GameStop 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

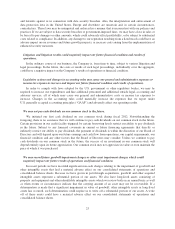

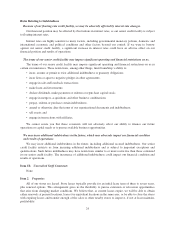

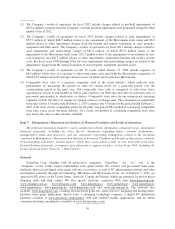

Operations Data” for fiscal years ended January 30, 2010 and January 31, 2009 and the “Balance Sheet Data” as

of January 29, 2011, January 30, 2010 and January 31, 2009 are derived from our audited consolidated financial

statements which are not included elsewhere in this Form 10-K.

Our selected financial data set forth below should be read in conjunction with “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and

notes thereto included elsewhere in this Form 10-K.

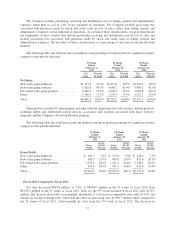

53 Weeks

Ended

February 2,

2013

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

52 Weeks

Ended

January 30,

2010

52 Weeks

Ended

January 31,

2009

(In millions, except per share data and statistical data)

Statement of Operations Data:

Net sales ................................. $8,886.7 $9,550.5 $9,473.7 $9,078.0 $8,805.9

Cost of sales .............................. 6,235.2 6,871.0 6,936.1 6,643.3 6,535.8

Gross profit ............................... 2,651.5 2,679.5 2,537.6 2,434.7 2,270.1

Selling, general and administrative expenses ..... 1,835.9 1,842.1 1,698.8 1,633.3 1,444.0

Depreciation and amortization ................ 176.5 186.3 174.7 162.6 145.0

Goodwill impairments(1) .................... 627.0————

Asset impairments and restructuring charges(2) . . 53.7 81.2 1.5 1.8 1.4

Merger-related expenses(3) .................. ————4.6

Operating earnings (loss) .................... (41.6) 569.9 662.6 637.0 675.1

Interest expense (income), net ................ 3.3 19.8 35.2 43.2 38.8

Debt extinguishment expense ................. — 1.0 6.0 5.3 2.3

Earnings (loss) before income tax expense ...... (44.9) 549.1 621.4 588.5 634.0

Income tax expense ........................ 224.9 210.6 214.6 212.8 235.7

Consolidated net income (loss) ............... (269.8) 338.5 406.8 375.7 398.3

Net loss attributable to noncontrolling interests . . . 0.1 1.4 1.2 1.6 —

Consolidated net income (loss) attributable to

GameStop Corp. ......................... $ (269.7) $ 339.9 $ 408.0 $ 377.3 $ 398.3

Basic net income (loss) per common share ...... $ (2.13) $ 2.43 $ 2.69 $ 2.29 $ 2.44

Diluted net income (loss) per common share ..... $ (2.13) $ 2.41 $ 2.65 $ 2.25 $ 2.38

Dividends per common share ................. $ 0.80 $ — $ — $ — $ —

Weighted average common shares outstanding —

basic .................................. 126.4 139.9 151.6 164.5 163.2

Weighted average common shares outstanding —

diluted ................................. 126.4 141.0 154.0 167.9 167.7

Store Operating Data:

Number of stores by segment

United States ............................ 4,425 4,503 4,536 4,429 4,331

Canada ................................ 336 346 345 337 325

Australia ............................... 416 411 405 388 350

Europe ................................ 1,425 1,423 1,384 1,296 1,201

Total .................................. 6,602 6,683 6,670 6,450 6,207

Comparable store sales increase (decrease)(4) .... (8.0)% (2.1)% 1.1% (7.9)% 12.3%

Inventory turnover ......................... 5.0 5.1 5.1 5.2 5.8

Balance Sheet Data:

Working capital ........................... $ 295.6 $ 363.4 $ 407.0 $ 471.6 $ 255.3

Total assets ............................... 4,133.6 4,847.4 5,063.8 4,955.3 4,483.5

Total debt, net ............................. — — 249.0 447.3 545.7

Total liabilities ............................ 1,847.3 1,807.2 2,167.9 2,232.3 2,212.9

Total equity ............................... 2,286.3 3,040.2 2,895.9 2,723.0 2,270.6

29