Hertz 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We believe that cash generated from operations, together with amounts available under the Senior

Credit Facilities, asset-backed financing and other available financing arrangements will be adequate to

permit us to meet our debt service obligations, ongoing costs of operations, working capital needs and

capital expenditure requirements for the foreseeable future. Our future financial and operating

performance, ability to service or refinance our debt and ability to comply with covenants and restrictions

contained in our debt agreements will be subject to future economic conditions and to financial,

business and other factors, many of which are beyond our control. Recent turmoil in the credit markets

and the financial instability of insurance companies providing financial guarantees for asset-backed

securities has reduced the availability of debt financing, which may result in increases in the interest

rates at which lenders are willing to make debt financing available to us. The impact of such an increase

would be more significant than it would be for some other companies because of our substantial debt.

See ‘‘Cautionary Note Regarding Forward-Looking Statements’’ and ‘‘Item 1A—Risk Factors.’’

Financing

Senior Credit Facilities

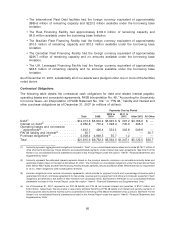

Senior Term Facility. In connection with the Acquisition, Hertz entered into a credit agreement, dated

December 21, 2005, with respect to its Senior Term Facility with Deutsche Bank AG, New York Branch as

administrative agent and collateral agent, Lehman Commercial Paper Inc. as syndication agent, Merrill

Lynch & Co., Merrill Lynch, Pierce, Fenner & Smith Incorporated as documentation agent, and the other

financial institutions party thereto from time to time. The facility consisted of a $2,000.0 million secured

term loan facility (which was decreased in February 2007 to $1,400.0 million) providing for loans

denominated in U.S. dollars, which included a delayed draw facility of $293.0 million (which was utilized

in 2006). In addition, there is a pre-funded synthetic letter of credit facility in an aggregate principal

amount of $250.0 million. On the Closing Date, Hertz utilized $1,707.0 million of the Senior Term Facility

and $182.2 million in letters of credit. As of December 31, 2007, we had $1,362.7 million in borrowings

outstanding under this facility, which is net of a discount of $23.4 million and had issued $242.7 million in

letters of credit. The term loan facility and the synthetic letter of credit facility will mature in December

2012.

Senior ABL Facility. Hertz, Hertz Equipment Rental Corporation and certain other subsidiaries of Hertz

entered into a credit agreement, dated December 21, 2005, with respect to the Senior ABL Facility with

Deutsche Bank AG, New York Branch as administrative agent, Lehman Commercial Paper Inc. as

syndication agent, Merrill Lynch & Co., Merrill Lynch, Pierce, Fenner & Smith Incorporated as

documentation agent and the financial institutions party thereto from time to time. This facility provided

(subject to availability under a borrowing base) for aggregate maximum borrowings of $1,600.0 million

(which was increased in February 2007 to $1,800.0 million) under a revolving loan facility providing for

loans denominated in U.S. dollars, Canadian dollars, euros and pounds sterling. Up to $200.0 million of

the revolving loan facility is available for the issuance of letters of credit. On the Closing Date, Hertz

borrowed $206 million under this facility and Matthews Equipment Limited, or ‘‘Matthews,’’ one of

Hertz’s Canadian subsidiaries, borrowed CAN$225 million under this facility, in each case to finance a

portion of the Transactions. Hertz and Hertz Equipment Rental Corporation are the U.S. borrowers under

the Senior ABL Facility and Matthews and its subsidiaries Western Shut-Down (1995) Ltd. and Hertz

Canada Equipment Rental Partnership are the Canadian borrowers under the Senior ABL Facility. At

December 31, 2007, net of a discount of $19.1 million, Hertz and Matthews Equipment Limited

collectively had $191.8 million in borrowings outstanding under this facility and issued $21.4 million in

letters of credit. The Senior ABL Facility will mature in February 2012.

Hertz’s obligations under the Senior Term Facility and the Senior ABL Facility are guaranteed by Hertz

Investors, Inc., its immediate parent and most of its direct and indirect domestic subsidiaries (subject to

certain exceptions, including for subsidiaries involved in the U.S. Fleet Debt facility and similar special

purpose financings), though HERC does not guarantee Hertz’s obligations under the Senior ABL Facility

because it is a borrower under that facility. In addition, the obligations of the Canadian borrowers under

86