Cisco 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 63

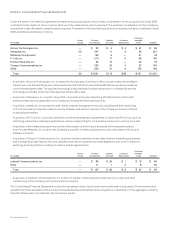

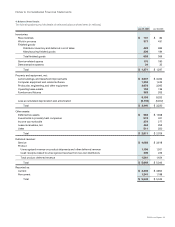

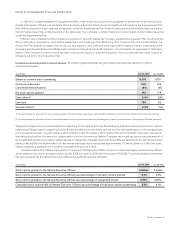

Purchase Commitments with Contract Manufacturers and Suppliers

The Company purchases components from a variety of suppliers and uses several contract manufacturers to provide manufacturing services

for its products. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component

supply, the Company enters into agreements with contract manufacturers and suppliers that either allow them to procure inventory based

upon criteria as dened by the Company or that establish the parameters dening the Company’s requirements. In certain instances, these

agreements allow the Company the option to cancel, reschedule, and adjust the Company’s requirements based on its business needs

prior to rm orders being placed. Consequently, only a portion of the Company’s reported purchase commitments arising from these

agreements are rm, noncancelable, and unconditional commitments. As of July 29, 2006, the Company had total purchase commitments

for inventory of approximately $2.0 billion, compared with $954 million as of July 30, 2005.

In addition to the above, the Company records a liability for rm, noncancelable, and unconditional purchase commitments for quantities

in excess of its future demand forecasts consistent with the Company’s allowance for inventory. As of July 29, 2006, the liability for these

purchase commitments was $148 million, compared with $87 million as of July 30, 2005, and was included in other accrued liabilities.

Other Commitments

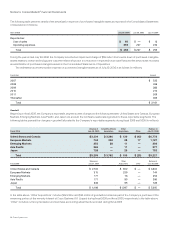

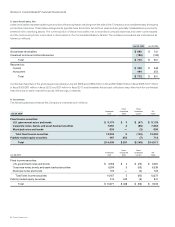

The Company has entered into an agreement to invest approximately $800 million in venture funds managed by SOFTBANK that are

required to be funded on demand. The total commitment is to be invested in venture funds and as senior debt with entities as directed by

SOFTBANK. The Company’s commitment to fund the senior debt is contingent upon the achievement of certain agreed-upon milestones.

As of July 29, 2006, the Company had invested $523 million in the venture funds pursuant to the commitment, compared with $414 million

as of July 30, 2005. In addition, as of July 29, 2006, the Company had invested $49 million in the senior debt pursuant to the commitment,

all of which has been repaid. As of July 30, 2005, the Company had invested $49 million in the senior debt pursuant to the commitment, of

which $47 million had been repaid.

The Company also has certain other funding commitments related to its privately held investments that are based on the achievement of

certain agreed-upon milestones. The funding commitments were approximately $34 million as of July 29, 2006, compared with approximately

$56 million as of July 30, 2005.

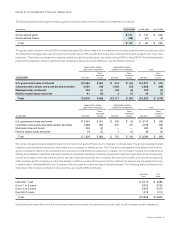

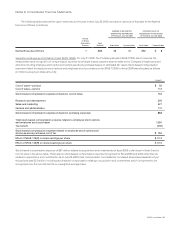

Variable Interest Entities

In the ordinary course of business, the Company has investments in privately held companies and provides nancing to certain customers

through its wholly owned subsidiaries, which may be considered to be variable interest entities. The Company has evaluated its investments

in privately held companies and customer nancings and determined that there were no signicant unconsolidated variable interest entities

as of July 29, 2006.

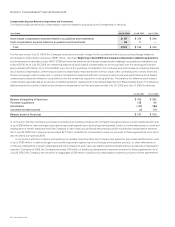

Guarantees and Product Warranties

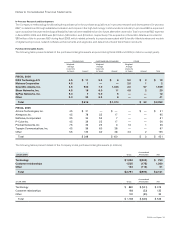

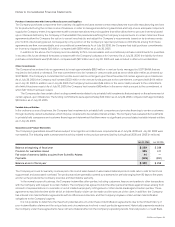

The Company’s guarantees issued that are subject to recognition and disclosure requirements as of July 29, 2006 and July 30, 2005 were

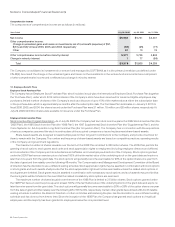

not material. The following table summarizes the activity related to the product warranty liability during scal 2006 and 2005 (in millions):

July 29, 2006 July 30, 2005

Balance at beginning of fiscal year $ 259 $ 239

Provision for warranties issued 395 411

Fair value of warranty liability acquired from Scientific-Atlanta 44 —

Payments (389) (391)

Balance at end of fiscal year $ 309 $ 259

The Company accrues for warranty costs as part of its cost of sales based on associated material product costs, labor costs for technical

support staff, and associated overhead. The products sold are generally covered by a warranty for periods ranging from 90 days to ve years,

and for some products the Company provides a limited lifetime warranty.

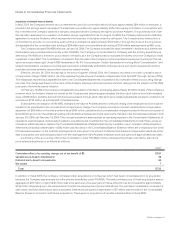

In the normal course of business, the Company indemnies other parties, including customers, lessors, and parties to other transactions

with the Company, with respect to certain matters. The Company has agreed to hold the other parties harmless against losses arising from

a breach of representations or covenants, or out of intellectual property infringement or other claims made against certain parties. These

agreements may limit the time within which an indemnication claim can be made and the amount of the claim. In addition, the Company

has entered into indemnication agreements with its ofcers and directors, and the Company’s bylaws contain similar indemnication

obligations to the Company’s agents.

It is not possible to determine the maximum potential amount under these indemnication agreements due to the limited history of

prior indemnication claims and the unique facts and circumstances involved in each particular agreement. Historically, payments made by

the Company under these agreements have not had a material effect on the Company’s operating results, nancial position, or cash ows.

Notes to Consolidated Financial Statements