GameStop 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

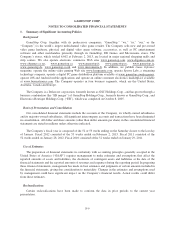

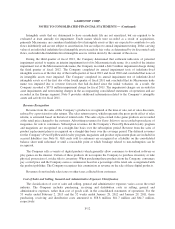

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Fair Values of Financial Instruments

The carrying values of cash and cash equivalents, receivables, net, accounts payable and accrued liabilities

reported in the accompanying consolidated balance sheets approximate fair value due to the short-term maturities

of these assets and liabilities. Note 6 provides additional information regarding the Company’s fair values of our

financial assets and liabilities.

Guarantees

The Company had bank guarantees relating primarily to international store leases totaling $21.0 million as

of February 2, 2013 and $18.2 million as of January 28, 2012.

Vendor Concentration

The Company’s largest vendors worldwide are Sony Computer Entertainment, Activision, Nintendo,

Microsoft and Electronic Arts, Inc., which accounted for 17%, 16%, 14%, 13% and 11%, respectively, of the

Company’s new product purchases in fiscal 2012, 15%, 11%, 16%, 17% and 13%, respectively, in fiscal 2011

and 16%, 12%, 16%, 18% and 10%, respectively in fiscal 2010.

New Accounting Pronouncements

In February 2013, an accounting standard update was issued regarding disclosure of amounts reclassified

out of accumulated other comprehensive income by component. An entity is required to present either on the face

of the statement of operations or in the notes, significant amounts reclassified out of accumulated other

comprehensive income by the respective line items of net income but only if the amount reclassified is required

to be reclassified to net income in its entirety in the same reporting period. For amounts not reclassified in their

entirety to net income, an entity is required to cross-reference to other disclosures that provide additional detail

about those amounts. This accounting standard update is effective prospectively for annual and interim periods

beginning after December 15, 2012. The Company is evaluating the effect this accounting standard update will

have on its consolidated financial statements.

In July 2012, an accounting standard update was issued related to testing indefinite-lived intangible assets

for impairment. The purpose of the update is to simplify the guidance for testing indefinite-lived intangible assets

for impairment and the update permits entities to first assess qualitative factors to determine whether it is

necessary to perform the quantitative impairment test. Unless an entity determines, through its qualitative

assessment, that it is more likely than not that an indefinite-lived intangible asset is impaired, it would not be

required to calculate the fair value of the asset. This standard is effective for annual and interim impairment tests

of indefinite-lived intangible assets performed in fiscal years beginning after September 15, 2012, and early

adoption is permitted. This standard did not have an impact on our annual indefinite-lived asset impairment

testing process in fiscal 2012 as we did not elect to perform a qualitative assessment. The adoption of this

guidance may result in a change in how we perform our goodwill impairment assessment; however, it will not

have a material impact on our consolidated financial statements.

During the first quarter of fiscal 2012, we adopted the accounting standard update regarding the presentation

of comprehensive income. This accounting standard update was issued to increase the prominence of items

reported in other comprehensive income. The accounting standard update requires that all non-owner changes in

stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two

separate, but consecutive statements. In connection with the adoption of this accounting standard update, our

consolidated financial statements now include separate consolidated statements of comprehensive income.

F-16