GameStop 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

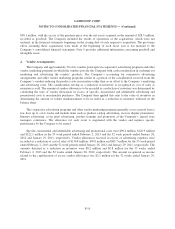

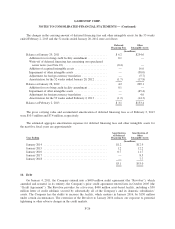

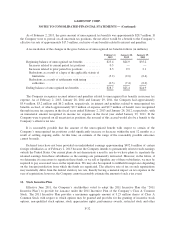

The changes in the carrying amount of deferred financing fees and other intangible assets for the 53 weeks

ended February 2, 2013 and the 52 weeks ended January 28, 2012 were as follows:

Deferred

Financing Fees

Other

Intangible Assets

(In millions)

Balance at January 29, 2011 ............................... $6.2 $254.6

Addition for revolving credit facility amendment ............. 0.1 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 10) ............................. (0.4) —

Addition of acquired intangible assets ...................... — 16.0

Impairment of other intangible assets ...................... — (38.0)

Adjustment for foreign currency translation ................. — (5.7)

Amortization for the 52 weeks ended January 28, 2012 ........ (1.7) (17.8)

Balance at January 28, 2012 ............................... 4.2 209.1

Addition for revolving credit facility amendment ............. 0.1 —

Impairment of other intangible assets ...................... — (45.4)

Adjustment for foreign currency translation ................. — 4.0

Amortization for the 53 weeks ended February 2, 2013 ........ (1.2) (14.3)

Balance at February 2, 2013 ............................... $3.1 $153.4

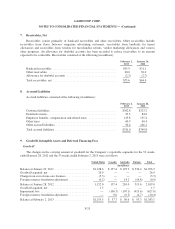

The gross carrying value and accumulated amortization of deferred financing fees as of February 2, 2013

were $10.5 million and $7.4 million, respectively.

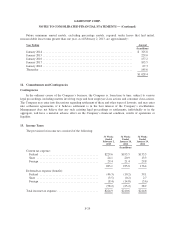

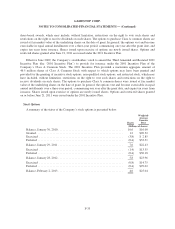

The estimated aggregate amortization expenses for deferred financing fees and other intangible assets for

the next five fiscal years are approximately:

Year Ending

Amortization

of Deferred

Financing Fees

Amortization of

Other

Intangible Assets

(In millions)

January 2014 ........................................... $1.2 $12.9

January 2015 ........................................... 1.2 12.2

January 2016 ........................................... 0.7 11.7

January 2017 ........................................... — 8.5

January 2018 ........................................... — 7.7

$3.1 $53.0

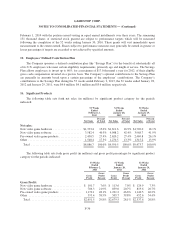

10. Debt

On January 4, 2011, the Company entered into a $400 million credit agreement (the “Revolver”), which

amended and restated, in its entirety, the Company’s prior credit agreement entered into in October 2005 (the

“Credit Agreement”). The Revolver provides for a five-year, $400 million asset-based facility, including a $50

million letter of credit sublimit, secured by substantially all of the Company’s and its domestic subsidiaries’

assets. The Company has the ability to increase the facility, which matures in January 2016, by $150 million

under certain circumstances. The extension of the Revolver to January 2016 reduces our exposure to potential

tightening or other adverse changes in the credit markets.

F-26