GameStop 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In July 2012, an accounting standard update was issued related to testing indefinite-lived intangible assets

for impairment. The purpose of the update is to simplify the guidance for testing indefinite-lived intangible assets

for impairment and the update permits entities to first assess qualitative factors to determine whether it is

necessary to perform the quantitative impairment test. Unless an entity determines, through its qualitative

assessment, that it is more likely than not that an indefinite-lived intangible asset is impaired, it would not be

required to calculate the fair value of the asset. This standard is effective for annual and interim impairment tests

of indefinite-lived intangible assets performed in fiscal years beginning after September 15, 2012, and early

adoption is permitted. This standard did not have an impact on our annual indefinite-lived asset impairment

testing process in fiscal 2012 as we did not elect to perform a qualitative assessment. The adoption of this

guidance may result in a change in how we perform our goodwill impairment assessment; however, it will not

have a material impact on our consolidated financial statements.

During the first quarter of fiscal 2012, we adopted the accounting standard update regarding the presentation

of comprehensive income. This accounting standard update was issued to increase the prominence of items

reported in other comprehensive income. The accounting standard update requires that all non-owner changes in

stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two

separate, but consecutive statements. In connection with the adoption of this accounting standard update, our

consolidated financial statements now include separate consolidated statements of comprehensive income.

During the first quarter of fiscal 2012, we adopted the accounting standard update regarding fair value

measurement and disclosure. This accounting standard update was issued to provide a consistent definition of fair

value and ensure that the fair value measurement and disclosure requirements are similar between GAAP and

International Financial Reporting Standards. This accounting standard update also changes certain fair value

measurement principles and enhances the disclosure requirements particularly for Level 3 fair value

measurements. The adoption of this accounting standard update did not have a significant impact on our

consolidated financial statements.

In September 2011, an accounting standard update was issued related to testing goodwill for impairment.

The purpose of the update is to simplify the guidance for testing goodwill for impairment and the update permits

entities to first assess qualitative factors to determine whether it is necessary to perform the quantitative

impairment test. An entity will no longer be required to calculate the fair value of a reporting unit unless the

entity determines, based on a qualitative assessment, that it is more likely than not that its fair value is less than

its carrying amount. This standard did not have an impact on our annual goodwill impairment testing process in

fiscal 2012 as we did not elect to perform a qualitative assessment. The adoption of this guidance may result in a

change in how we perform our goodwill impairment assessment; however, it will not have a material impact on

our consolidated financial statements.

Seasonality

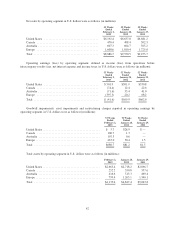

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit

realized during the fourth quarter which includes the holiday selling season. Results for any quarter are not

necessarily indicative of the results that may be achieved for a full fiscal year. Quarterly results may fluctuate

materially depending upon, among other factors, the timing of new product introductions and new store

openings, sales contributed by new stores, increases or decreases in comparable store sales, adverse weather

conditions, shifts in the timing of certain holidays or promotions and changes in our merchandise mix.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Exposure

Our Revolver’s per annum interest rate is variable and is based on one of (i) the U.S. prime rate, (ii) the

LIBO rate or (iii) the U.S. federal funds rate. We do not use derivative financial instruments to hedge interest rate

exposure. We limit our interest rate risks by investing our excess cash balances in short-term, highly-liquid

instruments with a maturity of one year or less. We do not expect any material losses from our invested cash

balances, and we believe that our interest rate exposure is modest.

51