Cisco 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 51

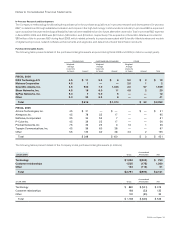

Upon adoption of SFAS 123(R), the Company also changed its method of valuation for share-based awards granted beginning in scal

2006 to a lattice-binomial option-pricing model (“lattice-binomial model”) from the Black-Scholes option-pricing model (“Black-Scholes

model”) which was previously used for the Company’s pro forma information required under SFAS 123. For additional information, see

Note 10 to the Consolidated Financial Statements. The Company’s determination of fair value of share-based payment awards on the date of

grant using an option-pricing model is affected by the Company’s stock price as well as assumptions regarding a number of highly complex

and subjective variables. These variables include, but are not limited to, the Company’s expected stock price volatility over the term of the

awards, and actual and projected employee stock option exercise behaviors. Option-pricing models were developed for use in estimating

the value of traded options that have no vesting or hedging restrictions and are fully transferable. Because the Company’s employee stock

options have certain characteristics that are signicantly different from traded options, and because changes in the subjective assumptions

can materially affect the estimated value, in management’s opinion, the existing valuation models may not provide an accurate measure of

the fair value of the Company’s employee stock options. Although the fair value of employee stock options is determined in accordance

with SFAS 123(R) and SAB 107 using an option-pricing model, that value may not be indicative of the fair value observed in a willing buyer/

willing seller market transaction.

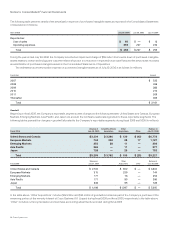

On November 10, 2005, the Financial Accounting Standards Board (FASB) issued FASB Staff Position No. FAS 123(R)-3 “Transition

Election Related to Accounting for Tax Effects of Share-Based Payment Awards.” The Company has elected to adopt the alternative transition

method provided in the FASB Staff Position for calculating the tax effects of stock-based compensation pursuant to SFAS 123(R). The

alternative transition method includes simplied methods to establish the beginning balance of the additional paid-in capital pool (“APIC

pool”) related to the tax effects of employee stock-based compensation, and to determine the subsequent impact on the APIC pool and

Consolidated Statements of Cash Flows of the tax effects of employee stock-based compensation awards that are outstanding upon

adoption of SFAS 123(R).

Recent Accounting Pronouncement In July 2006, the FASB issued Financial Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes-an interpretation of FASB Statement No. 109” (“FIN 48”), which is a change in accounting for income taxes. FIN 48 species how tax

benets for uncertain tax positions are to be recognized, measured, and derecognized in nancial statements; requires certain disclosures

of uncertain tax matters; species how reserves for uncertain tax positions should be classied on the balance sheet; and provides transition

and interim period guidance, among other provisions. FIN 48 is effective for scal years beginning after December 15, 2006 and as a result,

is effective for the Company in the rst quarter of scal 2008. The Company is currently evaluating the impact of FIN 48 on its Consolidated

Financial Statements.

Reclassifications Certain reclassications have been made to prior year balances in order to conform to the current year’s presentation.

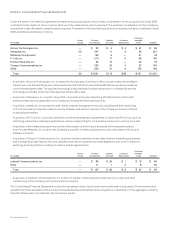

3. Business Combinations

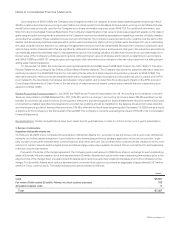

Acquisition of Scientific-Atlanta, Inc.

On February 24, 2006, Cisco completed the acquisition of Scientic-Atlanta, Inc., a provider of set-top boxes, end-to-end video distribution

networks, and video system integration. Cisco believes video is emerging as the key strategic application in the service provider “triple

play” bundle of consumer entertainment, communications, and online services. Cisco believes the combined entity creates an end-to-end

solution for carrier networks and the digital home and delivers large-scale video systems to extend Cisco’s commitment to and leadership

in the service provider market.

Pursuant to the terms of the merger agreement, the Company paid a cash amount of $43.00 per share in exchange for each outstanding

share of Scientic-Atlanta common stock and assumed each Scientic-Atlanta stock option which was outstanding immediately prior to the

effective time of the merger. Each unvested Scientic-Atlanta stock option became fully vested immediately prior to the completion of the

merger. The Scientic-Atlanta stock options assumed were converted into options to purchase an aggregate of approximately 32.1 million

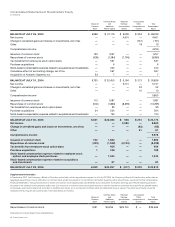

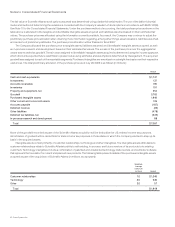

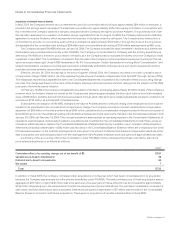

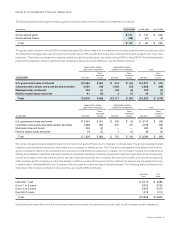

shares of Cisco common stock. The total purchase price was as follows (in millions):

Amount

Cash $ 6,907

Fair value of fully-vested Scientific-Atlanta, Inc. stock options assumed 163

Acquisition-related costs 17

Total $ 7,087

Notes to Consolidated Financial Statements