Cisco 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 69

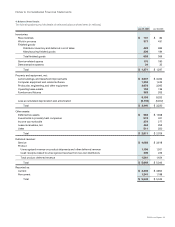

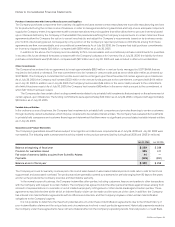

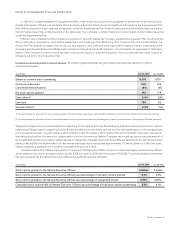

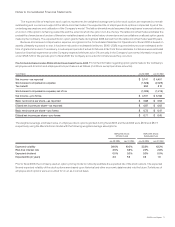

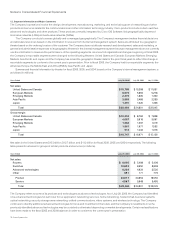

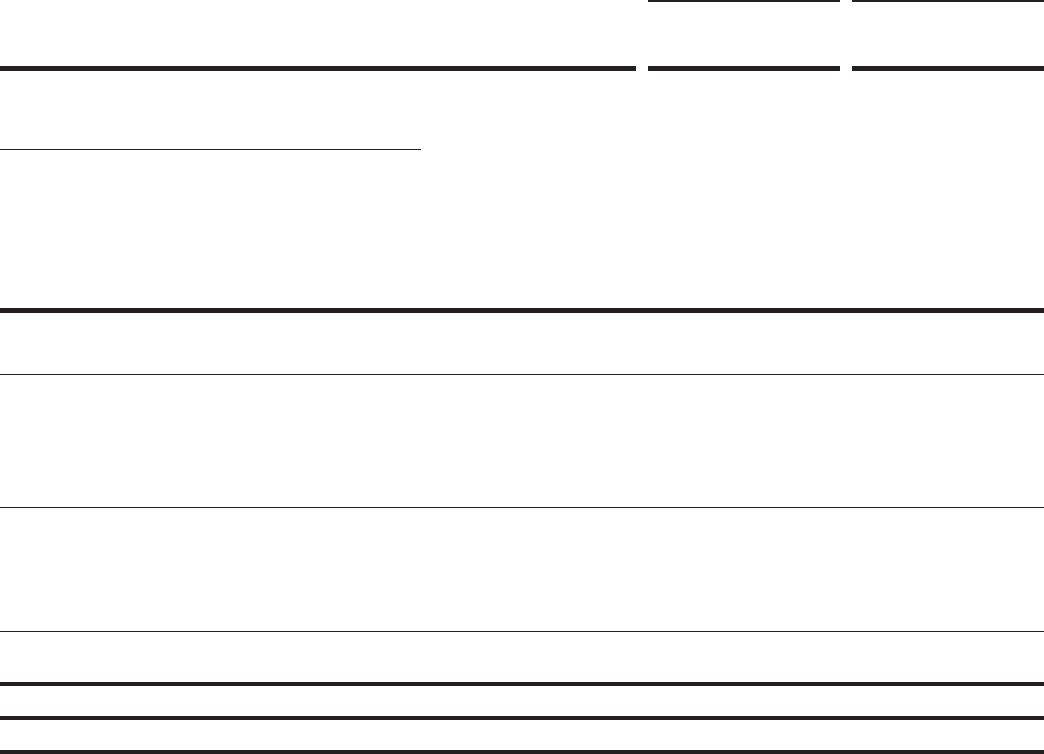

The following table presents the option exercises for the year ended July 29, 2006, and option values as of that date for the Named

Executive Ofcers (in millions):

NUMBER OF SECURITIES

UNDERLYING UNEXERCISED

OPTIONS AT JULY 29, 2006

INTRINSIC VALUE OF

UNEXERCISED IN-THE-MONEY

OPTIONS AT JULY 29, 2006

Number

of Shares

Acquired on

Exercise

Value

Realized Exercisable Unexercisable Exercisable Unexercisable

Named Executive Officers 7 $88 39 10 $52 $ 8

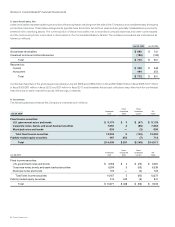

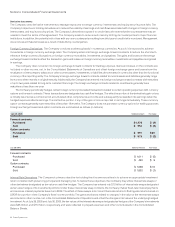

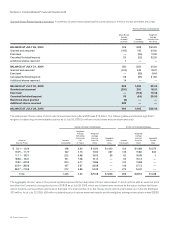

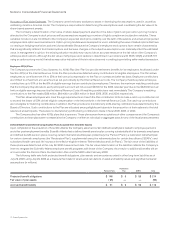

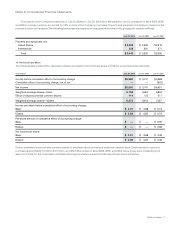

Valuation and Expense Information Under SFAS 123(R) On July 31, 2005, the Company adopted SFAS 123(R), which requires the

measurement and recognition of compensation expense for all share-based payment awards made to the Company’s employees and

directors including employee stock options and employee stock purchases based on estimated fair values. Stock-based compensation

expense related to employee stock options and employee stock purchases under SFAS 123(R) for scal 2006 was allocated as follows

(in millions except per-share amounts):

Amount

Cost of sales—product $ 50

Cost of sales—service 112

Stock-based compensation expense included in cost of sales 162

Research and development 346

Sales and marketing 427

General and administrative 115

Stock-based compensation expense included in operating expenses 888

Total stock-based compensation expense related to employee stock options

and employee stock purchases 1,050

Tax benefit (294)

Stock-based compensation expense related to employee stock options and

employee stock purchases, net of tax $ 756

Effect of SFAS 123(R) on basic earnings per share $ 0.12

Effect of SFAS 123(R) on diluted earnings per share $ 0.12

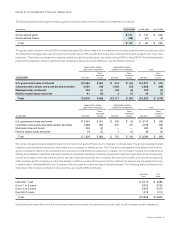

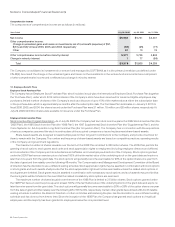

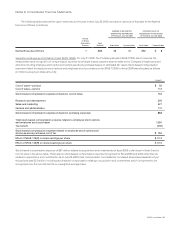

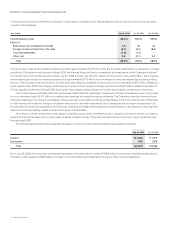

Stock-based compensation expense of $87 million related to acquisitions and investments for scal 2006 is disclosed in Note 3 and is

not included in the above table. There was no stock-based compensation expense recognized for scal 2005 and 2004 other than as

related to acquisitions and investments. As of July 29, 2006, total compensation cost related to nonvested share-based awards not yet

recognized was $2.0 billion, including stock-based compensation relating to acquisition and investments, which is expected to be

recognized over the next 39 months on a weighted-average basis.

Notes to Consolidated Financial Statements