GameStop 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

further information associated with the trade name impairment. In addition, $22.7 million was recorded related to

the impairment of investments in non-core businesses, primarily a small retail movie chain of stores owned by

the Company until fiscal 2011. The Company also incurred restructuring charges in the fourth quarter of fiscal

2011 related to the exit of certain markets in Europe and the closure of underperforming stores in the

international segments, as well as the consolidation of European home office sites and back-office functions.

These restructuring charges were a result of management’s plan to rationalize the international store base and

improve profitability. In addition, the Company recognized impairment charges related to its annual evaluation of

store property, equipment and other assets in situations where the asset’s carrying value was not expected to be

recovered by its future cash flows over its remaining useful life.

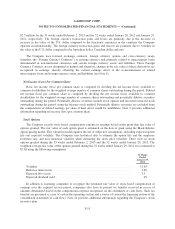

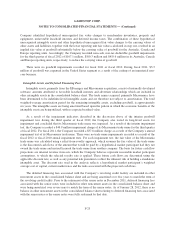

A summary of the Company’s asset impairments and restructuring charges for the 52 weeks ended

January 28, 2012 is as follows:

United States Canada Australia Europe Total

(In millions)

Intangible asset impairment ............................ $ — $— $— $37.8 $37.8

Impairment of investments in non-core businesses .......... 22.7 — — — 22.7

Property, equipment and other asset impairments ........... 3.2 1.1 0.5 6.4 11.2

Termination benefits .................................. 3.0 0.2 — 2.4 5.6

Facility closure and other costs ......................... — — 0.1 3.8 3.9

Total .............................................. $28.9 $1.3 $0.6 $50.4 $81.2

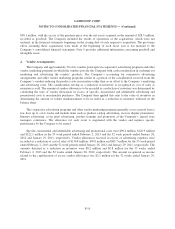

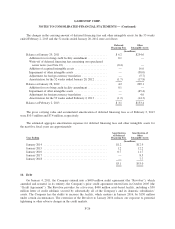

The Company’s accrual for termination benefits and facility closure and other costs was recorded as a

current liability within accrued liabilities on its consolidated balance sheet as of January 28, 2012 in the amount

of $9.5 million. The following table summarizes the balance of accrued expenses related to the restructuring

initiative and the changes in the accrued expenses as of and for the 53 weeks ended February 2, 2013 (in

millions):

Accrued

Balance as of

January 28,

2012

Activity for the 53 Weeks Ended February 2, 2013

Accrued

Balance as of

February 2,

2013Charges

Cash

Payments

Non-cash and

Foreign

Currency

Changes

Termination benefits ................ $5.6 $— $(4.6) $(0.1) $0.9

Facility closure and other costs ........ 3.9 — (2.2) (1.7) —

Total ............................ $9.5 $— $(6.8) $(1.8) $0.9

The Company also recognized impairment charges in fiscal 2010 of $1.5 million related to its annual

evaluation of store property, equipment and other assets in situations where the asset’s carrying value was not

expected to be recovered by its future discounted cash flows over its remaining useful life. These charges were

primarily related to the Company’s stores in the European segment.

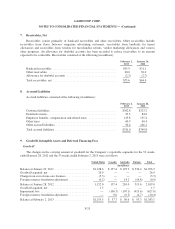

3. Acquisitions

During fiscal 2012, the Company completed acquisitions with a total consideration of $1.5 million, with the

excess of the purchase price over the net identifiable assets acquired, in the amount of $1.5 million recorded as

goodwill. During fiscal 2011, the Company completed acquisitions with a total consideration of $30.1 million,

with the excess of the purchase price over the net identifiable assets acquired, in the amount of $26.9 million

recorded as goodwill. During fiscal 2010, the Company completed acquisitions with a total consideration of

F-18