GameStop 2012 Annual Report Download - page 53

Download and view the complete annual report

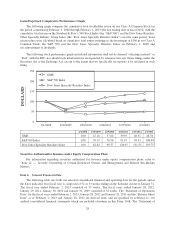

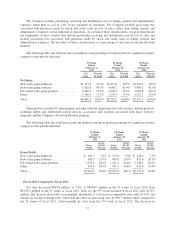

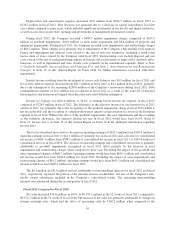

Please find page 53 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.comparable store sales was primarily due to decreases in new video game hardware sales, new video game

software sales and pre-owned video game products sales offset partially by an increase in other product sales.

Refer to the note to the Selected Financial Data table in Item 6, Selected Financial Data, for a discussion of the

calculation of comparable store sales.

New video game hardware sales decreased $278.2 million, or 17.3%, from fiscal 2011 to fiscal 2012,

primarily due to a decrease in hardware unit sell-through related to being in the late stages of the current console

cycle and sales from the launch of the Nintendo 3DS in the first quarter of fiscal 2011, which exceeded the sales

from the launch of the Sony PlayStation Vita in the first quarter of fiscal 2012. These sales declines were offset

partially by the launch of the Nintendo Wii U in the fourth quarter of fiscal 2012 and sales for the 53rd week in

fiscal 2012. New video game software sales decreased $465.8 million, or 11.5%, from fiscal 2011 to fiscal 2012,

primarily due to a lack of new release video game titles in fiscal 2012 when compared to fiscal 2011 and declines

in sales due to the late stages of the console cycle, offset partially by sales for the 53rd week in fiscal 2012. Pre-

owned video game products sales decreased $189.7 million, or 7.2%, from fiscal 2011 to fiscal 2012, primarily

due to a decrease in store traffic related to the lack of new release video game titles in fiscal 2012 when

compared to fiscal 2011 and lower video game demand due to the late stages of the current console cycle, offset

partially by sales for the 53rd week in fiscal 2012. Sales of other product categories increased $269.9 million, or

21.2%, from fiscal 2011 to fiscal 2012. The increase in other product sales was primarily due to an increase in

sales of PC entertainment software and mobile devices in fiscal 2012 when compared to fiscal 2011 and sales for

the 53rd week in fiscal 2012.

As a percentage of net sales, new video game hardware sales and new video game software sales decreased

and other product sales increased in fiscal 2012 compared to fiscal 2011. The change in the mix of net sales was

primarily due to the increase in other product sales as a result of the expansion of the mobile sales category and

growth in the PC entertainment software category due to new releases. These categories showed significant

growth in fiscal 2012 while sales of new video game hardware and new video game software decreased due to

fewer new software title launches compared to the same period last year and lower sales due to the late stages of

the current console cycle. Cost of sales decreased by $635.8 million, or 9.3%, from $6,871.0 million in fiscal

2011 to $6,235.2 million in fiscal 2012 primarily as a result of the decrease in net sales, offset partially by cost of

sales related to sales for the 53rd week in fiscal 2012 and the changes in gross profit discussed below.

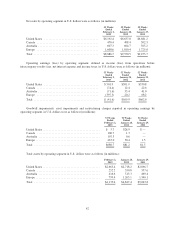

Gross profit decreased by $28.0 million, or 1.0%, from $2,679.5 million in fiscal 2011 to $2,651.5 million in

fiscal 2012. Gross profit as a percentage of net sales was 28.1% in fiscal 2011 and 29.8% in fiscal 2012. The

gross profit percentage increase was primarily due to the increase in sales of other products as a percentage of

total net sales and the increase in gross profit as a percentage of sales on new video game hardware and software

sales and pre-owned video game products sales. Gross profit as a percentage of sales on new video game

hardware increased slightly from 7.0% in fiscal 2011 to 7.6% in fiscal 2012. Gross profit as a percentage of sales

on new video game software increased from 20.7% for fiscal 2011 to 21.9% for fiscal 2012. Gross profit as a

percentage of sales on pre-owned video game products increased from 46.6% in fiscal 2011 to 48.1% in fiscal

2012 due to a decrease in promotional activities and improvements in margin rates throughout most of our

international operations when compared to the prior year. Gross profit as a percentage of sales on the other

product sales category decreased from 39.8% in fiscal 2011 to 38.5% in fiscal 2012 primarily due to an increase

in the mix of PC entertainment software sales and mobile sales to total other product sales. New PC

entertainment software and mobile products have a lower gross profit percentage than total other product sales.

Selling, general and administrative expenses decreased by $6.2 million, or 0.3%, from $1,842.1 million in

fiscal 2011 to $1,835.9 million in fiscal 2012. This decrease was primarily due to changes in foreign exchange rates

which had the effect of decreasing expenses by $26.7 million when compared to fiscal 2011 offset partially by

expenses for the 53rd week in fiscal 2012. Selling, general and administrative expenses as a percentage of sales

increased from 19.3% in the fiscal 2011 to 20.7% in fiscal 2012. The increase in selling, general and administrative

expenses as a percentage of net sales was primarily due to deleveraging of fixed costs as a result of the decrease in

comparable store sales. Included in selling, general and administrative expenses are $19.6 million and $18.8 million

in stock-based compensation expense for fiscal 2012 and fiscal 2011, respectively.

38