Cisco 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 73

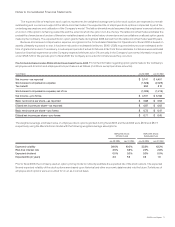

The accumulated benet obligations under these plans were $199 million as of July 29, 2006 and represent the total benets earned by

active and retired employees discounted at an assumed interest rate. Earned benets for active employees are based on their current pay

and service. The accumulated post-retirement benet obligations of the Retiree Medical and Life Plans were $12 million as of July 29, 2006

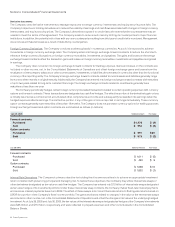

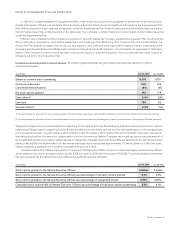

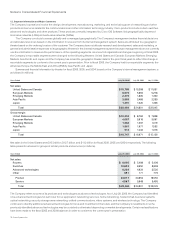

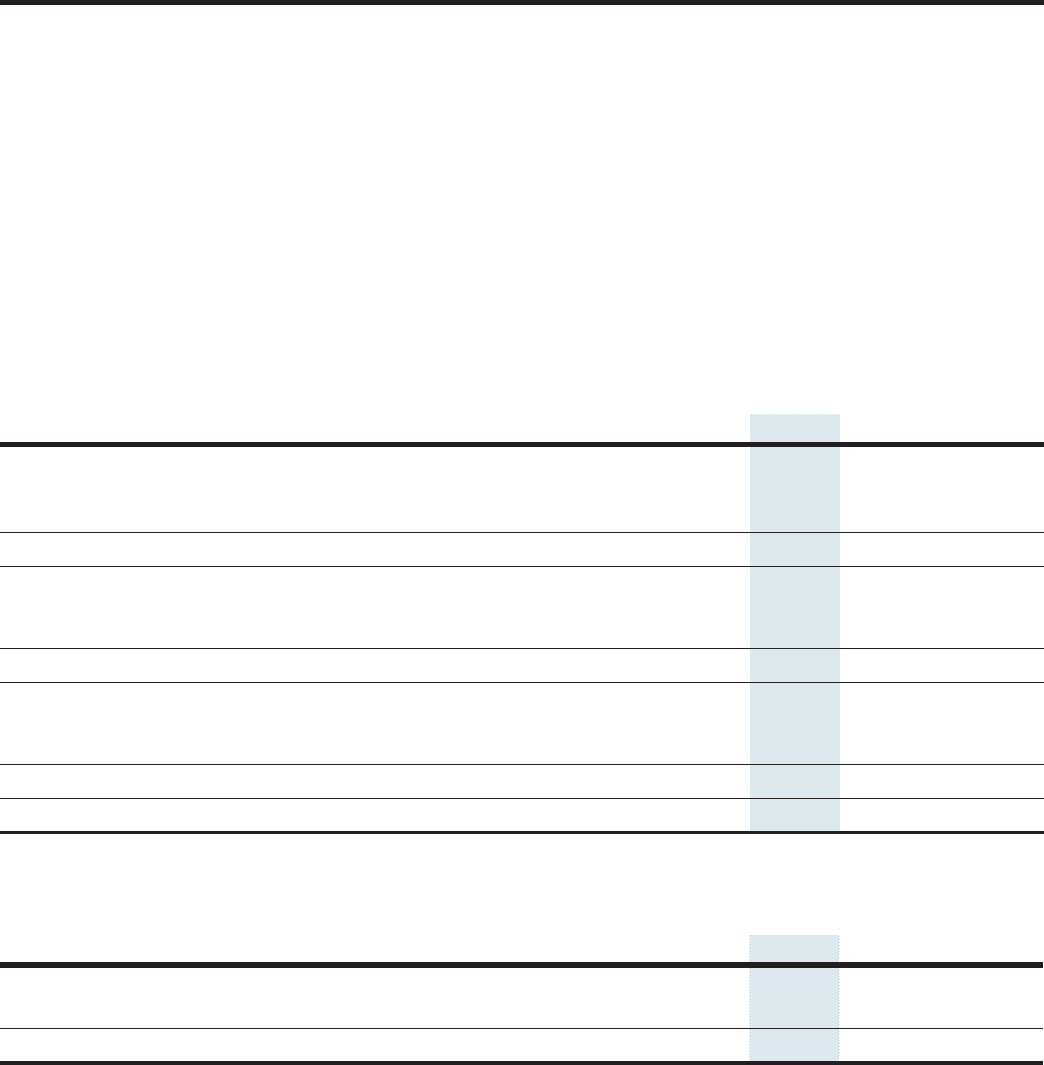

and are unfunded. Signicant weighted-average actuarial assumptions for each plan were as follows:

Pension Plans

Restoration

Plan SERPs

Retiree Medical

and Life Plans

Discount rate 5.9% 5.9% 6.4% 6.2%

Rate of compensation increase 5.0% 5.0% 5.0% N/A

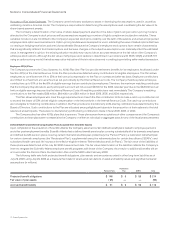

The Company’s expected return on plan assets for the Pension Plans is 8.0%. To determine the expected long-term rate of return on the

assets for the Pension Plans, the Company considered the historical and expected returns on the plan assets, as well as the current and

expected allocation of the plan assets. Plan assets are invested in publicly traded equity securities, xed income securities, and cash and

cash equivalents. The equity portfolio is diversied between domestic growth, value and index components, and an international investment

component. The xed income portfolio is managed by utilizing intermediate-term instruments of high credit quality. The Company’s periodic

pension cost related to the dened benet pension plans and post retirement benets was not material for scal 2006. The Company was not

required to make any contributions to these plans during scal 2006. The Company also assumed deferred compensation plans for certain

employees and directors of Scientic-Atlanta. As of July 29, 2006, the deferred compensation liability under these plans was approximately

$100 million and was recorded in other long-term liabilities.

11. Income Taxes

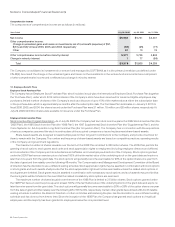

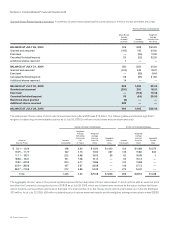

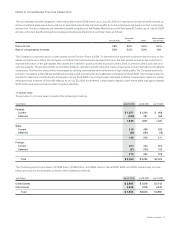

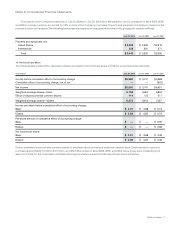

The provision for income taxes consists of the following (in millions):

Years Ended July 29, 2006 July 30, 2005 July 31, 2004

Federal:

Current $ 1,877 $ 1,340 $ 968

Deferred (292) 497 469

1,585 1,837 1,437

State:

Current 215 496 230

Deferred (20) (292) (19)

195 204 211

Foreign:

Current 304 404 274

Deferred (31) (150) 102

273 254 376

Total $ 2,053 $ 2,295 $ 2,024

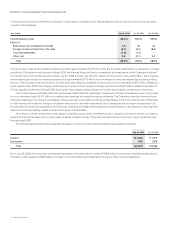

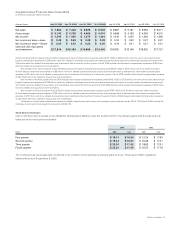

The Company paid income taxes of $1.642 billion, $1.266 billion, and $644 million in scal 2006, 2005, and 2004, respectively. Income

before provision for income taxes consists of the following (in millions):

Years Ended July 29, 2006 July 30, 2005 July 31, 2004

United States $ 2,685 $ 7,028 $ 2,743

International 4,948 1,008 4,249

Total $ 7,633 $ 8,036 $ 6,992

Notes to Consolidated Financial Statements