Hertz 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

$156.3 million decrease to goodwill. We determined that these adjustments were not material to the

2006 or previously issued consolidated financial statements. In addition, further refinements in this

analysis and other processes were made during 2007 and resulted in an additional $41.7 million

decrease to the deferred tax liability and a $41.9 million decrease to goodwill. We have determined that

the adjustments recorded in 2007 were not material to our current or previously issued consolidated

financial statements.

The American Jobs Creation Act, or ‘‘the Act,’’ was enacted in October 2004. The Act contained a

provision allowing a one-time favorable tax benefit in 2005 related to the repatriation of foreign earnings

to the U.S. During 2005, in connection with the Acquisition, $547.8 million of foreign earnings from

certain foreign subsidiaries of Hertz were repatriated to the U.S. The repatriation generated

$168.2 million of tax expense, of which $136.9 million was mitigated by foreign tax credits, resulting in a

net tax expense of $31.3 million.

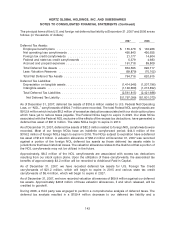

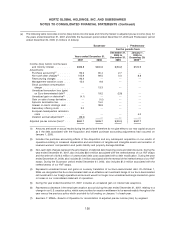

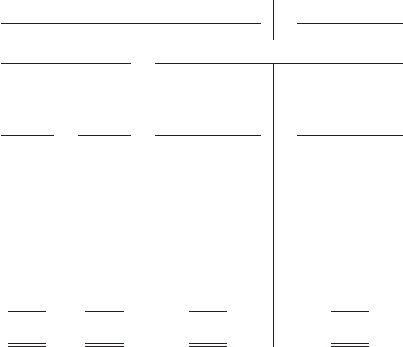

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the

following:

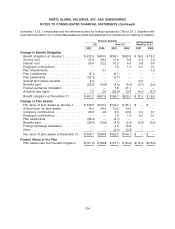

Successor Predecessor

Years ended

December 31, For the periods from

December 21, January 1,

2005 to 2005 to

December 31, December 20,

2007 2006 2005 2005

Statutory Federal Tax Rate .................... 35.0% 35.0% 35.0% 35.0%

Foreign tax differential ....................... (5.6) (4.8) (2.8) 2.7

State and local income taxes, net of federal income

tax benefit .............................. 2.1 2.3 3.4 2.3

Increase (decrease) in valuation allowance ........ — 4.9 — (6.1)

Change in statutory rates .................... (8.0) (5.4) — —

All other items, net ......................... 3.0 1.9 1.3 (0.6)

Effective Tax Rate ........................ 26.5% 33.9% 36.9% 33.3%

The reduction in the 2007 effective tax rate is primarily attributable to a net reduction in the global

valuation allowance mainly attributable to France and a reduction to the net deferred tax liability

attributable to decreases in statutory income tax rates in various jurisdictions.

As of December 31, 2007, approximately $181.3 million of undistributed earnings of foreign subsidiaries

existed for which U.S. deferred taxes have not been recorded because it is management’s current

intention to permanently reinvest these undistributed earnings offshore and it is not practicable to

determine such deferred tax liability. If, in the future these earnings are repatriated to the United States, or

it is determined such earnings will be repatriated in the foreseeable future, additional tax provisions will

be recorded.

We adopted the provisions of FASB Interpretation No. 48, ‘‘Accounting for Uncertainty in Income

Taxes—an Interpretation of FASB Statement No. 109,’’ or ‘‘FIN 48,’’ on January 1, 2007. Upon adoption,

we recorded an $18.9 million increase to our liabilities for unrecognized tax benefits. The increase in

liabilities was recorded as a decrease of $3.6 million and an increase of $15.3 million to the January 1,

2007 retained earnings and goodwill balances, respectively.

144