GameStop 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

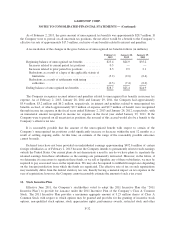

The availability under the Revolver is limited to a borrowing base which allows the Company to borrow up

to 90% of the appraisal value of the inventory, in each case plus 90% of eligible credit card receivables, net of

certain reserves. Letters of credit reduce the amount available to borrow by their face value. The Company’s

ability to pay cash dividends, redeem options and repurchase shares is generally permitted, except under certain

circumstances, including if Revolver excess availability is less than 20%, or is projected to be within 12 months

after such payment. In addition, if Revolver usage is projected to be equal to or greater than 25% of total

commitments during the prospective 12-month period, the Company is subject to meeting a fixed charge

coverage ratio of 1.1:1.0 prior to making such payments. In the event that excess availability under the Revolver

is at any time less than the greater of (1) $40.0 million or (2) 12.5% of the lesser of the total commitment or the

borrowing base, the Company will be subject to a fixed charge coverage ratio covenant of 1.1:1.0.

The Revolver places certain restrictions on the Company and its subsidiaries, including limitations on asset

sales, additional liens, investments, loans, guarantees, acquisitions and the incurrence of additional

indebtedness. Absent consent from its lenders, the Company may not incur more than $750 million of additional

unsecured indebtedness to be limited to $250 million in general unsecured obligations and $500 million in

unsecured obligations to finance acquisitions valued at $500 million or more. The per annum interest rate under

the Revolver is variable and is calculated by applying a margin (1) for prime rate loans of 1.25% to 1.50% above

the highest of (a) the prime rate of the administrative agent, (b) the federal funds effective rate plus 0.50% or

(c) the London Interbank Offered (“LIBO”) rate for a 30-day interest period as determined on such day plus

1.00%, and (2) for LIBO rate loans of 2.25% to 2.50% above the LIBO rate. The applicable margin is determined

quarterly as a function of the Company’s average daily excess availability under the facility. In addition, the

Company is required to pay a commitment fee of 0.375% or 0.50%, depending on facility usage, for any unused

portion of the total commitment under the Revolver. As of February 2, 2013, the applicable margin was 1.25%

for prime rate loans and 2.25% for LIBO rate loans, while the required commitment fee was 0.50% for the

unused portion of the Revolver.

The Revolver provides for customary events of default with corresponding grace periods, including failure

to pay any principal or interest when due, failure to comply with covenants, any material representation or

warranty made by the Company or the borrowers proving to be false in any material respect, certain bankruptcy,

insolvency or receivership events affecting the Company or its subsidiaries, defaults relating to certain other

indebtedness, imposition of certain judgments and mergers or the liquidation of the Company or certain of its

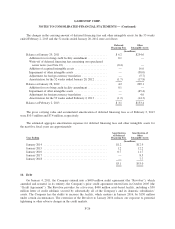

subsidiaries. During fiscal 2012, the Company borrowed and repaid $81.0 million under the Revolver. During

fiscal 2011 and fiscal 2010, the Company borrowed and repaid $35.0 million and $120.0 million, respectively,

under the prior Credit Agreement. As of February 2, 2013, total availability under the Revolver was $388.7

million, there were no borrowings outstanding and letters of credit outstanding totaled $9.0 million.

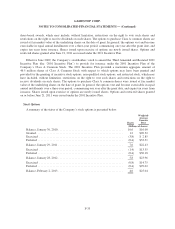

In September 2007, the Company’s Luxembourg subsidiary entered into a discretionary $20.0 million

Uncommitted Line of Credit (the “Line of Credit”) with Bank of America. There is no term associated with the

Line of Credit and Bank of America may withdraw the facility at any time without notice. The Line of Credit is

available to the Company’s foreign subsidiaries for use primarily as a bank overdraft facility for short-term

liquidity needs and for the issuance of bank guarantees and letters of credit to support operations. As of

February 2, 2013, there were cash overdrafts outstanding under the Line of Credit of $3.4 million and bank

guarantees outstanding totaled $5.0 million.

In September 2005, the Company, along with GameStop, Inc. as co-issuer (together with the Company, the

“Issuers”), completed the offering of $300 million aggregate principal amount of Senior Floating Rate Notes due

2011 (the “Senior Floating Rate Notes”) and $650 million aggregate principal amount of Senior Notes due 2012

(the “Senior Notes” and, together with the Senior Floating Rate Notes, the “Notes”). The Notes were issued

F-27