GameStop 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

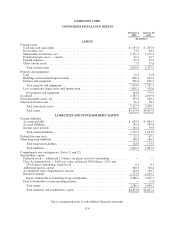

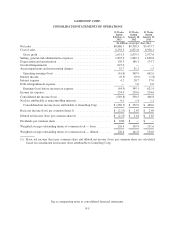

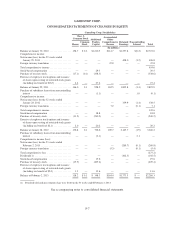

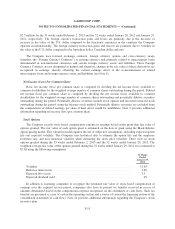

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

GameStop Corp. Stockholders

Noncontrolling

Interest Total

Class A

Common Stock Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income

Retained

EarningsShares

Common

Stock

(In millions)

Balance at January 30, 2010 ................. 158.7 $ 0.2 $1,210.5 $114.7 $1,397.8 $(0.2) $2,723.0

Comprehensive income:

Net income (loss) for the 52 weeks ended

January 29, 2011 ........................ — — — — 408.0 (1.2) 406.8

Foreign currency translation ................. — — — 47.8 — — 47.8

Total comprehensive income ................. 454.6

Stock-based compensation .................. — — 29.5 — — — 29.5

Purchase of treasury stock ................... (17.1) (0.1) (338.5) — — — (338.6)

Exercise of employee stock options and issuance

of shares upon vesting of restricted stock grants

(including tax benefit of $18.7) ............. 4.4 — 27.4 — — — 27.4

Balance at January 29, 2011 ................. 146.0 0.1 928.9 162.5 1,805.8 (1.4) 2,895.9

Purchase of subsidiary shares from noncontrolling

interest ................................ — — (1.1) — — 1.0 (0.1)

Comprehensive income:

Net income (loss) for the 52 weeks ended

January 28, 2012 ........................ — — — — 339.9 (1.4) 338.5

Foreign currency translation ................. — — — 7.2 — (0.1) 7.1

Total comprehensive income ................. 345.6

Stock-based compensation .................. — — 18.8 — — — 18.8

Purchase of treasury stock ................... (11.2) — (240.2) — — — (240.2)

Exercise of employee stock options and issuance

of shares upon vesting of restricted stock grants

(including tax benefit of $2.1) .............. 2.0 — 20.2 — — — 20.2

Balance at January 28, 2012 ................. 136.8 0.1 726.6 169.7 2,145.7 (1.9) 3,040.2

Purchase of subsidiary shares from noncontrolling

interest ................................ — — (2.1) — — 2.1 —

Comprehensive income (loss):

Net income (loss) for the 53 weeks ended

February 2, 2013 ........................ — — — — (269.7) (0.1) (269.8)

Foreign currency translation ................. — — — (5.3) — (0.1) (5.4)

Total comprehensive loss ................... (275.2)

Dividends(1) ............................. — — — — (102.5) — (102.5)

Stock-based compensation .................. — — 19.6 — — — 19.6

Purchase of treasury stock ................... (19.9) — (409.4) — — — (409.4)

Exercise of employee stock options and issuance

of shares upon vesting of restricted stock grants

(including tax benefit of $2.0) .............. 1.3 — 13.6 — — — 13.6

Balance at February 2, 2013 ................. 118.2 $ 0.1 $ 348.3 $164.4 $1,773.5 $ — $2,286.3

(1) Dividends declared per common share were $0.80 in the 53 weeks ended February 2, 2013.

See accompanying notes to consolidated financial statements.

F-7