GameStop 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

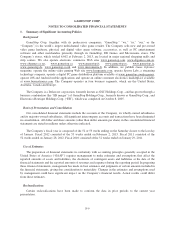

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

$2.5 million for the 53 weeks ended February 2, 2013 and the 52 weeks ended January 28, 2012 and January 29,

2011, respectively. The foreign currency transaction gains and losses are primarily due to the decrease or

increase in the value of the U.S. dollar compared to the functional currencies in the countries the Company

operates in internationally. The foreign currency transaction gains and (losses) are primarily due to volatility in

the value of the U.S. dollar compared to the Australian dollar, Canadian dollar and euro.

The Company uses forward exchange contracts, foreign currency options and cross-currency swaps

(together, the “Foreign Currency Contracts”) to manage currency risk primarily related to intercompany loans

denominated in non-functional currencies and certain foreign currency assets and liabilities. These Foreign

Currency Contracts are not designated as hedges and, therefore, changes in the fair values of these derivatives are

recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of related

intercompany loans and foreign currency assets and liabilities (see Note 6).

Net Income (Loss) Per Common Share

Basic net income (loss) per common share is computed by dividing the net income (loss) available to

common stockholders by the weighted average number of common shares outstanding during the period. Diluted

net income (loss) per common share is computed by dividing the net income (loss) available to common

stockholders by the weighted average number of common shares outstanding and potentially dilutive securities

outstanding during the period. Potentially dilutive securities include stock options and unvested restricted stock

outstanding during the period, using the treasury stock method. Potentially dilutive securities are excluded from

the computations of diluted earnings per share if their effect would be antidilutive. Note 5 provides additional

information regarding net income (loss) per common share.

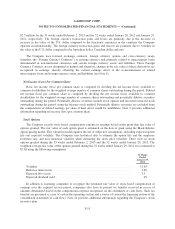

Stock Options

The Company records stock-based compensation expense in earnings based on the grant-date fair value of

options granted. The fair value of each option grant is estimated on the date of grant using the Black-Scholes

option pricing model. This valuation model requires the use of subjective assumptions, including expected option

life and expected volatility. The Company uses historical data to estimate the option life and the employee

forfeiture rate, and uses historical volatility when estimating the stock price volatility. There were no stock

options granted during the 53 weeks ended February 2, 2013 and the 52 weeks ended January 28, 2012. The

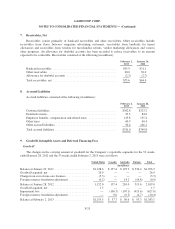

weighted-average fair value of the options granted during the 52 weeks ended January 29, 2011 was estimated at

$7.88 using the following assumptions:

52 Weeks

Ended

January 29,

2011

Volatility ................................................................ 51.6%

Risk-free interest rate ...................................................... 1.6%

Expected life (years) ....................................................... 3.5

Expected dividend yield .................................................... 0%

In addition to requiring companies to recognize the estimated fair value of stock-based compensation in

earnings over the required service period, companies also have to present tax benefits received in excess of

amounts determined based on the compensation expense recognized on the statements of cash flows. Such tax

benefits are presented as a use of cash in the operating section and a source of cash in the financing section of the

consolidated statements of cash flows. Note 14 provides additional information regarding the Company’s stock

incentive plan.

F-15