GameStop 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

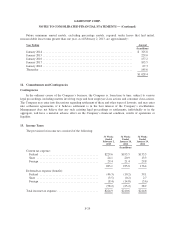

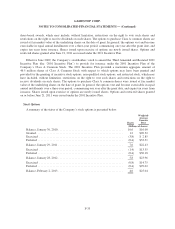

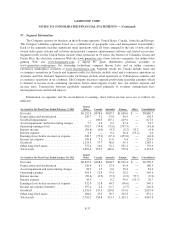

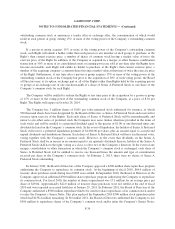

As of and for the Fiscal Year Ended January 29, 2011

United

States Canada Australia Europe Other Consolidated

Net sales ............................... $6,681.2 $502.3 $565.2 $1,725.0 $ — $9,473.7

Depreciation and amortization .............. 115.6 7.4 10.9 40.8 — 174.7

Asset impairment and restructuring charges .... — — — 1.5 — 1.5

Operating earnings ....................... 530.8 22.6 41.0 68.2 — 662.6

Interest income .......................... (45.7) (0.2) (4.4) (0.7) 49.2 (1.8)

Interest expense .......................... 35.7 — 0.2 50.3 (49.2) 37.0

Earnings before income tax expense .......... 534.9 22.8 45.1 18.6 — 621.4

Income tax expense ....................... 180.4 7.4 13.7 13.1 — 214.6

Goodwill ............................... 1,128.6 137.4 195.9 534.4 — 1,996.3

Other long-lived assets .................... 421.9 27.2 50.5 413.1 — 912.7

Total assets ............................. 2,896.7 357.6 469.4 1,340.1 — 5,063.8

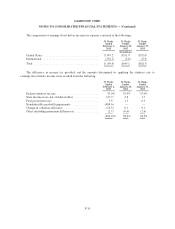

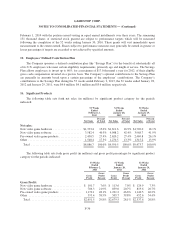

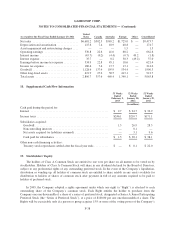

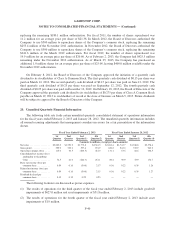

18. Supplemental Cash Flow Information

53 Weeks

Ended

February 2,

2013

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

(In millions)

Cash paid during the period for:

Interest ..................................................... $ 2.7 $ 24.7 $ 36.9

Income taxes ................................................. $246.1 $210.7 $171.1

Subsidiaries acquired:

Goodwill .................................................. 1.5 26.9 28.5

Noncontrolling interests ...................................... — 0.1 —

Net assets acquired (or liabilities assumed) ....................... — 3.1 9.6

Cash paid for subsidiaries .................................... $ 1.5 $ 30.1 $ 38.1

Other non-cash financing activities:

Treasury stock repurchases settled after the fiscal year ends .......... $ — $ 0.1 $ 22.0

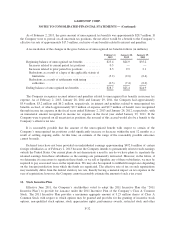

19. Stockholders’ Equity

The holders of Class A Common Stock are entitled to one vote per share on all matters to be voted on by

stockholders. Holders of Class A Common Stock will share in any dividend declared by the Board of Directors,

subject to any preferential rights of any outstanding preferred stock. In the event of the Company’s liquidation,

dissolution or winding up, all holders of common stock are entitled to share ratably in any assets available for

distribution to holders of shares of common stock after payment in full of any amounts required to be paid to

holders of preferred stock.

In 2005, the Company adopted a rights agreement under which one right (a “Right”) is attached to each

outstanding share of the Company’s common stock. Each Right entitles the holder to purchase from the

Company one one-thousandth of a share of a series of preferred stock, designated as Series A Junior Participating

Preferred Stock (the “Series A Preferred Stock”), at a price of $100.00 per one one-thousandth of a share. The

Rights will be exercisable only if a person or group acquires 15% or more of the voting power of the Company’s

F-38