GameStop 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

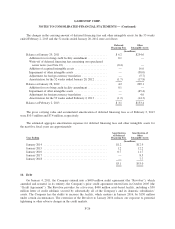

share-based awards, which may include, without limitation, restrictions on the right to vote such shares and

restrictions on the right to receive dividends on such shares. The options to purchase Class A common shares are

issued at fair market value of the underlying shares on the date of grant. In general, the options vest and become

exercisable in equal annual installments over a three-year period, commencing one year after the grant date, and

expire ten years from issuance. Shares issued upon exercise of options are newly issued shares. Options and

restricted shares granted after June 21, 2011 are issued under the 2011 Incentive Plan.

Effective June 2009, the Company’s stockholders voted to amend the Third Amended and Restated 2001

Incentive Plan (the “2001 Incentive Plan”) to provide for issuance under the 2001 Incentive Plan of the

Company’s Class A Common Stock. The 2001 Incentive Plan provided a maximum aggregate amount of

46.5 million shares of Class A Common Stock with respect to which options may have been granted and

provided for the granting of incentive stock options, non-qualified stock options, and restricted stock, which may

have included, without limitation, restrictions on the right to vote such shares and restrictions on the right to

receive dividends on such shares. The options to purchase Class A common shares were issued at fair market

value of the underlying shares on the date of grant. In general, the options vest and become exercisable in equal

annual installments over a three-year period, commencing one year after the grant date, and expire ten years from

issuance. Shares issued upon exercise of options are newly issued shares. Options and restricted shares granted

on or before June 21, 2011 were issued under the 2001 Incentive Plan.

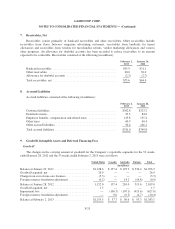

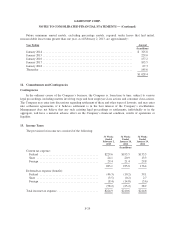

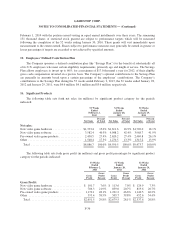

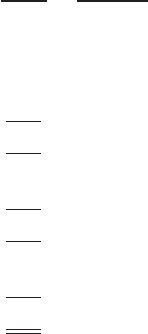

Stock Options

A summary of the status of the Company’s stock options is presented below:

Shares

Weighted-

Average

Exercise

Price

(Millions of shares)

Balance, January 30, 2010 ............................................ 10.6 $16.00

Granted ........................................................... 1.2 $20.32

Exercised ......................................................... (3.8) $ 2.85

Forfeited .......................................................... (0.4) $33.51

Balance, January 29, 2011 ............................................ 7.6 $22.43

Exercised ......................................................... (1.4) $13.35

Forfeited .......................................................... (0.4) $30.18

Balance, January 28, 2012 ............................................ 5.8 $23.96

Exercised ......................................................... (0.8) $14.75

Forfeited .......................................................... (0.4) $29.02

Balance, February 2, 2013 ............................................ 4.6 $25.04

F-33