GameStop 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

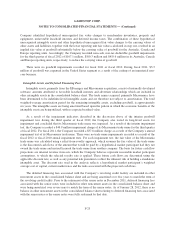

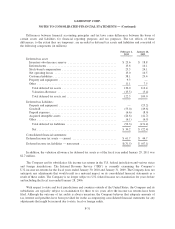

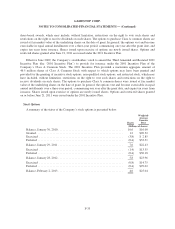

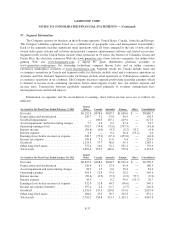

The following table presents a summary of the Company’s restricted stock awards activity:

Shares

Weighted-

Average

Grant Date

Fair Value

(Millions of shares)

Nonvested shares at January 30, 2010 .................................. 1.3 $32.94

Granted ....................................................... 0.7 $20.43

Vested ........................................................ (0.6) $33.05

Forfeited ....................................................... (0.2) $23.07

Nonvested shares at January 29, 2011 .................................. 1.2 $26.27

Granted ....................................................... 0.5 $20.90

Vested ........................................................ (0.6) $30.86

Forfeited ....................................................... — $21.61

Nonvested shares at January 28, 2012 .................................. 1.1 $21.57

Granted ....................................................... 1.4 $23.66

Vested ........................................................ (0.6) $22.37

Forfeited ....................................................... (0.1) $22.24

Nonvested shares at February 2, 2013 .................................. 1.8 $22.92

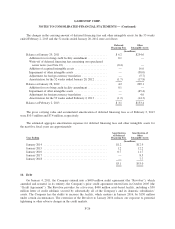

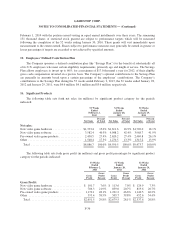

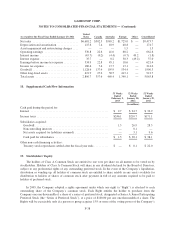

During the 53 weeks ended February 2, 2013, the Company granted 1.4 million shares of restricted stock

with a weighted average grant date fair value of $23.66 per common share with fair value being determined by

the quoted market price of the Company’s common stock on the date of grant. Of these shares, 783 thousand

shares of restricted stock were granted under the 2011 Incentive Plan, which vest in equal annual installments

over three years. At the same time, an additional 626 thousand shares of restricted stock were granted under the

2011 Incentive Plan, of which 101 thousand shares vest in equal annual installments over three years based on

performance targets that were achieved and 25 thousand shares were forfeited based on fiscal 2012 performance.

The remaining 500 thousand shares of restricted stock granted are subject to performance targets which will be

measured following the completion of the 52 weeks ending January 31, 2015. These grants will vest immediately

upon measurement to the extent earned. Shares subject to performance measures may generally be earned in

greater or lesser percentages if targets are exceeded or not achieved by specified amounts. The restricted stock

granted in the 52 weeks ended January 28, 2012 and the 52 weeks ended January 29, 2011 vest in equal annual

installments over three years.

During the 53 weeks ended February 2, 2013, the 52 weeks ended January 28, 2012 and the 52 weeks ended

January 29, 2011, the Company included compensation expense relating to the grant of these restricted shares in

the amounts of $17.5 million, $12.4 million and $17.4 million, respectively, in selling, general and administrative

expenses in the accompanying consolidated statements of operations. As of February 2, 2013, there was

$24.2 million of unrecognized compensation expense related to nonvested restricted stock awards that is

expected to be recognized over a weighted average period of 2.0 years.

Subsequent to the fiscal year ended February 2, 2013, the Company granted 1.2 million shares of restricted

stock with a grant date fair value of $24.82 per common share and 457 thousand shares of stock options under the

2011 Incentive Plan. Of these restricted shares, 614 thousand shares vest in equal annual installments over three

years and 303 thousand shares vest in full in February 2016. Restricted shares and options granted are subject to

continued service. Of the restricted shares granted subsequent to February 2, 2013, 131 thousand shares are

subject to a performance target which will be measured following the completion of the 52 weeks ending

F-35