Hertz 2007 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

or the Compensation Committee of Hertz Holdings may determine the specific number of shares to be

offered or options to be granted to an individual employee or director. A maximum of 25 million shares

are reserved for issuance under the Stock Incentive Plan. We currently intend to satisfy any need for

shares of our common stock associated with the exercise of options issued under the Stock Incentive

Plan through those new shares reserved for issuance, not through the use of Treasury shares or open

market purchases of shares. The Stock Incentive Plan was approved by the stockholders of Hertz

Holdings on March 8, 2006.

All option grants will be non-qualified options with a per-share exercise price no less than fair market

value of one share of Hertz Holdings stock on the grant date. Any stock options granted will generally

have a term of ten years, and unless otherwise determined by the Board or the Compensation

Committee of Hertz Holdings, will vest in five equal annual installments. The options granted in 2006 vest

over five years; the options granted in 2007 vest over three years, except for the grants to Mark P.

Frissora, our Chief Executive Officer, and certain key executives, which vest over four years. The options

granted to the outside Directors vest immediately. The Board or Compensation Committee may

accelerate the vesting of an option at any time. In addition, vesting of options will be accelerated if Hertz

Holdings experiences a change in control (as defined in the Stock Incentive Plan) unless options with

substantially equivalent terms and economic value are substituted for existing options in place of

accelerated vesting. Vesting of options will also be accelerated in the event of an employee’s death or

disability (as defined in the Stock Incentive Plan). Upon a termination for cause (as defined in the Stock

Incentive Plan), all options held by an employee are immediately cancelled. Following a termination

without cause, vested options will generally remain exercisable through the earliest of the expiration of

their term or 60 days following termination of employment (180 days in the case of death, disability or

retirement at normal retirement age).

Unless sooner terminated by the Board of Directors, the Stock Incentive Plan will remain in effect until

February 15, 2016.

We are in the process of obtaining shareholder approval for an Omnibus long-term incentive plan

providing for grants of both equity and cash awards, including non-qualified stock options, incentive

stock options, stock appreciation rights, performance awards (shares and units), restricted stock,

restricted stock units and deferred stock units. See Note 16—Subsequent Events.

In May 2007, Hertz Holdings granted options to acquire 1,029,007 shares of Hertz Holdings’ common

stock to key executives, employees and non-management directors at exercise prices ranging from

$20.55 to $21.87. In August 2007, Hertz Holdings granted options to acquire 510,000 shares of Hertz

Holdings’ common stock to certain executives, including an award to Mr. Frissora at exercise prices

ranging from $22.61 to $23.06. In November 2007, Hertz Holdings granted options to acquire 232,000

shares of Hertz Holdings’ common stock to certain executives at exercise prices ranging from $17.14 to

$21.22. These options are subject to and governed by the terms of the Stock Incentive Plan and the

Hertz Global Holdings, Inc. Director Stock Incentive Plan, or the ‘‘Director Plan.’’ See Note 14—Related

Party Transactions—‘‘Director Stock Incentive Plan.’’

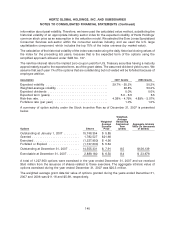

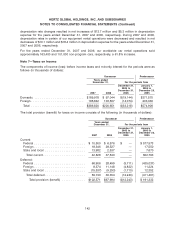

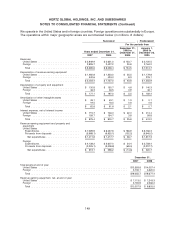

We have accounted for our employee stock-based compensation awards in accordance with SFAS

No. 123R. The options are being accounted for as equity-classified awards. We will recognize

compensation cost on a straight-line basis over the vesting period. The value of each option award is

estimated on the grant date using a Black-Scholes option valuation model that incorporates the

assumptions noted in the following table. Because the stock of Hertz Holdings became publicly traded in

November 2006 and has a short trading history, it is not practicable for us to estimate the expected

volatility of our share price, or a peer company share price, because there is not sufficient historical

139