Cisco 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 Cisco Systems, Inc.

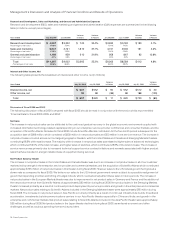

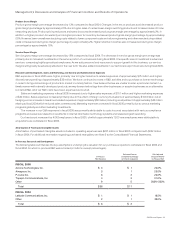

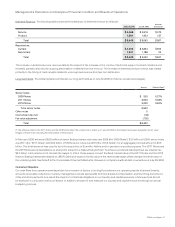

Amortization of Purchased Intangible Assets

Amortization of purchased intangible assets included in operating expenses was $393 million in scal 2006, compared with $227 million

in scal 2005. The increase was related primarily to additional amortization from the Scientic-Atlanta acquisition and an impairment charge

of $69 million from a write down of purchased intangible assets related to certain technology and customer relationships due to a reduction

in expected future cash ows. For additional information regarding our purchased intangible assets, see Note 3 to the Consolidated

Financial Statements.

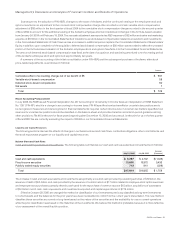

In-Process Research and Development

Our methodology for allocating the purchase price, relating to purchase acquisitions, to in-process R&D is determined through established

valuation techniques in the high-technology communications industry. In-process R&D expense in scal 2006 was $91 million, compared with

$26 million in scal 2005. See Note 3 to the Consolidated Financial Statements for additional information regarding the acquisitions completed

in fiscal 2006 and fiscal 2005 and the in-process R&D recorded for each acquisition. In-process R&D was expensed upon acquisition

because technological feasibility had not been established and no future alternative uses existed. The acquisition of Scientic-Atlanta

accounted for $88 million of the in-process R&D during scal 2006, which related primarily to projects associated with Scientic-Atlanta’s

advanced models of digital set-top boxes, network software enhancements and upgrades, and data products and transmission products.

The fair value of the existing purchased technology and patents, as well as the technology under development, is determined using the

income approach, which discounts expected future cash ows to present value. The discount rates used in the present value calculations

are typically derived from a weighted-average cost of capital analysis and venture capital surveys, adjusted upward to reect additional

risks inherent in the development lifecycle. We consider the pricing model for products related to these acquisitions to be standard within

the high-technology communications industry. However, we do not expect to achieve a material amount of expense reductions as a result

of integrating the acquired in-process technology. Therefore, the valuation assumptions do not include signicant anticipated cost savings.

For purchase acquisitions completed to date, the development of these technologies remains a signicant risk due to the remaining

efforts to achieve technological feasibility, rapidly changing customer markets, uncertain standards for new products, and significant

competitive threats. The nature of the efforts to develop these technologies into commercially viable products consists primarily of

planning, designing, experimenting, and testing activities necessary to determine that the technologies can meet market expectations,

including functionality and technical requirements. Failure to bring these products to market in a timely manner could result in a loss of

market share or a lost opportunity to capitalize on emerging markets and could have a material adverse impact on our business and

operating results.

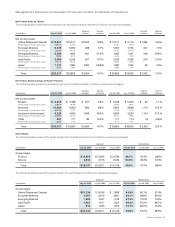

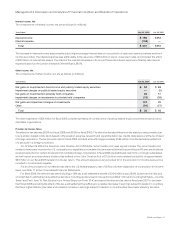

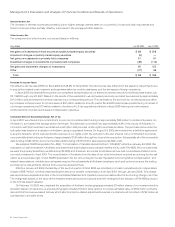

The following table summarizes the key assumptions underlying the valuation for our purchase acquisitions completed in scal 2006

for which in-process R&D was recorded (in millions, except percentages):

In-Process

R&D Expense

Estimated Cost to

Complete Technology

at Time of Acquisition

Risk-Adjusted

Discount Rate for

In-Process R&D

KiSS Technology A/S $ 2 $ 1 22.0%

Scientific-Atlanta, Inc. 88 93 17.0%

Other 1 1 22.0%

Total $ 91 $ 95

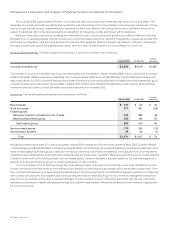

The key assumptions primarily consist of an expected completion date for the in-process projects; estimated costs to complete the projects;

revenue and expense projections, assuming the products have entered the market; and discount rates based on the risks associated with

the development lifecycle of the in-process technology acquired. Failure to achieve the expected levels of revenue and net income from

these products will negatively impact the return on investment expected at the time that the acquisitions were completed and may result

in impairment charges. Actual results from the purchase acquisitions to date did not have a material adverse impact on our business and

operating results.

Management’s Discussion and Analysis of Financial Condition and Results of Operations