revenue Service but are

under audit in several non-U.S. jurisdictions. It is reasonably possible that approximately $19.0 million of

unrecognized tax benefits may reverse within the next twelve months due to their settlement with the

relevant taxing authorities and/or the filing of amended income tax returns.

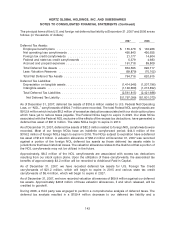

Net, after-tax interest and penalties related to the liabilities for unrecognized tax benefits are classified as

a component of ‘‘Provision for taxes on income’’ in our consolidated statement of operations. During

2007, we recognized approximately $2.2 million in net, after-tax interest and penalties. We had

approximately $12.0 million of net, after-tax interest and penalties accrued in our consolidated balance

sheet at December 31, 2007.

145