GameStop 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

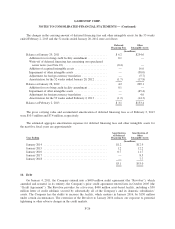

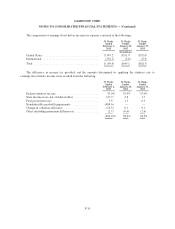

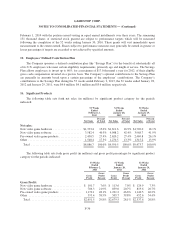

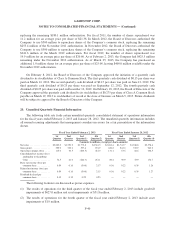

The following table summarizes information as of February 2, 2013 concerning outstanding and exercisable

options:

Options Outstanding Options Exercisable

Range of Exercise Prices

Number

Outstanding

(Millions)

Weighted-

Average

Remaining

Life (Years)

Weighted-

Average

Contractual

Price

Number

Exercisable

(Millions)

Weighted-

Average

Exercise

Price

$ 9.29 - $10.13 .......................... 1.0 1.86 $ 9.93 1.0 $ 9.93

$17.94 - $20.69 .......................... 1.5 4.64 $20.39 1.3 $20.40

$26.02 - $26.69 .......................... 1.3 5.33 $26.24 1.3 $26.24

$49.95 - $49.95 .......................... 0.8 5.01 $49.95 0.8 $49.95

$ 9.29 - $49.95 .......................... 4.6 4.32 $25.04 4.4 $25.26

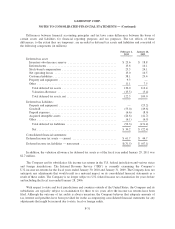

The total intrinsic value of options exercised during the fiscal years ended February 2, 2013, January 28,

2012 and January 29, 2011 was $7.7 million, $16.0 million, and $59.9 million, respectively. The intrinsic value

of options exercisable and options outstanding was $19.8 million and $20.8 million, respectively, as of

February 2, 2013.

The fair value of each option is recognized as compensation expense on a straight-line basis between the

grant date and the date the options become fully vested. During the 53 weeks ended February 2, 2013 and the

52 weeks ended January 28, 2012 and January 29, 2011, the Company included compensation expense relating to

the grant of these options in the amount of $2.1 million, $6.4 million and $12.2 million, respectively, in selling,

general and administrative expenses. As of February 2, 2013, there was no unrecognized compensation expense

related to the unvested portion of the Company’s stock options.

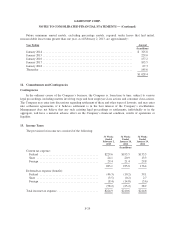

Restricted Stock Awards

The Company grants restricted stock awards to certain of its employees, officers and non-employee

directors. Restricted stock awards generally vest over a three-year period on the anniversary of the date of

issuance.

F-34