Cisco 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Cisco Systems, Inc.

Interest Income, Net

The increase in interest income was primarily due to higher average interest rates on our portfolio of cash and cash equivalents and

xed-income securities, partially offset by a decrease in the average portfolio balance.

Other Income, Net

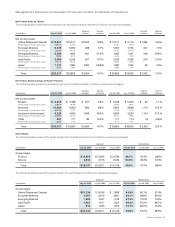

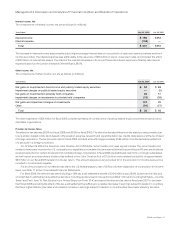

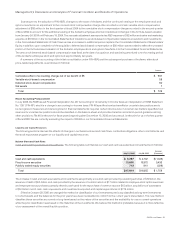

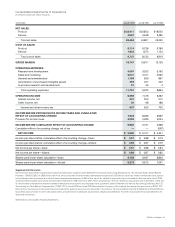

The components of other income, net, are as follows (in millions):

Years Ended July 30, 2005 July 31, 2004

Net gains on investments in fixed income and publicly traded equity securities $ 88 $ 206

Impairment charges on publicly traded equity securities (5) —

Net gains on investments in privately held companies 51 61

Impairment charges on investments in privately held companies (39) (112)

Net gains and impairment charges on investments 95 155

Other (27) 33

Total $ 68 $ 188

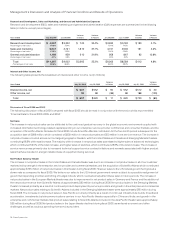

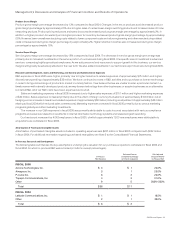

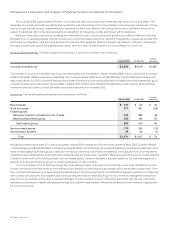

Provision for Income Taxes

The effective tax rate was 28.6% for scal 2005 and 28.9% for scal 2004. The effective tax rate differs from the statutory rate primarily due

to acquisition-related costs, research and experimentation tax credits, state taxes, and the tax impact of foreign operations.

In scal 2005, the Internal Revenue Service completed its examination of our federal income tax returns for the scal years ended July

25, 1998 through July 28, 2001. Based on the results of the examination, we decreased previously recorded tax reserves by approximately

$110 million and decreased income tax expense by a corresponding amount. This decrease to the provision for income taxes was offset

by increases to the provision for income taxes of $57 million related to a fourth quarter scal 2005 intercompany restructuring of certain of

our foreign operations and $70 million related to the effect of U.S. tax regulations effective in scal 2005 that require intercompany

reimbursement of certain stock-based compensation expenses.

Cumulative Effect of Accounting Change, Net of Tax

In April 2001, we entered into a commitment to provide convertible debt funding of approximately $84 million to Andiamo Systems, Inc.

(“Andiamo”), a privately held storage switch developer. This debt was convertible into approximately 44% of the equity of Andiamo. In

connection with this investment, we obtained a call option that provided us the right to purchase Andiamo. The purchase price under the

call option was based on a valuation of Andiamo using a negotiated formula. On August 19, 2002, we entered into a denitive agreement

to acquire Andiamo, which represented the exercise of our rights under the call option. We also entered into a commitment to provide

nonconvertible debt funding to Andiamo of approximately $100 million through the close of the acquisition. Substantially all of the convertible

debt funding of $84 million and nonconvertible debt funding of $100 million was expensed as R&D costs.

We adopted FASB Interpretation No. 46(R), “Consolidation of Variable Interest Entities” (“FIN 46(R)”), effective January 24, 2004. We

evaluated our debt investment in Andiamo and determined that Andiamo was a variable interest entity under FIN 46(R). We concluded that

we were the primary beneciary as dened by FIN 46(R) and, therefore, accounted for Andiamo as if we had consolidated Andiamo since

our initial investment in April 2001. The consolidation of Andiamo from the date of our initial investment required accounting for the call

option as a repurchase right. Under FASB Interpretation No. 44, “Accounting for Certain Transactions Involving Stock Compensation,” and

related interpretations, variable accounting was required for substantially all Andiamo employee stock and options because the ending

purchase price was primarily derived from a revenue-based formula.

Effective January 24, 2004, the last day of the second quarter of scal 2004, we recorded a noncash cumulative stock compensation

charge of $567 million, net of tax (representing the amount of variable compensation from April 2001 through January 2004). This charge

was reported as a separate line item in the Consolidated Statements of Operations as a cumulative effect of accounting change, net of tax.

The charge was based on the value of the Andiamo employee stock and options and their vesting from the adoption of FIN 46(R) pursuant

to the formula-based valuation.

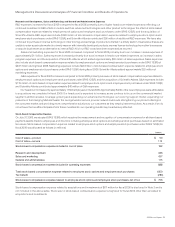

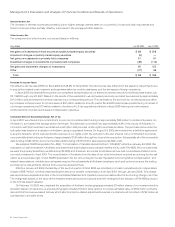

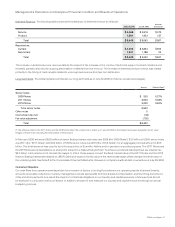

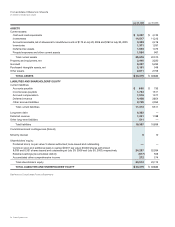

On February 19, 2004, we completed the acquisition of Andiamo, exchanging approximately 23 million shares of our common stock for

Andiamo shares not owned by us and assuming approximately 6 million stock options, for a total estimated value of $750 million, primarily

derived from the revenue-based formula, which after stock price-related adjustments resulted in a total amount recorded of $722 million as

summarized in the table below.

Management’s Discussion and Analysis of Financial Condition and Results of Operations