Cisco 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 29

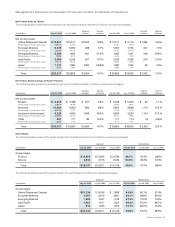

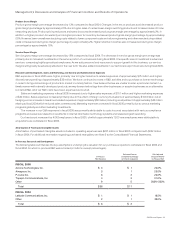

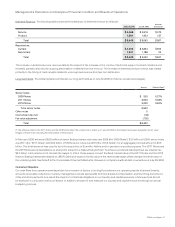

Research and Development, Sales and Marketing, and General and Administrative Expenses

R&D expenses increased for scal 2006 compared to scal 2005 primarily due to higher headcount-related expenses reecting our

continued investment in R&D efforts in routers, switches, advanced technologies, and other product technologies; the effect of stock-based

compensation expense related to employee stock options and employee stock purchases under SFAS 123(R); and the acquisition of

Scientic-Atlanta. R&D expenses include $346 million of stock-based compensation expense related to employee stock options and

employee stock purchases under SFAS 123(R), and Scientic-Atlanta contributed $90 million of additional R&D expenses. We have also

continued to purchase or license technology in order to bring a broad range of products to market in a timely fashion. If we believe that we are

unable to enter a particular market in a timely manner with internally developed products, we may license technology from other businesses

or acquire businesses as an alternative to internal R&D. All of our R&D costs have been expensed as incurred.

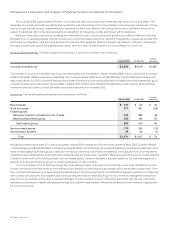

Sales and marketing expenses for scal 2006 increased compared to scal 2005 primarily due to an increase in sales expenses of

approximately $1.1 billion. Sales expenses increased primarily due to an increase in headcount-related expenses, an increase in sales

program expenses, and the acquisition of Scientic-Atlanta, which added approximately $30 million of sales expenses. Sales expenses

also include stock-based compensation expense related to employee stock options and employee stock purchases under SFAS 123(R) of

$337 million during scal 2006. Marketing expenses include $90 million of stock-based compensation expense related to employee stock

options and employee stock purchases under SFAS 123(R) during scal 2006. Scientic-Atlanta added approximately $20 million of

marketing expenses.

G&A expenses for scal 2006 increased compared to scal 2005 primarily because of stock-based compensation expense related to

employee stock options and employee stock purchases under SFAS 123(R), and the acquisition of Scientic-Atlanta. G&A expenses include

$115 million of stock-based compensation expense related to employee stock options and employee stock purchases under SFAS 123(R)

and Scientic-Atlanta contributed approximately $40 million of G&A expenses.

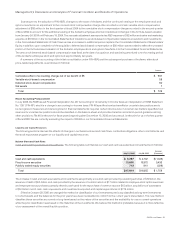

Our headcount increased by approximately 11,500 employees in scal 2006. Approximately 8,000 of the new employees were attributable

to acquisitions we completed in scal 2006. Our headcount is expected to increase, as we continue to focus on the commercial market

segment; additional sales coverage; growing and expanding our advanced technologies; our evolving support model; expanding our

presence in the Emerging Markets theater; the next-generation service provider network build-outs; strengthening our product offerings in

the consumer market; and providing more comprehensive solutions to our customers as they employ Internet solutions. As a result, if we do

not achieve the benets anticipated from these investments, our operating results may be adversely affected.

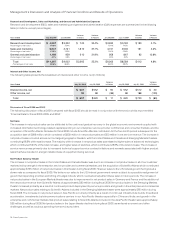

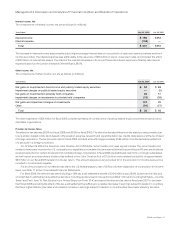

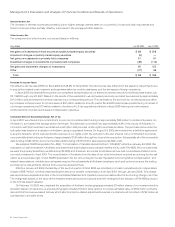

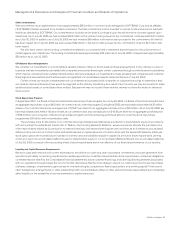

Stock-Based Compensation Expense

On July 31, 2005, we adopted SFAS 123(R), which requires the measurement and recognition of compensation expense for all share-based

payment awards made to employees and directors including employee stock options and employee stock purchases based on estimated

fair values. Stock-based compensation expense related to employee stock options and employee stock purchases under SFAS 123(R) for

scal 2006 was allocated as follows (in millions):

Amount

Cost of sales—product $ 50

Cost of sales—service 112

Stock-based compensation expense included in cost of sales 162

Research and development 346

Sales and marketing 427

General and administrative 115

Stock-based compensation expense included in operating expenses 888

Total stock-based compensation expense related to employee stock options and employee stock purchases 1,050

Tax benefit (294)

Stock-based compensation expense related to employee stock options and employee stock purchases, net of tax $ 756

Stock-based compensation expense related to acquisitions and investments of $87 million for scal 2006 is disclosed in Note 3 and is

not included in the above table. There was no stock-based compensation expense recognized for scal 2005 other than as related to

acquisitions and investments.

Management’s Discussion and Analysis of Financial Condition and Results of Operations