Hertz 2007 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

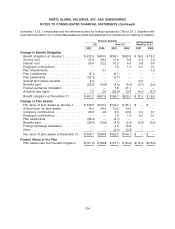

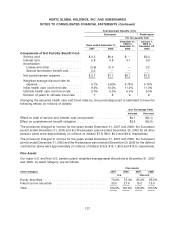

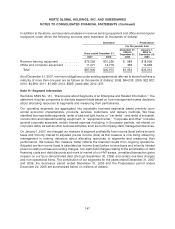

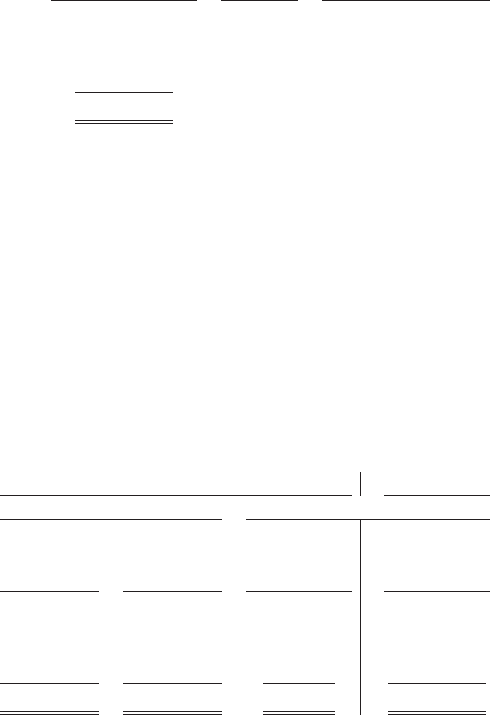

A summary of non-vested options as of December 31, 2007, and changes during the year, is presented

below.

Weighted- Weighted-

Average Average Grant-

Exercise Date Calculated

Non-vested Shares Price Value

Non-vested as of January 1, 2007 ........... 15,748,354 $ 5.85 $ 5.99

Granted .............................. 1,782,527 $21.66 $11.16

Vested ............................... (4,117,130) $ 5.90 $ 6.02

Forfeited or Expired ..................... (1,747,600) $ 5.64 $ 5.57

Non-vested as of December 31, 2007 ......... 11,666,151 $ 8.21 $ 6.90

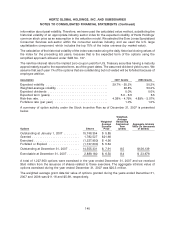

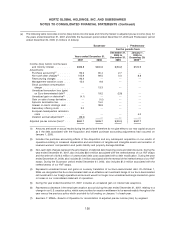

For the year ended December 31, 2007, we recognized compensation cost of $32.9 million

($20.2 million, net of tax) including $5.1 million related to restructuring activities to accelerate the vesting

for certain executives. As of December 31, 2007, there was approximately $85.3 million of total

unrecognized compensation cost related to non-vested stock options granted by Hertz Holdings under

the Stock Incentive Plan, including costs related to modifying the exercise prices of certain option grants

in order to preserve the intrinsic value of the options, consistent with applicable tax law, to reflect special

cash dividends of $4.32 per share paid on June 30, 2006 and $1.12 per share paid on November 21,

2006. These remaining costs are expected to be recognized over the remaining 2.1 years, on a weighted

average basis, of the requisite service period that began on the grant dates. For the year ended

December 31, 2006, we recognized compensation cost of $13.8 million ($8.3 million, net of tax).

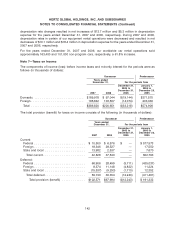

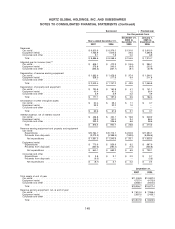

Note 6—Depreciation of Revenue Earning Equipment

Depreciation of revenue earning equipment includes the following (in thousands of dollars):

Successor Predecessor

Years ended December 31, For the periods from

December 21, January 1,

2005 to 2005 to

December 31, December 20,

2007 2006 2005 2005

Depreciation of revenue earning equipment . $1,905,846 $1,761,804 $45,362 $1,605,243

Adjustment of depreciation upon disposal of

the equipment ..................... 21,185 (35,857) (2,123) (68,307)

Rents paid for vehicles leased ........... 76,329 31,255 588 18,926

Total ............................ $2,003,360 $1,757,202 $43,827 $1,555,862

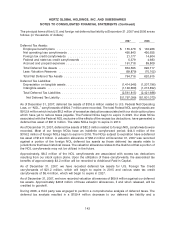

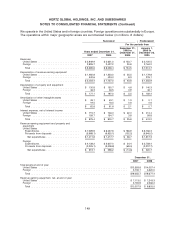

The adjustment of depreciation upon disposal of revenue earning equipment for the years ended

December 31, 2007 and 2006, the Successor period ended December 31, 2005 and the Predecessor

period ended December 20, 2005 included (in millions of dollars) net gains of $0.6, $16.3, $1.3 and

$41.8, respectively, on the disposal of industrial and construction equipment used in our equipment

rental operations, and a net loss of $21.8 and net gains of $19.6, $0.8 and $26.5, respectively, on the

disposal of vehicles used in our car rental operations.

Depreciation rates are reviewed on an ongoing basis based on management’s routine review of present

and estimated future market conditions and their effect on residual values at the time of disposal. During

2007 and 2006, depreciation rates being used to compute the provision for depreciation of revenue

earning equipment were adjusted on certain vehicles in our car rental operations to reflect changes in

the estimated residual values to be realized when revenue earning equipment is sold. These

141