Cisco 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 65

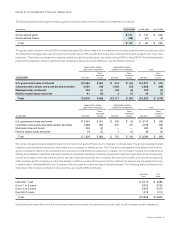

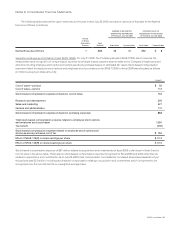

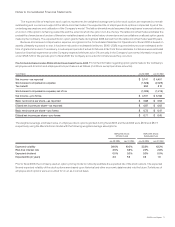

In conjunction with its issuance of xed-rate senior notes in February 2006, the Company entered into $6.0 billion of interest rate swaps

designated as fair value hedges of the xed-rate debt. Under these interest rate swap contracts, the Company receives xed-rate interest

payments and makes interest payments based on LIBOR. The effect of these swaps is to convert xed-rate interest expense to oating-rate

interest expense based on LIBOR. The gains and losses related to changes in the value of the interest rate swaps are included in other

income, net, in the Consolidated Statements of Operations and offset the changes in fair value of the underlying debt. As of July 29, 2006

the fair value of the interest rate swaps was $155 million and was reected in other long-term liabilities in the Consolidated Balance Sheets.

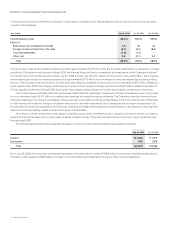

Equity Derivatives The Company maintains a portfolio of publicly traded equity securities which are subject to price risk. The Company

may hold equity securities for strategic purposes or to diversify the Company’s overall investment portfolio. To manage its exposure to

changes in the fair value of certain equity securities, the Company may, from time to time, enter into equity derivative contracts. As of July

29, 2006, the Company had entered into forward sale and option agreements on certain publicly traded equity securities designated as fair

value hedges. The gains and losses due to changes in the value of the hedging instruments are included in other income, net, in the

Consolidated Statements of Operations and offset the change in the fair value of the underlying hedged investment. As of July 29, 2006,

the notional and fair value amounts of the derivatives were $164 million and $93 million, respectively. As of July 30, 2005, the notional and

fair value amounts of the derivatives were $198 million and $19 million, respectively.

Legal Proceedings

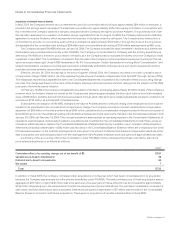

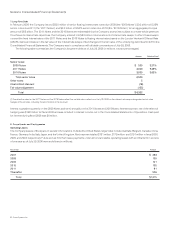

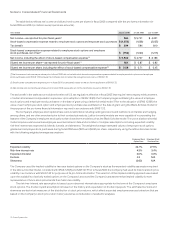

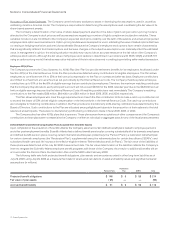

Beginning on April 20, 2001, a number of purported shareholder class action lawsuits were led in the United States District Court for the

Northern District of California against the Company and certain of its officers and directors. The lawsuits were consolidated, and the

consolidated action is purportedly brought on behalf of those who purchased the Company’s publicly traded securities during an alleged

class period of November 10, 1999 through February 6, 2001. Plaintiffs allege that defendants have made false and misleading statements,

purport to assert claims for violations of the federal securities laws, and seek unspecied compensatory damages and other relief. On

August 18, 2006, the Company announced an agreement to resolve the litigation. Pursuant to that agreement (which is subject to nal

documentation and court approval), liability insurers will pay $91.75 million to the plaintiffs in resolution of all claims against the Company

and its ofcers and directors. If the settlement is approved by the Court, the settlement fund, less fees and expenses, will be distributed to

purchasers of Cisco common stock between November 10, 1999 and February 6, 2001 who timely le valid proofs of claim under procedures

to be implemented by the Court. The Company and the individual defendants continue to deny all allegations in the lawsuit.

On February 16, 2005, a purported shareholder derivative lawsuit was led in the Superior Court of California, County of Santa Clara,

against various of the Company’s ofcers and directors and naming the Company as a nominal defendant. The lawsuit includes derivative

and class claims for breach of duciary duty, unjust enrichment, constructive trust and violations of the California Corporations Code, is based

upon allegations of wrongdoing in connection with option grants and compensation to ofcers and directors, the timing of option grants,

and the Company’s share repurchase plan, and seeks unspecied compensation and other damages, rescission of options and other relief.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business, including

intellectual property litigation. While the outcome of these matters is currently not determinable, the Company does not expect that the

ultimate costs to resolve these matters will have a material adverse effect on the Company’s consolidated nancial position, results of

operations, or cash ows.

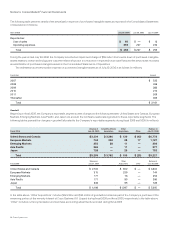

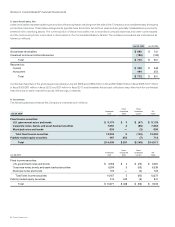

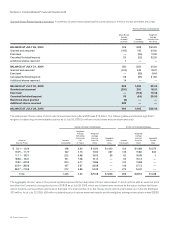

9. Shareholders’ Equity

Stock Repurchase Program

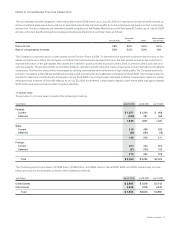

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 29, 2006, the Company’s Board of

Directors had authorized an aggregate repurchase of up to $40 billion of common stock under this program. During scal 2006, the Company

repurchased and retired 435 million shares of Cisco common stock at an average price of $19.07 per share for an aggregate purchase

price of $8.3 billion. As of July 29, 2006, the Company had repurchased and retired 1.9 billion shares of Cisco common stock at an average

price of $18.36 per share for an aggregate purchase price of $35.4 billion since inception of the stock repurchase program, and the remaining

authorized amount for stock repurchases under this program was $4.6 billion with no termination date.

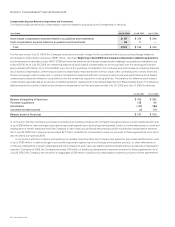

The purchase price for the shares of the Company’s stock repurchased was reected as a reduction to shareholders’ equity. In accordance

with Accounting Principles Board Opinion No. 6, “Status of Accounting Research Bulletins,” the Company is required to allocate the purchase

price of the repurchased shares as (i) a reduction to retained earnings until retained earnings are zero and then as an increase to accumulated

decit and (ii) a reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benet related to employee

stock option plans are recorded as an increase to common stock and additional paid-in capital.

Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights, preferences, and terms of the

Company’s authorized but unissued shares of preferred stock.

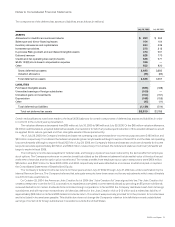

Notes to Consolidated Financial Statements