Cisco 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Cisco Systems, Inc.

Fair Value of Financial Instruments The fair value of certain of the Company’s nancial instruments, including cash and cash equivalents,

accrued compensation, and other accrued liabilities, approximate cost because of their short maturities. The fair values of investments and

the Company’s long-term debt are determined using quoted market prices for those securities or similar nancial instruments.

Concentrations of Risk Cash and cash equivalents are maintained with several nancial institutions. Deposits held with banks may exceed

the amount of insurance provided on such deposits. Generally, these deposits may be redeemed upon demand and are maintained with

nancial institutions of reputable credit and therefore bear minimal credit risk.

The Company performs ongoing credit evaluations of its customers and, with the exception of certain nancing transactions, does not

require collateral from its customers. The Company’s customers are primarily in the enterprise, service provider and commercial markets.

The Company receives certain of its components from sole suppliers. Additionally, the Company relies on a limited number of contract

manufacturers and suppliers to provide manufacturing services for its products. The inability of a contract manufacturer or supplier to fulll

supply requirements of the Company could materially impact future operating results.

Revenue Recognition The Company’s products are generally integrated with software that is essential to the functionality of the equipment.

Additionally, the Company provides unspecied software upgrades and enhancements related to the equipment through its maintenance

contracts for most of its products. Accordingly, the Company accounts for revenue in accordance with Statement of Position No. 97-2, “Software

Revenue Recognition,” and all related interpretations. For sales of products where software is incidental to the equipment, the Company

applies the provisions of Staff Accounting Bulletin No. 101, “Revenue Recognition in Financial Statements” and Staff Accounting Bulletin

No. 104, “Revenue Recognition,” and all related interpretations.

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the fee is xed or

determinable, and collectibility is reasonably assured. In instances where nal acceptance of the product, system, or solution is specied

by the customer, revenue is deferred until all acceptance criteria have been met. Technical support services revenue is deferred and

recognized ratably over the period during which the services are to be performed, which is typically from one to three years. Advanced

services revenue is recognized upon delivery or completion of performance.

When a sale involves multiple elements, such as sales of products that include services, the entire fee from the arrangement is allocated

to each respective element based on its relative fair value and recognized when revenue recognition criteria for each element are met. Fair

value for each element is established based on the sales price charged when the same element is sold separately.

The Company uses distributors that stock inventory and typically sell to systems integrators, service providers, and other resellers. In

addition, certain products are sold through retail partners. The Company refers to these sales through distributors and retail partners as its

two-tier system of sales to the end customer. Revenue from distributors and retail partners is recognized based on a sell-through method

using information provided by them. Distributors and retail partners participate in various cooperative marketing and other programs, and

the Company maintains estimated accruals and allowances for these programs. The Company accrues for warranty costs, sales returns,

and other allowances based on its historical experience.

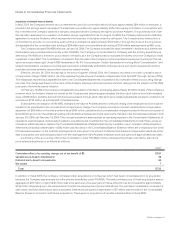

Allowance for Doubtful Accounts The allowance for doubtful accounts is based on the Company’s assessment of the collectibility of

customer accounts. The Company regularly reviews the allowance by considering factors such as historical experience, credit quality, the

age of the accounts receivable balances, and current economic conditions that may affect a customer’s ability to pay.

Lease Receivables The Company provides a variety of lease nancing services to its customers to build, maintain, and upgrade their networks.

Lease receivables primarily represent the principal balance remaining in sales-type and direct-nancing leases under these programs, net of

allowances. These leases typically have two- to three-year terms and are usually collateralized by a security interest in the underlying assets.

Advertising Costs The Company expenses all advertising costs as incurred, and the amounts were not material for all years presented.

Software Development Costs Software development costs required to be capitalized pursuant to Statement of Financial Accounting Standards

No. 86, “Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed,” have not been material to date. Software

development costs for internal use required to be capitalized pursuant to Statement of Position No. 98-1, “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use,” have also not been material to date.

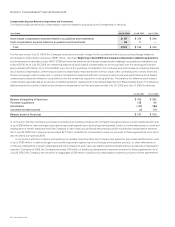

Depreciation and Amortization Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation

and amortization are computed using the straight-line method over the estimated useful lives of the assets. Estimated useful lives of 25 years

are used for buildings. Estimated useful lives of 30 to 36 months are used for computer equipment and related software and ve years

for furniture and xtures. Estimated useful lives of up to ve years are used for production, engineering, and other equipment. Depreciation

of operating lease assets is computed based on the respective lease terms, which generally range up to three years. Depreciation and

amortization of leasehold improvements are computed using the shorter of the remaining lease terms or ve years.

Notes to Consolidated Financial Statements