Cisco 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Cisco Systems, Inc.

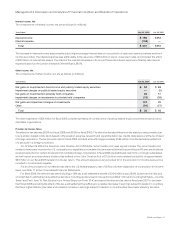

Warranty Costs

The liability for product warranties, included in other accrued liabilities, was $309 million as of July 29, 2006, compared with $259 million

as of July 30, 2005. See Note 8 to the Consolidated Financial Statements. Our products are generally covered by a warranty for periods

ranging from 90 days to ve years, and for some products we provide a limited lifetime warranty. We accrue for warranty costs as part of our

cost of sales based on associated material costs, technical support labor costs, and associated overhead. Material cost is estimated based

primarily upon historical trends in the volume of product returns within the warranty period and the cost to repair or replace the equipment.

Technical support labor cost is estimated based primarily upon historical trends in the rate of customer cases and the cost to support the

customer cases within the warranty period. Overhead cost is applied based on estimated time to support warranty activities.

The provision for product warranties issued during scal 2006 and 2005 was $395 million and $411 million, respectively. The decrease

in the provision for product warranties was due to lower warranty claims partially offset by higher shipment volume of our products. If we

experience an increase in warranty claims compared with our historical experience, or if the cost of servicing warranty claims is greater than

the expectations on which the accrual has been based, our gross margin could be adversely affected.

Stock-Based Compensation Expense

On July 31, 2005, we adopted SFAS 123(R) which requires the measurement and recognition of compensation expense for all share-based

payment awards made to our employees and directors including employee stock options and employee stock purchases related to the

Employee Stock Purchase Plan (“employee stock purchases”) based on estimated fair values. Stock-based compensation expense recognized

under SFAS 123(R) for scal 2006 was $1.1 billion, which consisted of stock-based compensation expense related to employee stock

options and employee stock purchases of $1.0 billion, and stock-based compensation expense related to acquisitions and investments of

$87 million. For scal 2005 and scal 2004, stock-based compensation expense of $154 million and $244 million, respectively, was related to

acquisitions and investments which we had been recognizing under previous accounting standards. There was no stock-based compensation

expense related to employee stock options and employee stock purchases recognized during scal 2005 and scal 2004. See Note 10

to the Consolidated Financial Statements for additional information.

Upon adoption of SFAS 123(R), we began estimating the value of employee stock options on the date of grant using a lattice-binomial

model. Prior to the adoption of SFAS 123(R), the value of each employee stock option was estimated on the date of grant using the Black-Scholes

model for the purpose of the pro forma nancial information provided in accordance with SFAS 123. The determination of fair value of

share-based payment awards on the date of grant using an option-pricing model is affected by our stock price as well as assumptions

regarding a number of highly complex and subjective variables. These variables include, but are not limited to, the expected stock price

volatility over the term of the awards, and actual and projected employee stock option exercise behaviors. The use of a lattice-binomial

model requires extensive actual employee exercise behavior data and a number of complex assumptions including expected volatility,

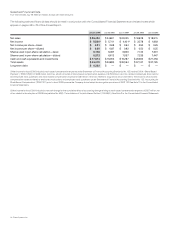

risk-free interest rate, expected dividends, kurtosis, and skewness. The weighted-average estimated value of employee stock options

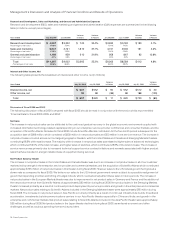

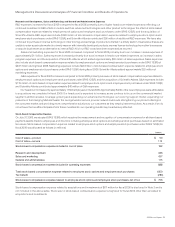

granted during scal 2006 was $5.15 per share, using the lattice-binomial model with the following weighted-average assumptions:

Weighted-

Average

Assumptions

Expected volatility 23.7%

Risk-free interest rate 4.3%

Expected dividend 0.0%

Kurtosis 4.3

Skewness (0.62)

We used the implied volatility for two-year traded options on our stock as the expected volatility assumption required in the lattice-binomial

model consistent with SFAS 123(R) and SAB 107. Prior to scal 2006, we had used our historical stock price volatility in accordance with

SFAS 123 for purposes of our pro forma information. The selection of the implied volatility approach was based upon the availability of

actively traded options on our stock and also upon our assessment that implied volatility is more representative of future stock price trends

than historical volatility. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of our employee

stock options. The dividend yield assumption is based on the history and expectation of dividend payouts. The estimated kurtosis and

skewness are technical measures of the distribution of stock price returns, which affect expected employee exercise behaviors that are

based on our stock price return history as well as consideration of academic analyses. Because stock-based compensation expense

recognized in the Consolidated Statement of Operations for scal 2006 is based on awards ultimately expected to vest, it has been reduced

for estimated forfeitures. SFAS 123(R) requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent

periods if actual forfeitures differ from those estimates. Forfeitures were estimated based on historical experience.If factors change and

we employ different assumptions in the application of SFAS 123(R) in future periods, the compensation expense that we record under

SFAS 123(R) may differ signicantly from what we have recorded in the current period.

Management’s Discussion and Analysis of Financial Condition and Results of Operations