GameStop 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

We do not use derivative financial instruments for trading or speculative purposes. We are exposed to

counterparty credit risk on all of our derivative financial instruments and cash equivalent investments. The

Company manages counterparty risk according to the guidelines and controls established under comprehensive

risk management and investment policies. We continuously monitor our counterparty credit risk and utilize a

number of different counterparties to minimize our exposure to potential defaults. We do not require collateral

under derivative or investment agreements.

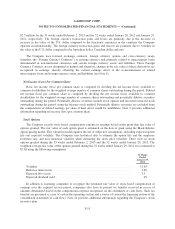

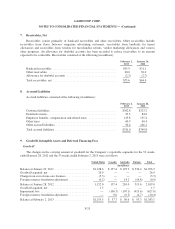

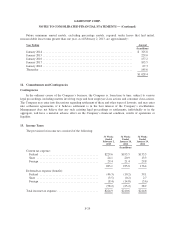

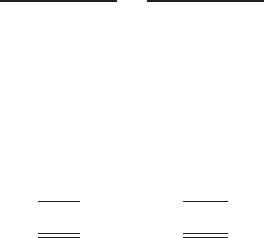

The fair values of derivative instruments not receiving hedge accounting treatment in the consolidated

balance sheets presented herein were as follows (in millions):

February 2, 2013 January 28, 2012

Assets

Foreign Currency Contracts

Other current assets ................................... $7.3 $12.3

Other noncurrent assets ................................ 0.9 4.7

Liabilities

Foreign Currency Contracts

Accrued liabilities ..................................... (9.1) (2.0)

Other long-term liabilities .............................. (4.4) (0.5)

Total derivatives ........................................ $(5.3) $14.5

Nonrecurring Fair Value Measurements

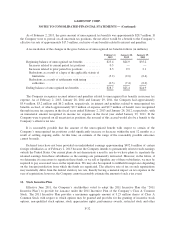

In addition to assets and liabilities that are recorded at fair value on a recurring basis, the Company records

certain assets and liabilities at fair value on a nonrecurring basis as required by GAAP. Assets and liabilities that

are measured at fair value on a nonrecurring basis relate primarily to our tangible property and equipment,

goodwill and other intangible assets, which are remeasured when the derived fair value is below carrying value

on our consolidated balance sheets. For these assets, we do not periodically adjust carrying value to fair value

except in the event of impairment. When we determine that impairment has occurred, the carrying value of the

asset is reduced to fair value and the difference is recorded within operating earnings in our consolidated

statements of operations. During fiscal 2012, the Company recorded a $680.7 million impairment charge related

to assets measured at fair value on a nonrecurring basis, comprised of $627.0 million of goodwill impairments,

$44.9 million of trade name impairment and $8.8 million of property and equipment impairments. During fiscal

2011, the Company recorded a $71.7 million impairment charge related to assets measured at fair value on a

nonrecurring basis, comprised of $37.8 million of trade name impairment, $22.7 million of the impairment of

investments in non-core businesses and $11.2 million of property and equipment impairments.

The fair value remeasurements included in the goodwill, trade name and property and equipment

impairments were primarily based on significant unobservable inputs (Level 3) developed using company-

specific information. Refer to Note 9, Goodwill, Intangible Assets and Deferred Financing Fees, for further

information associated with the goodwill and trade name impairments, as well as Note 2, Asset Impairments and

Restructuring Charges, for further information associated with the property and equipment impairments.

Other Fair Value Disclosures

The Company’s carrying value of financial instruments such as cash and cash equivalents, receivables, net

and accounts payable approximates their fair value, except for differences with respect to the Company’s senior

notes that were outstanding until December 2011. As of January 28, 2012, there were no senior notes payable.

F-22