Cisco 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

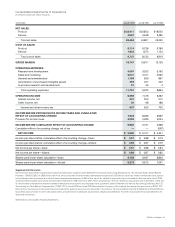

40 Cisco Systems, Inc.

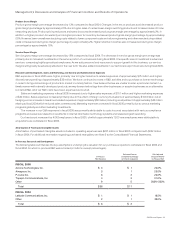

Investments

We maintain an investment portfolio of various holdings, types, and maturities. See Note 6 to the Consolidated Financial Statements. These

securities are classied as available-for-sale and consequently are recorded in the Consolidated Balance Sheets at fair value with unrealized

gains or losses, to the extent unhedged, reported as a separate component of accumulated other comprehensive income, net of tax.

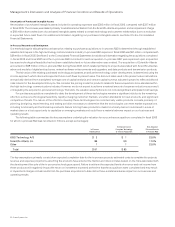

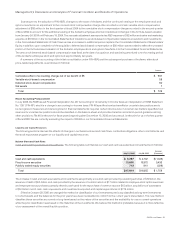

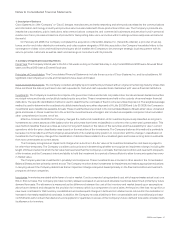

Fixed Income Securities

At any time, a sharp rise in interest rates could have a material adverse impact on the fair value of our xed income investment portfolio.

Conversely, declines in interest rates could have a material adverse impact on interest income for our investment portfolio. Our xed

income instruments are not leveraged as of July 29, 2006, and are held for purposes other than trading. The following tables present the

hypothetical fair values of xed income securities, including the effects of the interest rate swaps discussed further under “Interest Rate

Derivatives” below, as a result of selected potential market decreases and increases in interest rates. Market changes reect immediate

hypothetical parallel shifts in the yield curve of plus or minus 50 basis points (“BPS”), 100 BPS, and 150 BPS. The hypothetical fair values

as of July 29, 2006 and July 30, 2005 are as follows (in millions):

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 29,

2006

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

U.S. government notes and bonds $ 5,289 $ 5,238 $ 5,186 $ 5,135 $ 5,084 $ 5,032 $ 4,981

Corporate and municipal notes and bonds

and asset-backed securities 8,772 8,738 8,705 8,670 8,636 8,603 8,568

Total $ 14,061 $ 13,976 $ 13,891 $ 13,805 $ 13,720 $ 13,635 $ 13,549

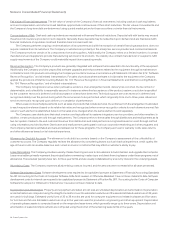

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 30,

2005

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

U.S. government notes and bonds $ 3,540 $ 3,503 $ 3,467 $ 3,430 $ 3,393 $ 3,357 $ 3,320

Corporate and municipal notes and bonds

and asset-backed securities 7,101 7,048 6,995 6,942 6,890 6,837 6,784

Total $ 10,641 $ 10,551 $ 10,462 $ 10,372 $ 10,283 $ 10,194 $ 10,104

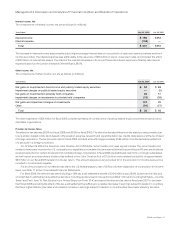

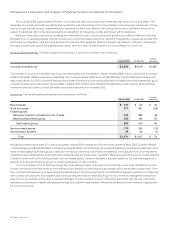

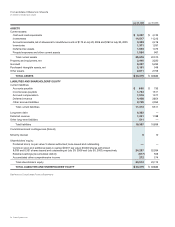

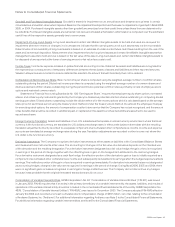

Publicly Traded Equity Securities

The values of our equity investments in several publicly traded companies are subject to market price volatility. The following tables present

the hypothetical fair values of publicly traded equity securities as a result of selected potential decreases and increases in the price of

each equity security in the portfolio, excluding hedged equity securities. Potential uctuations in the price of each equity security in the

portfolio of plus or minus 15%, 25%, and 35% were selected based on the probability of their occurrence. The hypothetical fair values as

of July 29, 2006 and July 30, 2005 are as follows (in millions):

VALUATION OF SECURITIES

GIVEN AN X% DECREASE

IN EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 29,

2006

VALUATION OF SECURITIES

GIVEN AN X% INCREASE

IN EACH STOCK’S PRICE

(35%) (25%) (15%) 15% 25% 35%

Publicly traded equity securities $ 421 $ 486 $ 551 $ 648 $ 745 $ 810 $ 875

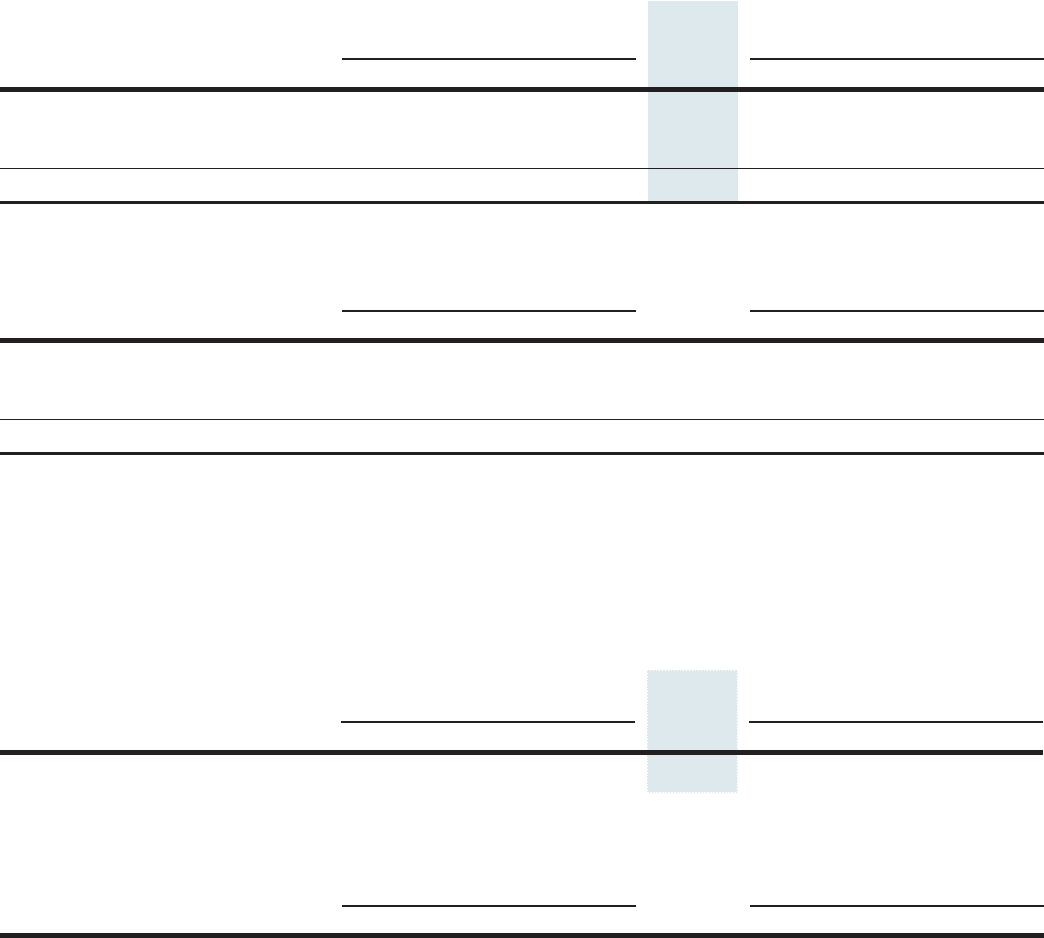

VALUATION OF SECURITIES

GIVEN AN X% DECREASE

IN EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 30,

2005

VALUATION OF SECURITIES

GIVEN AN X% INCREASE

IN EACH STOCK’S PRICE

(35%) (25%) (15%) 15% 25% 35%

Publicly traded equity securities $ 498 $ 575 $ 651 $ 766 $ 881 $ 958 $ 1,034

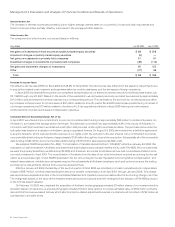

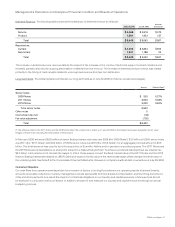

Quantitative and Qualitative Disclosures About Market Risk