Hertz 2007 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

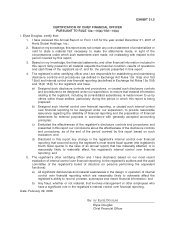

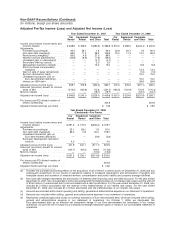

DEFINITIONS AND NON-GAAP RECONCILIATIONS

Definitions of Non-GAAP Measures

Pro Forma

Pro-forma metrics give effect to our new capital structure as if the debt associated with the acquisition on

December 21, 2005 and related purchase accounting adjustments had occurred on January 1, 2005.

The year ended December 31, 2005 profitability performance metrics are presented on a ‘‘pro forma’’

basis.

EBITDA

Earnings before net interest expense, income taxes, depreciation and amortization.

Corporate EBITDA

Corporate EBITDA is calculated as earnings before net interest expense (other than interest expense

relating to certain car rental fleet financing), income taxes, depreciation (other than depreciation related

to the car rental fleet), amortization and certain other items specified in the credit agreements governing

Hertz’s credit facilities. For purposes of consistency, we have revised our calculations of Corporate

EBITDA for the years ended December 31, 2005 and 2006 so that the identified extraordinary, unusual or

non-recurring gains and losses are consistent with those used in our calculation of adjusted pre-tax

income.

Adjusted Pre-Tax Income

Adjusted pre-tax income is calculated as income before income taxes and minority interest plus

non-cash purchase accounting charges, non-cash debt charges relating to the amortization of debt

financing costs and debt discounts, unrealized transaction gains (losses) on Euro-denominated debt

(through September 30, 2006) and certain one-time charges and non-operational items.

Adjusted Net Income

Adjusted net income is calculated as adjusted pre-tax income less an assumed provision for income

taxes and minority interest.

Adjusted Diluted Earnings Per Share

Adjusted diluted earnings per share is calculated as adjusted net income divided by the pro forma

post-IPO number of shares outstanding.

Unlevered Pre-Tax Cash Flow

Unlevered pre-tax cash flow is calculated as Corporate EBITDA less equipment rental fleet depreciation

including gain (loss) on sale, non-fleet capital expenditures, net of non-fleet disposals, plus changes in

working capital (accounts receivable, inventories, prepaid expenses, accounts payable and accrued

liabilities), and changes in other assets and liabilities (including public liability and property damage,

U.S. pension liability, other assets and liabilities, equity and minority interest).

Levered After-Tax Cash Flow before Fleet Growth

Levered after-tax cash flow before fleet growth is calculated as unlevered pre-tax cash flow less

corporate net cash interest and corporate cash taxes.