Cisco 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Cisco Systems, Inc.

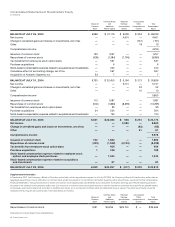

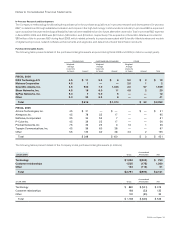

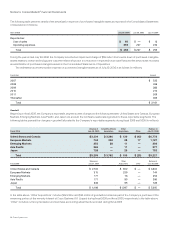

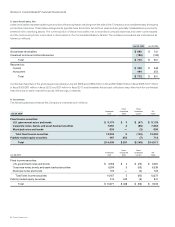

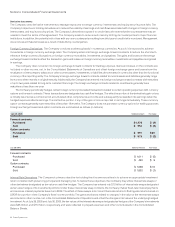

The following table presents details of the amortization expense of purchased intangible assets as reported in the Consolidated Statements

of Operations (in millions):

Years Ended July 29, 2006 July 30, 2005 July 31, 2004

Reported as:

Cost of sales $ 60 $ — $ 13

Operating expenses 393 227 242

Total $ 453 $ 227 $ 255

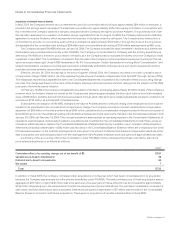

During the year ended July 29, 2006, the Company recorded an impairment charge of $69 million from a write down of purchased intangible

assets related to certain technology and customer relationships due to a reduction in expected future cash ows and the amount was recorded

as amortization of purchased intangible assets in the Consolidated Statements of Operations.

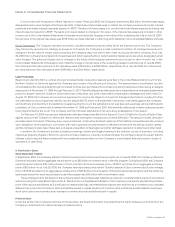

The estimated future amortization expense of purchased intangible assets as of July 29, 2006, is as follows (in millions):

Fiscal Year Amount

2007 $ 525

2008 466

2009 382

2010 274

2011 209

Thereafter 305

Total $ 2,161

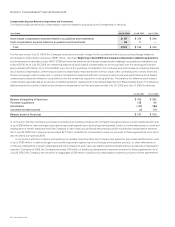

Goodwill

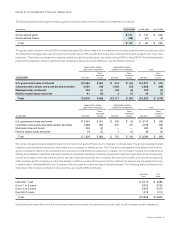

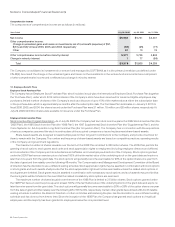

Beginning in scal 2006, the Company’s reportable segments were changed to the following theaters: United States and Canada; European

Markets; Emerging Markets; Asia Pacic; and Japan. As a result, the Company reallocated goodwill to these reportable segments. The

following tables present the changes in goodwill allocated to the Company’s reportable segments during scal 2006 and 2005 (in millions):

Balance at

July 30, 2005

Scientific-Atlanta

Acquisition

Other

Acquisitions Other

Balance at

July 29, 2006Fiscal 2006

United States and Canada $ 3,304 $ 3,396 $ 120 $ (42) $ 6,778

European Markets 744 338 28 17 1,127

Emerging Markets 253 28 11 — 292

Asia Pacific 266 — 11 — 277

Japan 728 — 25 — 753

Total $ 5,295 $ 3,762 $ 195 $ (25) $ 9,227

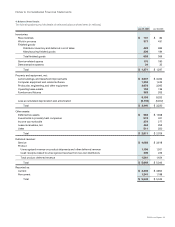

Fiscal 2005

Balance at

July 31, 2004

Other

Acquisitions Other

Balance at

July 30, 2005

United States and Canada $ 2,702 $ 602 $ — $ 3,304

European Markets 515 229 — 744

Emerging Markets 177 76 — 253

Asia Pacific 171 95 — 266

Japan 633 95 — 728

Total $ 4,198 $ 1,097 $ — $ 5,295

In the table above, “Other Acquisitions” includes $22 million and $30 million of goodwill recorded as part of the Company’s purchase of the

remaining portion of the minority interest of Cisco Systems, K.K. (Japan) during scal 2006 and scal 2005, respectively. In the table above,

“Other” includes currency translation and purchase accounting adjustments recorded during scal 2006.

Notes to Consolidated Financial Statements