Cisco 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 Cisco Systems, Inc.

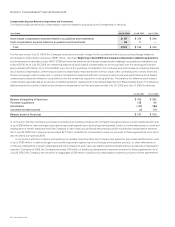

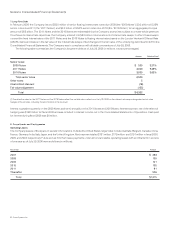

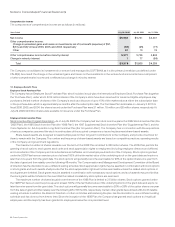

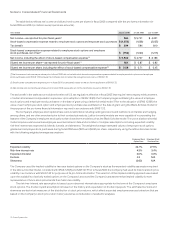

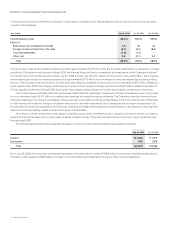

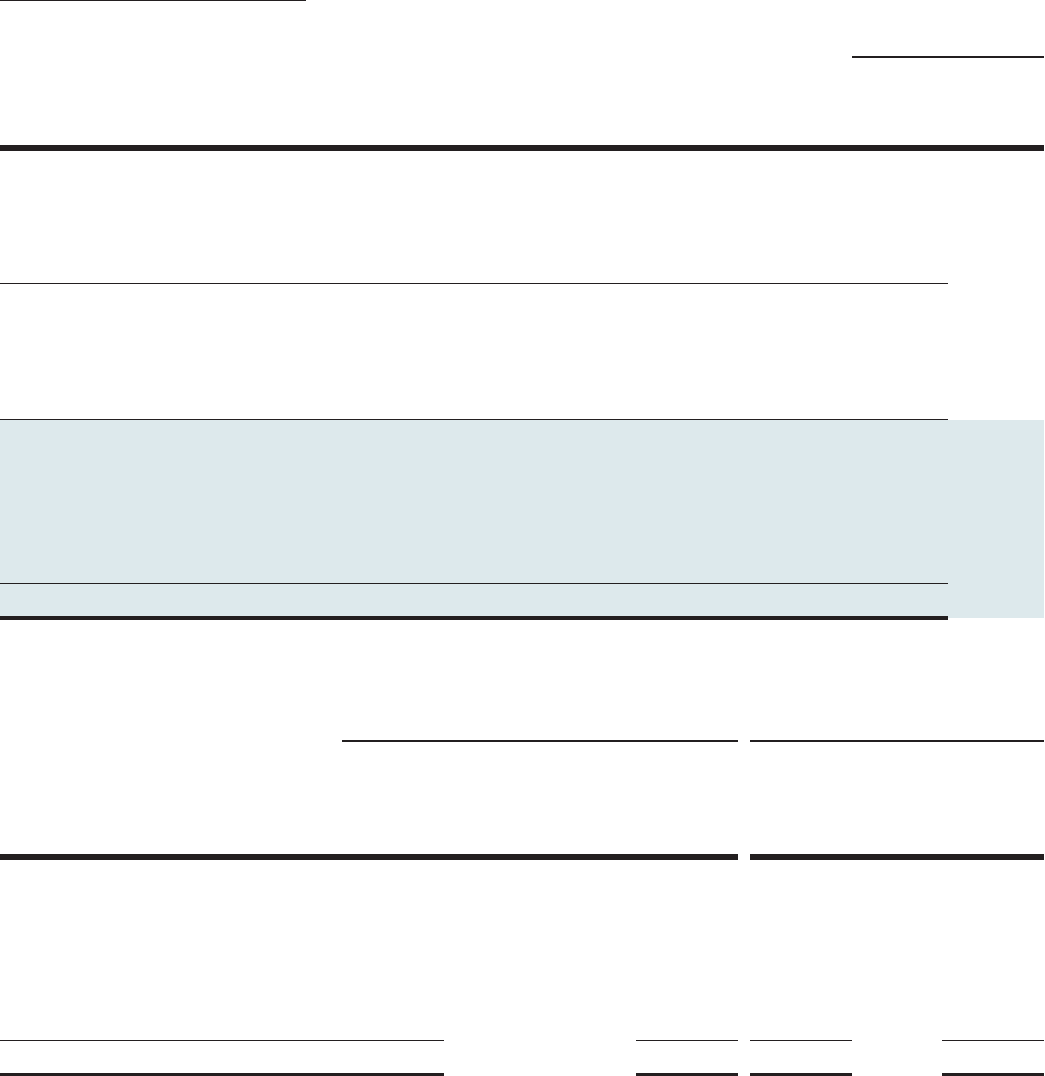

General Share-Based Award Information A summary of share-based award activity is as follows (in millions, except per-share amounts):

STOCK OPTIONS OUTSTANDING

Share-Based

Awards

Available

for Grant

Number

Outstanding

Weighted-

Average

Exercise Price

Per Share

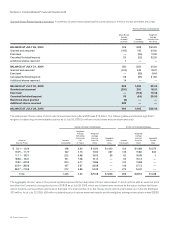

BALANCE AT JULY 26, 2003 526 1,303 $ 25.29

Granted and assumed (195) 195 20.00

Exercised — (96) 10.03

Canceled/forfeited/expired 52 (52) 32.33

Additional shares reserved 7 — —

BALANCE AT JULY 31, 2004 390 1,350 25.34

Granted and assumed (244) 244 18.70

Exercised — (93) 8.44

Canceled/forfeited/expired 63 (65) 31.63

Additional shares reserved 14 — —

BALANCE AT JULY 30, 2005 223 1,436 25.02

Granted and assumed (230) 230 18.21

Exercised — (136) 10.08

Canceled/forfeited/expired 79 (84) 29.53

Restricted stock granted (6) — —

Additional shares reserved 398 — —

BALANCE AT JULY 29, 2006 464 1,446 $ 25.08

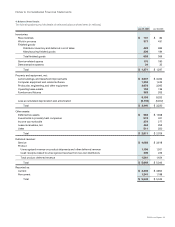

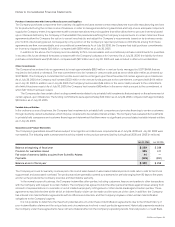

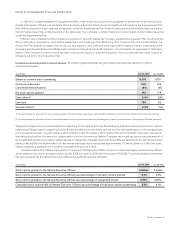

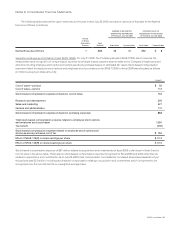

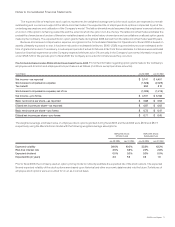

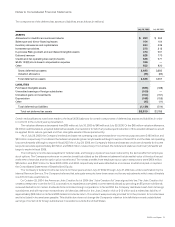

The total pretax intrinsic value of stock options exercised during scal 2006 was $1.3 billion. The following table summarizes signicant

ranges of outstanding and exercisable options as of July 29, 2006 (in millions, except years and per-share amounts):

STOCK OPTIONS OUTSTANDING STOCK OPTIONS EXERCISABLE

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

(in Years)

Weighted-

Average

Exercise

Price Per

Share

Aggregate

Intrinsic

Value

Number

Exercisable

Weighted-

Average

Exercise

Price Per

Share

Aggregate

Intrinsic

Value

$ 0.01 – 13.04 198 3.90 $ 10.92 $ 1,420 152 $ 10.89 $ 1,072

13.05 – 17.70 182 4.73 15.90 397 146 15.80 334

17.71 – 18.57 222 6.98 18.05 36 62 18.48 2

18.58 – 19.31 181 7.08 19.14 — 64 19.13 —

19.32 – 20.53 204 5.77 19.86 — 124 19.98 —

20.54 – 38.06 187 3.67 26.08 — 149 27.13 —

38.07 – 72.56 272 2.89 54.39 — 272 54.40 —

Total 1,446 4.92 $ 25.08 $ 1,853 969 $ 28.53 $ 1,408

The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value based on stock options with an exercise price

less than the Company’s closing stock price of $18.08 as of July 29, 2006, which would have been received by the option holders had those

option holders exercised their options as of that date. The total number of in-the-money stock options exercisable as of July 29, 2006 was

303 million. As of July 30, 2005, 906 million outstanding stock options were exercisable and the weighted-average exercise price was $28.80.

Notes to Consolidated Financial Statements

Range of

Exercise Prices