GameStop 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In January 2010, the Board of Directors of the Company approved a $300 million share repurchase program

authorizing the Company to repurchase its common stock. At the beginning of fiscal 2010, $64.6 million of

treasury share purchases made during fiscal 2009 were settled. In September 2010, the Board of Directors of the

Company approved an additional $300 million share repurchase program authorizing the Company to repurchase

its common stock. For fiscal 2010, the number of shares repurchased was 17.1 million for an average price per

share of $19.84. Approximately $22.0 million of treasury share purchases were not settled at the end of fiscal

2010 and were reported in accrued liabilities at January 29, 2011. In February 2011, the Board of Directors of the

Company authorized a $500 million repurchase fund to be used for share repurchases of its common stock and/or

to retire the Company’s Senior Notes. This plan replaced the September 2010 $300 million stock repurchase plan

which had $138.4 million remaining. In November 2011, the Board of Directors authorized the Company to use

$500 million to repurchase shares of the Company’s common stock and/or retire the Company’s Senior Notes,

replacing the remaining $180.1 million authorization. For fiscal 2011, the number of shares repurchased was

11.2 million for an average price per share of $21.38. In March 2012, the Board of Directors authorized the

Company to use $500 million to repurchase shares of the Company’s common stock, replacing the remaining

$253.4 million of the November 2011 authorization. In November 2012, the Board of Directors authorized the

Company to use $500 million to repurchase shares of the Company’s common stock, replacing the remaining

$241.6 million of the March 2012 authorization. For fiscal 2012, the number of shares repurchased was

19.9 million for an average price per share of $20.60. As of February 2, 2013, the Company had $425.3 million

remaining under the November 2012 authorization. As of March 25, 2013, the Company has purchased an

additional 1.0 million shares for an average price per share of $25.06, leaving $400.0 million available under the

November 2012 authorization.

On February 8, 2012, the Board of Directors of the Company approved the initiation of a quarterly cash

dividend to its stockholders of Class A Common Stock. The first quarterly cash dividend of $0.15 per share was

paid on March 12, 2012. The second quarterly cash dividend of $0.15 per share was paid on June 12, 2012. The

third quarterly cash dividend of $0.25 per share was paid on September 12, 2012. The fourth quarterly cash

dividend of $0.25 per share was paid on December 12, 2012. On February 18, 2013, the Board of Directors of the

Company approved the quarterly cash dividend to its stockholders of $0.275 per share of Class A Common Stock

payable on March 19, 2013 to stockholders of record at the close of business on March 5, 2013. Future dividends

will be subject to approval by the Board of Directors of the Company.

Based on our current operating plans, we believe that available cash balances, cash generated from our

operating activities and funds available under the Revolver will be sufficient to fund our operations, digital

initiatives, store openings and remodeling activities and corporate capital expenditure programs, including the

payment of dividends declared by the Board of Directors, for at least the next 12 months.

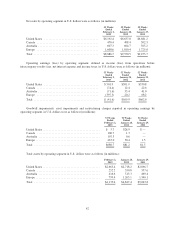

Contractual Obligations

The following table sets forth our contractual obligations as of February 2, 2013:

Payments Due by Period

Contractual Obligations Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

(In millions)

Operating Leases ................... $1,028.4 $ 325.8 $386.2 $170.8 $145.6

Purchase Obligations(1) ............. 769.1 769.1 — — —

Total ............................. $1,797.5 $1,094.9 $386.2 $170.8 $145.6

(1) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase

orders are generally cancelable until shipment of the products.

The Company leases retail stores, warehouse facilities, office space and equipment. These are generally

leased under noncancelable agreements that expire at various dates through 2034 with various renewal options

for additional periods. The agreements, which have been classified as operating leases, generally provide for

49