Cisco 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Cisco Systems, Inc.

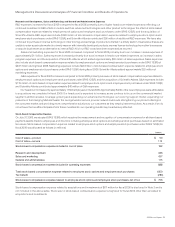

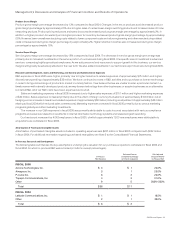

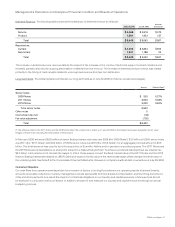

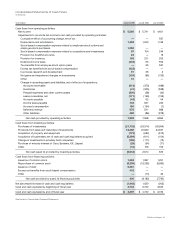

The following tables summarize our contractual obligations at July 29, 2006 and July 30, 2005 (in millions):

PAYMENTS DUE BY PERIOD

Total

Less than

1 Year

1–3

Years

3–5

Years

More than

5 YearsJuly 29, 2006

Operating leases $ 1,215 $ 233 $ 280 $ 196 $ 506

Purchase commitments with contract manufacturers and suppliers 1,979 1,979 — — —

Purchase obligations 1,418 994 314 66 44

Long-term debt 6,505 — 502 3,003 3,000

Other long-term liabilities 161 10 80 28 43

Total $ 11,278 $ 3,216 $ 1,176 $ 3,293 $ 3,593

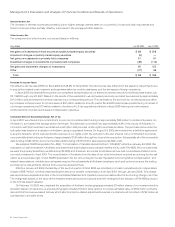

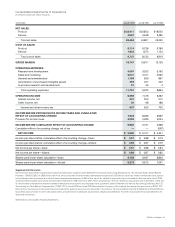

PAYMENTS DUE BY PERIOD

July 30, 2005 Total

Less than

1 Year

1–3

Years

3–5

Years

More than

5 Years

Operating leases $ 1,260 $ 215 $ 281 $ 184 $ 580

Purchase commitments with contract manufacturers and suppliers 954 954 — — —

Purchase obligations 1,398 1,014 338 46 —

Total $ 3,612 $ 2,183 $ 619 $ 230 $ 580

Operating Leases We lease ofce space in several U.S. locations. Outside the United States, larger sites include Australia, Belgium, Canada,

China, France, Germany, India, Italy, Japan, and the United Kingdom. Operating lease amounts include future minimum lease payments

under all our noncancelable operating leases with an initial term in excess of one year.

Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and use several

contract manufacturers to provide manufacturing services for our products. During the normal course of business, in order to manage

manufacturing lead times and help ensure adequate component supply, we enter into agreements with contract manufacturers and

suppliers that either allow them to procure inventory based upon criteria as dened by us or that establish the parameters dening our

requirements. In certain instances, these agreements allow us the option to cancel, reschedule, and adjust our requirements based on our

business needs prior to rm orders being placed. Consequently, only a portion of our reported purchase commitments arising from these

agreements are rm, noncancelable, and unconditional commitments. The purchase commitments for inventory are expected to be fullled

within one year. The increase in purchase commitments for inventory is related to the inclusion of approximately $295 million of purchase

commitments for Scientic-Atlanta, the implementation of the lean manufacturing model, higher backlog, and longer lead times in the

broader supply chain.

In addition to the above, we record a liability for rm, noncancelable, and unconditional purchase commitments for quantities in excess

of our future demand forecasts consistent with our allowance for inventory. As of July 29, 2006, the liability for these purchase commitments

was $148 million, compared with $87 million as of July 30, 2005. These amounts are included in other accrued liabilities in our Consolidated

Balance Sheets at July 29, 2006 and July 30, 2005, and are not included in the preceding table.

Purchase Obligations Purchase obligations represent an estimate of all open purchase orders and contractual obligations in the ordinary

course of business, other than commitments with contract manufacturers and suppliers, for which we have not received the goods or

services. Although open purchase orders are considered enforceable and legally binding, the terms generally allow us the option to cancel,

reschedule, and adjust our requirements based on our business needs prior to the delivery of goods or performance of services.

Other Long-Term Liabilities Our long-term liabilities consist of the fair value of interest rate swaps, accrued liability for dened benet and

deferred compensation plans, deferred tax liabilities, and other long-term liabilities. The future payments related to the fair value of interest

rate swaps, deferred tax liabilities, and certain other long-term liabilities have not been presented in the table above due to the uncertainty

regarding the timing of future payments with respect to these liabilities.

Management’s Discussion and Analysis of Financial Condition and Results of Operations