GameStop 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

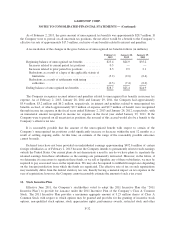

under an indenture, dated September 28, 2005, by and among the Issuers, the subsidiary guarantors party thereto,

and Citibank, N.A., as trustee. In November 2006, Wilmington Trust Company was appointed as the new trustee

for the Notes (the “Trustee”).

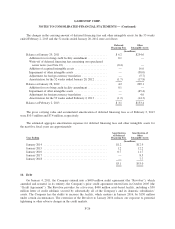

The Senior Notes bore interest at 8.0% per annum, were to mature on October 1, 2012 and were priced at

98.688%, resulting in a discount at the time of issue of $8.5 million. The discount was amortized using the

effective interest method. The Issuers paid interest on the Senior Notes semi-annually, in arrears, every April 1

and October 1, to holders of record on the immediately preceding March 15 and September 15. Between May

2006 and December 2011, the Company repurchased and redeemed the $300 million of Senior Floating Rate

Notes and the $650 million of Senior Notes under previously announced buybacks authorized by the Company’s

Board of Directors. The repurchased Notes were delivered to the Trustee for cancellation. The associated loss on

the retirement of debt was $1.0 million for the 52 week period ended January 28, 2012, which consisted of the

write-off of the deferred financing fees and original issue discount on the retired Senior Notes. The associated

loss on the retirement of debt was $6.0 million for the 52 week period ended January 29, 2011, which consisted

of the premium paid to retire the Notes and the write-off of the deferred financing fees and original issue

discount on the Senior Notes. As of January 28, 2012, the Senior Notes have been fully redeemed.

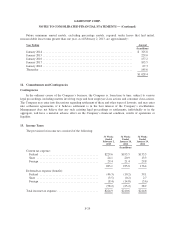

11. Leases

The Company leases retail stores, warehouse facilities, office space and equipment. These are generally

leased under noncancelable agreements that expire at various dates through 2034 with various renewal options

for additional periods. The agreements, which have been classified as operating leases, generally provide for

minimum and, in some cases, percentage rentals and require the Company to pay all insurance, taxes and other

maintenance costs. Leases with step rent provisions, escalation clauses or other lease concessions are accounted

for on a straight-line basis over the lease term, which includes renewal option periods when the Company is

reasonably assured of exercising the renewal options and includes “rent holidays” (periods in which the

Company is not obligated to pay rent). Cash or lease incentives received upon entering into certain store leases

(“tenant improvement allowances”) are recognized on a straight-line basis as a reduction to rent expense over the

lease term, which includes renewal option periods when the Company is reasonably assured of exercising the

renewal options. We record the unamortized portion of tenant improvement allowances as a part of deferred rent.

The Company does not have leases with capital improvement funding. Percentage rentals are based on sales

performance in excess of specified minimums at various stores and are accounted for in the period in which the

amount of percentage rentals can be accurately estimated.

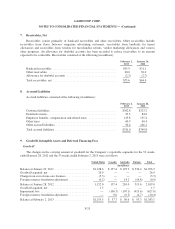

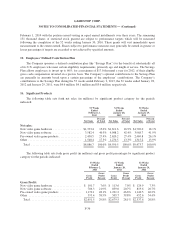

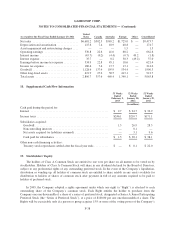

Approximate rental expenses under operating leases were as follows:

53 Weeks

Ended

February 2,

2013

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

(In millions)

Minimum ........................................ $385.4 $386.9 $370.8

Percentage rentals .................................. 9.3 12.3 11.1

$394.7 $399.2 $381.9

F-28