Hertz 2007 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

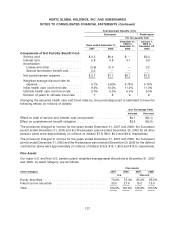

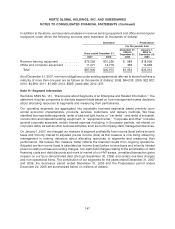

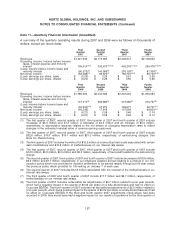

In addition to the above, we have various leases on revenue earning equipment and office and computer

equipment under which the following amounts were expensed (in thousands of dollars):

Successor Predecessor

For the periods from

December 21, January 1,

2005 to 2005 to

Years ended December 31, December 31, December 20,

2007 2006 2005 2005

Revenue earning equipment ........... $76,329 $31,255 $ 588 $18,926

Office and computer equipment ........ 11,271 14,718 466 14,984

Total ........................... $87,600 $45,973 $1,054 $33,910

As of December 31, 2007, minimum obligations under existing agreements referred to above that have a

maturity of more than one year are as follows (in thousands of dollars): 2008, $64,033; 2009, $22,902;

2010, $4,990; 2011, $1,069; 2012, $585; years after 2012, $37.

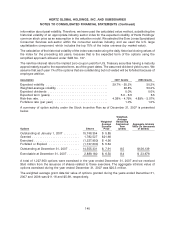

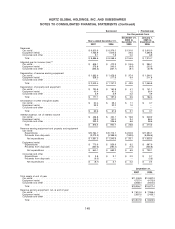

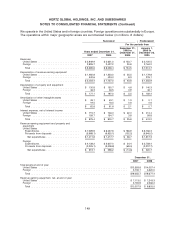

Note 9—Segment Information

We follow SFAS No. 131, ‘‘Disclosures about Segments of an Enterprise and Related Information.’’ The

statement requires companies to disclose segment data based on how management makes decisions

about allocating resources to segments and measuring their performance.

Our operating segments are aggregated into reportable business segments based primarily upon

similar economic characteristics, products, services, customers, and delivery methods. We have

identified two reportable segments: rental of cars and light trucks, or ‘‘car rental’’; and rental of industrial,

construction and material handling equipment, or ‘‘equipment rental.’’ ‘‘Corporate and other’’ includes

general corporate expenses, certain interest expense (including, in Successor periods, net interest on

corporate debt), as well as other business activities, such as our third party claim management services.

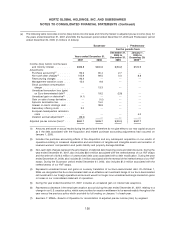

On January 1, 2007, we changed our measure of segment profitability from income (loss) before income

taxes and minority interest to adjusted pre-tax income (loss) as this measure is now being utilized by

management in making decisions about allocating resources to segments and measuring their

performance. We believe this measure better reflects the financial results from ongoing operations.

Adjusted pre-tax income (loss) is calculated as income (loss) before income taxes and minority interest

plus non-cash purchase accounting charges, non-cash debt charges relating to the amortization of debt

financing costs and debt discounts and mark to market of our HVF swaps, unrealized transaction gains

(losses) on our Euro-denominated debt (through September 30, 2006) and certain one-time charges

and non-operational items. The contribution of our segments for the years ended December 31, 2007

and 2006, the Successor period ended December 31, 2005 and the Predecessor period ended

December 20, 2005 are summarized below (in millions of dollars).

147