Cisco 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

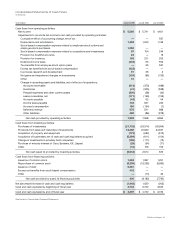

2006 Annual Report 35

Subsequent to the adoption of FIN 46(R), changes to the value of Andiamo and the continued vesting of the employee stock and

options resulted in an adjustment to the noncash stock compensation charge. We recorded a noncash variable stock compensation

adjustment of $58 million in the third quarter of scal 2004 to the cumulative stock compensation charge recorded in the second quarter

of scal 2004 to account for the additional vesting of the Andiamo employee stock and options and changes in the formula-based valuation

from January 24, 2004 until February 19, 2004. This noncash adjustment was reported as R&D expense of $52 million and sales and marketing

expense of $6 million in the Consolidated Statements of Operations, as stock-based compensation related to acquisitions and investments

in the Consolidated Statements of Cash Flows, and as an increase to additional paid-in capital in the Consolidated Statements of Shareholders’

Equity. In addition, upon completion of the acquisition, deferred stock-based compensation of $90 million was recorded to reect the unvested

portion of the formula-based valuation of the Andiamo employee stock and options. See Note 3 to the Consolidated Financial Statements.

The amount of deferred stock-based compensation was xed at the date of acquisition and was being amortized over the vesting period

of the Andiamo employee stock and options of approximately two years.

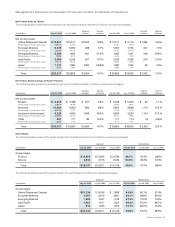

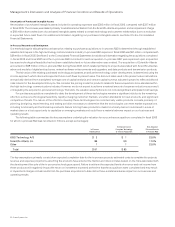

A summary of the accounting of the initial consolidation under FIN 46(R) and the subsequent purchase of Andiamo, after stock

price-related adjustments, is as follows (in millions):

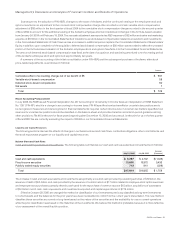

Amount

Cumulative effect of accounting change, net of tax benefit of $5 $ 567

Variable stock-based compensation 58

Deferred stock-based compensation 90

Net assets 7

Total $ 722

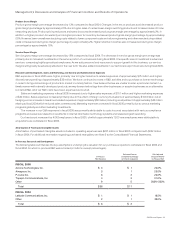

Recent Accounting Pronouncement

In July 2006, the FASB issued Financial Interpretation No. 48, “Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement

No. 109” (“FIN 48”), which is a change in accounting for income taxes. FIN 48 species how tax benets for uncertain tax positions are to

be recognized, measured, and derecognized in nancial statements; requires certain disclosures of uncertain tax matters; species how

reserves for uncertain tax positions should be classied on the balance sheet; and provides transition and interim-period guidance, among

other provisions. FIN 48 is effective for scal years beginning after December 15, 2006 and as a result, is effective for us in the rst quarter

of scal 2008. We are currently evaluating the impact of FIN 48 on our Consolidated Financial Statements.

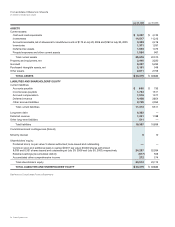

Liquidity and Capital Resources

The following sections discuss the effects of changes in our balance sheet and cash ows, contractual obligations, other commitments, and

the stock repurchase program on our liquidity and capital resources.

Balance Sheet and Cash Flows

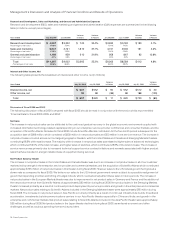

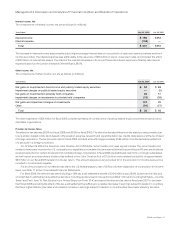

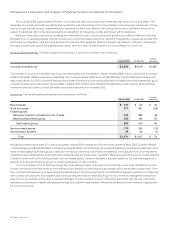

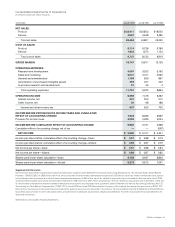

Cash and Cash Equivalents and Investments The following table summarizes our cash and cash equivalents and investments (in millions):

July 30, 2005

Increase

(Decrease)July 29, 2006

Cash and cash equivalents $ 3,297 $ 4,742 $ (1,445)

Fixed income securities 13,805 10,372 3,433

Publicly traded equity securities 712 941 (229)

Total $ 17,814 $ 16,055 $ 1,759

The increase in cash and cash equivalents and investments was primarily a result of cash provided by operating activities of $7.9 billion, the

issuance of debt of $6.5 billion, and cash provided by the issuance of common stock of $1.7 billion related to employee stock option exercises

and employee stock purchases, partially offset by cash used for the repurchase of common stock of $8.3 billion, acquisitions of businesses

of $5.3 billion net of cash, cash equivalents, and investments acquired, and capital expenditures of $772 million.

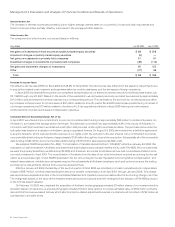

Effective October 29, 2005, we changed the method of classication of our investments previously classied as long-term investments

to current assets, and the balances for the prior years have been reclassied to conform to the current year’s presentation. This new method

classies these securities as current or long-term based on the nature of the securities and the availability for use in current operations

while the prior classication was based on the maturities of the investments. We believe this method is preferable because it is more reective

of our assessment of the overall liquidity position.

Management’s Discussion and Analysis of Financial Condition and Results of Operations