Cisco 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

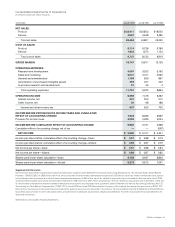

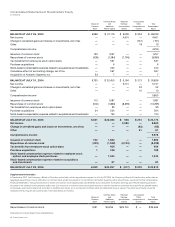

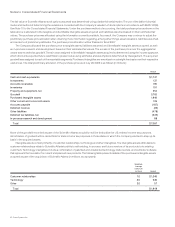

44 Cisco Systems, Inc.

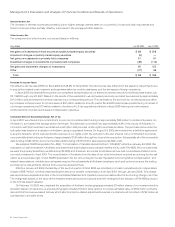

July 29, 2006 July 30, 2005

ASSETS

Current assets:

Cash and cash equivalents $ 3,297 $ 4,742

Investments 14,517 11,313

Accounts receivable, net of allowance for doubtful accounts of $175 at July 29, 2006 and $162 at July 30, 2005 3,303 2,216

Inventories 1,371 1,297

Deferred tax assets 1,604 1,475

Prepaid expenses and other current assets 1,584 967

Total current assets 25,676 22,010

Property and equipment, net 3,440 3,320

Goodwill 9,227 5,295

Purchased intangible assets, net 2,161 549

Other assets 2,811 2,709

TOTAL ASSETS $ 43,315 $ 33,883

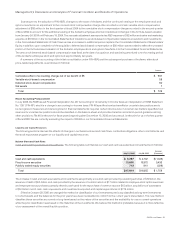

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 880 $ 735

Income taxes payable 1,744 1,511

Accrued compensation 1,516 1,317

Deferred revenue 4,408 3,854

Other accrued liabilities 2,765 2,094

Total current liabilities 11,313 9,511

Long-term debt 6,332 —

Deferred revenue 1,241 1,188

Other long-term liabilities 511 —

Total liabilities 19,397 10,699

Commitments and contingencies (Note 8)

Minority interest 6 10

Shareholders’ equity:

Preferred stock, no par value: 5 shares authorized; none issued and outstanding — —

Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized;

6,059 and 6,331 shares issued and outstanding at July 29, 2006 and July 30, 2005, respectively 24,257 22,394

Retained earnings (Accumulated deficit) (617) 506

Accumulated other comprehensive income 272 274

Total shareholders’ equity 23,912 23,174

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 43,315 $ 33,883

See Notes to Consolidated Financial Statements.

Consolidated Balance Sheets

(in millions, except par value)