Cisco 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 2006 Annual Report 13

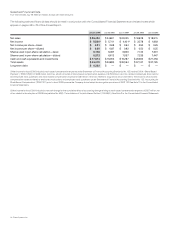

Our long-time commitment to ongoing research and development (R&D) is the basis for Cisco’s innovation. In scal

2006, we invested more than $4 billion in R&D. More importantly, the investments we made three to ve years ago are

the foundation for the growth Cisco experienced this scal year. Of particular interest in scal 2006 was the service

provider acceptance and business momentum of our CRS-1 Carrier Routing System. Our unied communications

advanced technology, formerly enterprise IP communications, has positioned Cisco as the market share leader in

the enterprise voice marketplace. Storage, another of our advanced technologies, experienced revenue growth of

approximately 50 percent on a year-over-year basis. Cisco also announced enhancements to our core routing and

switching product lines, introduced three new advanced technologies, and continued development on several

emerging technologies. We expect to continue our investment in R&D in scal 2007 to support our vision of innovation.

Balanced Strategy: Customer Market Segments and Geographies

Cisco’s strategy is built around four basic principles. First, our ability to identify market transitions and position Cisco

for those transitions based upon feedback primarily from our customers. Second, our unique approach to this market,

taking an architectural perspective, as opposed to just thinking about individual products. Third, our balanced business

and technology implementation. And fourth, careful collaboration and teamwork as we execute across what we dene

as a multiple-dimension chess game, including innovation, products, customer segments, and geographies, enabled

by services.

Our balanced approach to the industry in terms of our four customer segments (enterprise, service provider, com-

mercial, and consumer), core and advanced technologies, and our ve key geographic theaters continues to work very

well. With the acquisition of Scientic Atlanta, we gained systems integration expertise that allowed us to service a

segment of the global service provider market we hadn’t been able to fully reach before. The acquisition also brought

us an expanded consumer offering. Scientic Atlanta is a leading provider of high-end set-top boxes to view high-

denition digital video in addition to standard programming. We believe these devices drive increased demand

for bandwidth on service provider networks, making this a win for Cisco in both the service provider and consumer

segments of the market.

In scal 2006, we also saw previously unmatched acceptance of our products in the commercial market segment,

making it our fastest-growing market segment. We dene a commercial business as generally one with less than 1,000

employees. Small to medium-sized businesses and retail chains are some examples of this type of market segment.

It is exciting to watch this segment begin to embrace networking and unlock the power and efciency of their business

network investment. Again, we believe that Cisco will be a long-term, trusted partner for this segment, and we look

forward to helping these businesses grow to their fullest potential.

Cisco’s business is made up of ve distinct theaters, or geographical regions. These include the United States and

Canada, European Markets, Emerging Markets, Asia Pacic, and Japan. For scal 2006, we reorganized our sales

theaters and added the Emerging Markets theater in order to take advantage of the growth potential of these countries.

We met with government leaders around the world in countries such as India, China, Germany, Saudi Arabia, and Russia.

Our conversations centered around how Cisco could help their countries develop a stronger economy through Internet

access to education, healthcare, and business opportunities. As these countries begin to deploy Internet solutions,

they look to Cisco as a partner and resource vital to their success. As a result, product revenue in Cisco’s Emerging

Markets theater grew 38 percent on a year-over-year basis—the highest growth percentage of all ve theaters. Growth

in Emerging Markets is the truest example of the power of the network now.