Hertz 2007 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

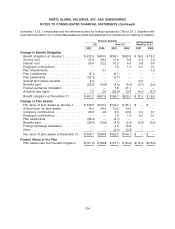

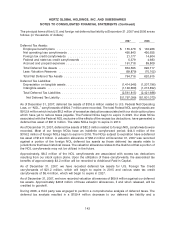

Pension Benefits Postretirement

U.S. Non-U.S. Benefits (U.S.)

2007 2006 2007 2006 2007 2006

Amounts recognized in balance sheet:

Liabilities .............................. $(121.5) $ (98.8) $ (37.1) $ (64.4) $(13.2) $(16.6)

Net obligation recognized in the balance sheet . . . $(121.5) $ (98.8) $ (37.1) $ (64.4) $(13.2) $(16.6)

Initial net asset (obligation) .................. $ — $ — $ — $ — $ — $ —

Prior service cost ........................ (0.1) (0.2) — — — —

Net gain (loss) .......................... (1.3) 13.1 29.5 (5.2) 7.2 3.6

Accumulated other comprehensive income (loss) . . (1.4) 12.9 29.5 (5.2) 7.2 3.6

Unfunded accrued pension or postretirement

benefit .............................. (120.1) (111.7) (66.6) (59.2) (20.4) (20.2)

Net obligation recognized in the balance sheet . . . $(121.5) $ (98.8) $ (37.1) $ (64.4) $(13.2) $(16.6)

Total recognized in other comprehensive income

(loss) ............................... $ (14.3) $ — $ 34.7 $ — $ 3.6 $ —

Total recognized in net periodic benefit cost and

other comprehensive loss (income) ........ $ 46.5 $ 26.2 $ (24.8) $ 9.4 $ (2.9) $ 1.1

Estimated amounts that will be amortized from

accumulated other comprehensive (income) loss

over the next fiscal year:

Net gain (loss) .......................... $ (0.6) $ — $ 0.7 $ — $ 0.6 $ 0.2

Balance sheet adjustment: Increase in accumulated

other comprehensive (income) loss (before tax)

to reflect the adoption of SFAS 158 .......... $ (12.9) $ 5.2 $ (3.6)

Accumulated Benefit Obligation at December 31 . . $ 377.2 $ 365.4 $168.1 $164.0 N/A N/A

Weighted-average assumptions as of December 31

Discount rate ........................... 6.30% 5.70% 5.51% 4.81% 6.30% 5.70%

Expected return on assets .................. 8.50% 8.75% 7.22% 7.22% N/A N/A

Average rate of increase in compensation ....... 4.3% 4.3% 4.0% 3.8% N/A N/A

Initial health care cost trend rate .............. — — — — 9.5% 9.5%

Ultimate health care cost trend rate ............ — — — — 5.0% 5.0%

Number of years to ultimate trend rate ......... — — — — 8 8

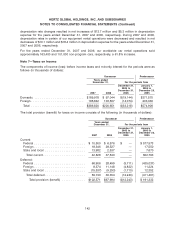

The discount rate used to determine the December 31, 2007 benefit obligations for U.S. pension plans is

based on an average of three indices of high quality corporate bonds whose duration closely matches

that of our plans. The rates on these bond indices are adjusted to reflect callable issues. For our plans

outside the U.S., the discount rate reflects the market rates for high-quality corporate bonds currently

available. The discount rate in a country was determined based on a yield curve constructed from high

quality corporate bonds in that country. The rate selected from the yield curve has a duration that

matches our plan.

135