GameStop 2012 Annual Report Download - page 61

Download and view the complete annual report

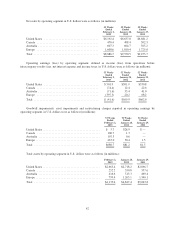

Please find page 61 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.number of stores in operation. This decrease in operating earnings was partially offset by the favorable impact of

changes in exchange rates which had the effect of increasing operating earnings by $1.7 million when compared

to fiscal 2010.

Europe

Segment results for Europe include retail operations in 13 European countries and e-commerce operations in

six countries. As of January 28, 2012, the European segment operated 1,423 stores, compared to 1,384 stores as

of January 29, 2011. For the 52 weeks ended January 28, 2012, European sales increased 5.0% compared to the

52 weeks ended January 29, 2011. This increase in sales was primarily due to the favorable impact of changes in

exchange rates in fiscal 2011, which had the effect of increasing sales by $73.8 million when compared to fiscal

2010. Excluding the impact of changes in exchange rates, sales in the European segment increased 0.7%. The

increase in sales was primarily due to additional sales in the 89 new stores opened since January 30, 2011,

partially offset by a decrease in sales at existing stores. The decrease in sales at existing stores was primarily

driven by weak consumer traffic due to the continued macroeconomic uncertainty and a decrease in comparable

new video game hardware sales as the current generation of hardware platforms continues to age.

The segment operating income in Europe for fiscal 2011 decreased by $48.0 million to $20.2 million

compared to $68.2 million in fiscal 2010. The decrease in the operating income was primarily due to the impact

of asset impairments and restructuring charges of $50.4 million, consisting primarily of the impairment of the

Micromania trade name in the amount of $37.8 million. The remaining amount of $12.6 million consists of

property and equipment impairments, other asset impairments, termination benefits, and facility closure and other

costs.

Liquidity and Capital Resources

Cash Flows

During fiscal 2012, cash provided by operations was $632.4 million, compared to cash provided by

operations of $624.7 million in fiscal 2011. The increase in cash provided by operations of $7.7 million from

fiscal 2011 to fiscal 2012 was primarily due to an increase in cash provided by working capital of $54.8 million,

primarily driven by a change in the timing of payments of accounts payable and other prepaid expenses, offset

partially by higher inventory purchases in fiscal 2012. The higher inventory purchases in fiscal 2012 were

primarily due to purchases to support the Company’s new mobile business. This increase in cash provided by

working capital was partially offset by a decrease in cash from net earnings after adjusting for non-cash items.

During fiscal 2011, cash provided by operations was $624.7 million, compared to cash provided by

operations of $591.2 million in fiscal 2010. The increase in cash provided by operations of $33.5 million from

fiscal 2010 to fiscal 2011 was primarily due to a decrease in cash used for working capital purposes of $49.6

million, primarily driven by lower inventory purchases in fiscal 2011 and the related effects on payments of

accounts payable. The lower inventory purchases were due to lower hardware sales in fiscal 2011, and inventory

management initiatives. Inventory turnover was relatively consistent from fiscal 2010 to fiscal 2011. Also

contributing to the change in cash flows from operating activities for fiscal 2011 compared to fiscal 2010 was the

increase in accrued liabilities, including customer liabilities, primarily related to the growth of the Company’s

PowerUp Rewards program.

Cash used in investing activities was $152.7 million in fiscal 2012, $201.6 million in fiscal 2011 and

$240.1 million in fiscal 2010. During fiscal 2012, the Company used $139.6 million for capital expenditures

primarily to open 146 stores in the U.S. and internationally and to invest in information systems and digital

initiatives. During fiscal 2011, the Company used $165.1 million for capital expenditures primarily to invest in

information systems, distribution center capacity and e-commerce, digital and loyalty program initiatives and to

open 285 stores in the U.S. and internationally. In addition, during fiscal 2011, the Company used $30.1 million

for acquisitions in support of the Company’s digital initiatives. During fiscal 2010, the Company used

$197.6 million for capital expenditures primarily to open 359 stores and to invest in information systems and

$38.1 million for acquisitions in support of the Company’s digital initiatives.

46