Cisco 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 31

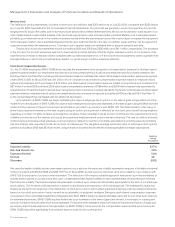

Interest Income, Net

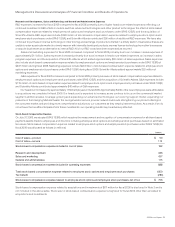

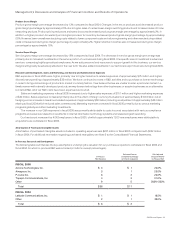

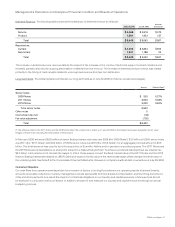

The components of interest income, net, are as follows (in millions):

Years Ended July 29, 2006 July 30, 2005

Interest income $ 755 $ 552

Interest expense (148) —

Total $ 607 $ 552

The increase in interest income was primarily due to higher average interest rates on our portfolio of cash and cash equivalents and xed-

income securities. The interest expense was attributable to the issuance of $6.5 billion in senior unsecured notes, and includes the effect

of $6.0 billion of interest rate swaps. The effect of the interest rate swaps is to convert xed-rate interest expense to oating-rate interest

expense based on the London Interbank Offered Rate (LIBOR).

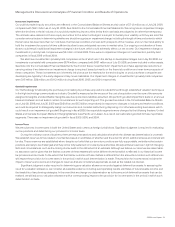

Other Income, Net

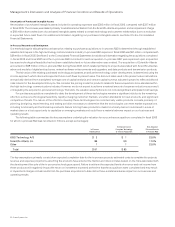

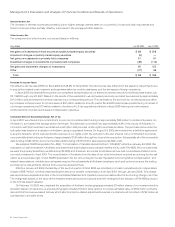

The components of other income, net, are as follows (in millions):

Years Ended July 29, 2006 July 30, 2005

Net gains on investments in fixed income and publicly traded equity securities $ 53 $ 88

Impairment charges on publicly traded equity securities — (5)

Net gains on investments in privately held companies 86 51

Impairment charges on investments in privately held companies (15) (39)

Net gains and impairment charges on investments 124 95

Other (94) (27)

Total $ 30 $ 68

The other expenses of $94 million for scal 2006 consisted primarily of contributions of publicly traded equity securities and products to

charitable organizations.

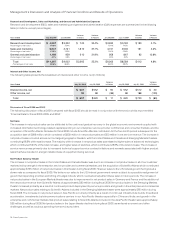

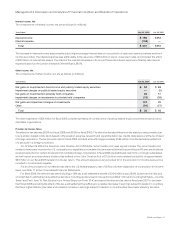

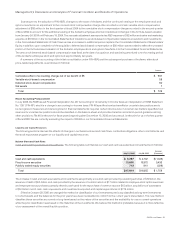

Provision for Income Taxes

The effective tax rate was 26.9% for scal 2006 and 28.6% for scal 2005. The effective tax rate differs from the statutory rate primarily due

to acquisition-related costs, stock-based compensation expense, research and experimentation tax credits, state taxes, and the tax impact

of foreign operations. The tax provision rate for scal 2006 included a benet of approximately $124 million from the favorable settlement

of a tax audit in a foreign jurisdiction.

On October 22, 2004, the American Jobs Creation Act of 2004 (the “Jobs Creation Act”) was signed into law. The Jobs Creation Act

created a temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by providing an 85 percent dividends

received deduction for certain dividends from controlled foreign corporations. In scal 2006, we distributed cash from our foreign subsidiaries

and will report an extraordinary dividend (as dened in the Jobs Creation Act) of $1.2 billion and a related tax liability of approximately

$63 million in our scal 2006 federal income tax return. This amount was previously provided for in the provision for income taxes and is

included in income taxes payable.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and further explanation of our provision for income

taxes, see Note 11 to the Consolidated Financial Statements.

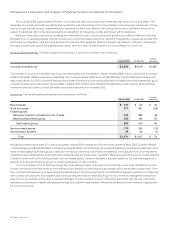

For scal 2006, the effective tax rate (including a 1.6% tax audit settlement benet of $124 million) was 26.9%. Subject to the risks and

uncertainties in estimating future effective tax rates, including as discussed in the sections entitled “Critical Accounting Estimates—Income

Taxes” and Part I, Item 1A, Risk Factors in our Annual Report on Form 10-K, we expect the effective tax rate for scal year 2007 to be lower

than scal 2006 (excluding the effect of the tax audit settlement benet) due to a relative decrease in earnings subject to taxation in countries

that have higher statutory tax rates and a relative increase in earnings subject to taxation in countries that have lower statutory tax rates.

Management’s Discussion and Analysis of Financial Condition and Results of Operations