GameStop 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

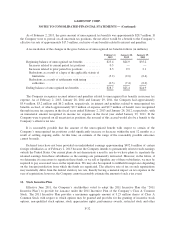

replacing the remaining $180.1 million authorization. For fiscal 2011, the number of shares repurchased was

11.2 million for an average price per share of $21.38. In March 2012, the Board of Directors authorized the

Company to use $500 million to repurchase shares of the Company’s common stock, replacing the remaining

$253.4 million of the November 2011 authorization. In November 2012, the Board of Directors authorized the

Company to use $500 million to repurchase shares of the Company’s common stock, replacing the remaining

$241.6 million of the March 2012 authorization. For fiscal 2012, the number of shares repurchased was

19.9 million for an average price per share of $20.60. As of February 2, 2013, the Company had $425.3 million

remaining under the November 2012 authorization. As of March 25, 2013, the Company has purchased an

additional 1.0 million shares for an average price per share of $25.06, leaving $400.0 million available under the

November 2012 authorization.

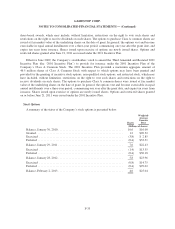

On February 8, 2012, the Board of Directors of the Company approved the initiation of a quarterly cash

dividend to its stockholders of Class A Common Stock. The first quarterly cash dividend of $0.15 per share was

paid on March 12, 2012. The second quarterly cash dividend of $0.15 per share was paid on June 12, 2012. The

third quarterly cash dividend of $0.25 per share was paid on September 12, 2012. The fourth quarterly cash

dividend of $0.25 per share was paid on December 12, 2012. On February 18, 2013, the Board of Directors of the

Company approved the quarterly cash dividend to its stockholders of $0.275 per share of Class A Common Stock

payable on March 19, 2013 to stockholders of record at the close of business on March 5, 2013. Future dividends

will be subject to approval by the Board of Directors of the Company.

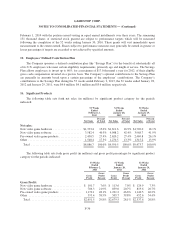

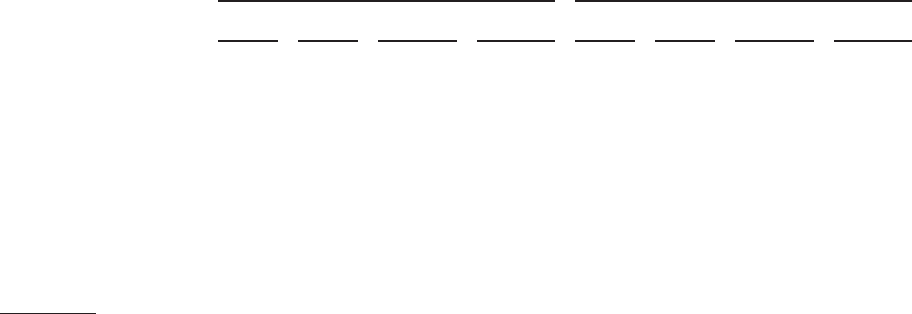

20. Unaudited Quarterly Financial Information

The following table sets forth certain unaudited quarterly consolidated statement of operations information

for the fiscal years ended February 2, 2013 and January 28, 2012. The unaudited quarterly information includes

all normal recurring adjustments that management considers necessary for a fair presentation of the information

shown.

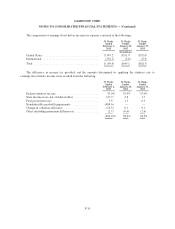

Fiscal Year Ended February 2, 2013 Fiscal Year Ended January 28, 2012

1st

Quarter

2nd

Quarter

3rd

Quarter(1)

4th

Quarter(2)

1st

Quarter

2nd

Quarter

3rd

Quarter(3)

4th

Quarter(4)

(Amounts in millions, except per share amounts)

Net sales ................. $2,002.2 $1,550.2 $1,772.8 $3,561.5 $2,281.4 $1,743.7 $1,946.8 $3,578.6

Gross profit ............... 599.9 519.3 557.4 974.9 620.2 543.2 572.9 943.2

Operating earnings (loss) .... 115.0 34.5 (603.5) 412.3 131.1 53.6 82.6 302.5

Consolidated net income (loss)

attributable to GameStop

Corp. .................. 72.5 21.0 (624.3) 261.1 80.4 30.9 53.9 174.7

Basic net income (loss) per

common share ........... 0.54 0.16 (5.08) 2.17 0.56 0.22 0.39 1.28

Diluted net income (loss) per

common share ........... 0.54 0.16 (5.08) 2.15 0.56 0.22 0.39 1.27

Dividend declared per

common share ........... 0.15 0.15 0.25 0.25 — — — —

The following footnotes are discussed as pretax expenses.

(1) The results of operations for the third quarter of the fiscal year ended February 2, 2013 include goodwill

impairments of $627.0 million and asset impairments of $51.8 million.

(2) The results of operations for the fourth quarter of the fiscal year ended February 2, 2013 include asset

impairments of $1.9 million.

F-40