Hertz 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.See Note 2 to the Notes to our consolidated financial statements included in this Annual Report under

the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Derivatives

We utilize certain derivative instruments to enhance our ability to manage risk related to cash flow and

interest rate exposure. Derivative instruments are entered into for periods consistent with the related

underlying exposures. We document all relationships between hedging instruments and hedge items,

as well as our risk management objectives and strategies for undertaking various hedge transactions.

These derivatives are marked to market either through other comprehensive income or earnings,

depending upon their effectiveness. The valuation used to mark these to market is a discounted cash

flow method. The key input is the current yield curve based upon market observable data.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. The effect of a change in tax rates is recognized in the statement of operations in

the period that includes the enactment date. Valuation allowances are recorded to reduce deferred tax

assets when it is more likely than not that a tax benefit will not be realized. Provisions are not made for

income taxes on undistributed earnings of foreign subsidiaries that are intended to be indefinitely

reinvested outside the United States or are expected to be remitted free of taxes.

See Note 7 to the Notes to our consolidated financial statements included in this Annual Report under

the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

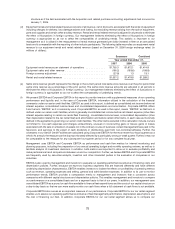

Stock-Based Compensation

In December 2004, the Financial Accounting Standards Board, or the ‘‘FASB,’’ revised its SFAS, No. 123,

with SFAS No. 123R, ‘‘Share-Based Payment.’’ The revised statement requires a public entity to measure

the cost of employee services received in exchange for an award of equity instruments based on the

grant-date fair value of the award. That cost is to be recognized over the period during which the

employee is required to provide service in exchange for the award. We have accounted for our employee

stock-based compensation awards in accordance with SFAS No. 123R. As disclosed in Note 5 to the

Notes to our consolidated financial statements included in this Annual Report under the caption

‘‘Item 8—Financial Statements and Supplementary Data,’’ we estimated the fair value of options issued

at the date of grant using a Black-Scholes option-pricing model, which includes assumptions related to

volatility, expected term, dividend yield, risk-free interest rate and forfeiture rate. Because the stock of

Hertz Holdings became publicly traded in November 2006 and has a short trading history, it is not

practicable for us to estimate the expected volatility of our share price, or a peer company share price,

because there is not sufficient historical information about past volatility. Therefore, we use the

calculated value method to estimate the expected volatility, based on the Dow Jones Specialized

Consumer Services sub-sector within the consumer services industry, and we use the U.S. large

capitalization component, which includes the top 70% of the index universe (by market value). Because

historical exercise data does not exist, and because we meet the requirements of SAB No. 107, we use

the simplified method for estimating the expected term. SAB No. 107 was set to expire on December 31,

2007. On December 21, 2007, the SEC issued SAB No. 110 which indicated that they will continue to

accept, under certain circumstances, the use of the simplified method beyond December 31, 2007. We

believe it is appropriate to continue to use this simplified method because we do not have sufficient

historical exercise data to provide a reasonable basis upon which to estimate the expected term due to

the limited period of time our common stock has been publicly traded. The assumed dividend yield is

68