GameStop 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

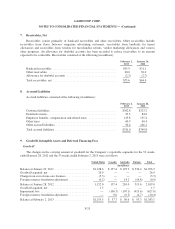

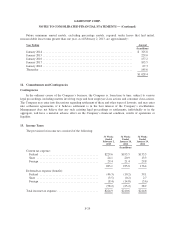

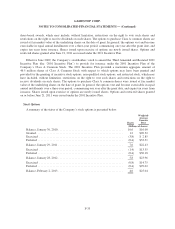

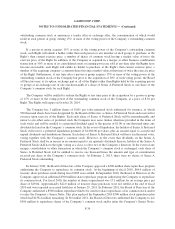

The components of earnings (loss) before income tax expense consisted of the following:

53 Weeks

Ended

February 2,

2013

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

(In millions)

United States ..................................... $547.2 $551.9 $553.8

International ...................................... (592.1) (2.8) 67.6

Total ............................................ $ (44.9) $549.1 $621.4

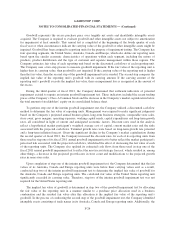

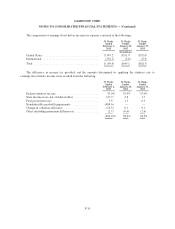

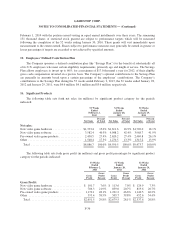

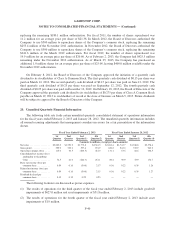

The difference in income tax provided and the amounts determined by applying the statutory rate to

earnings (loss) before income taxes resulted from the following:

53 Weeks

Ended

February 2,

2013

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

Federal statutory tax rate ............................ 35.0% 35.0% 35.0%

State income taxes, net of federal effect ................ (27.7) 2.6 1.7

Foreign income taxes ............................... 5.6 1.3 0.3

Nondeductible goodwill impairments .................. (488.6) — —

Change in valuation allowance ....................... (22.5) 0.1 0.1

Other (including permanent differences) ................ (2.7) (0.6) (2.6)

(500.9)% 38.4% 34.5%

F-30