Cisco 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Cisco Systems, Inc.

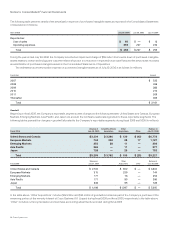

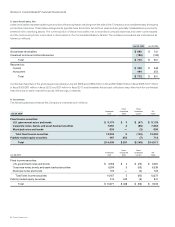

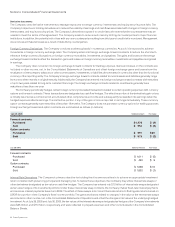

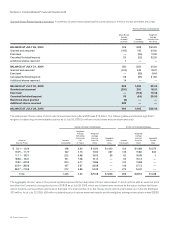

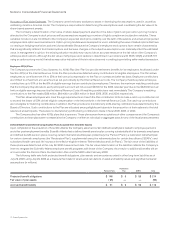

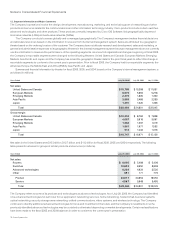

Comprehensive Income

The components of comprehensive income are as follows (in millions):

Years Ended July 29, 2006 July 30, 2005 July 31, 2004

Net income $ 5,580 $ 5,741 $ 4,401

Other comprehensive income:

Change in unrealized gains and losses on investments, net of tax benefit (expense) of $57,

$(61), and $42 in fiscal 2006, 2005, and 2004, respectively (64) (25) (77)

Other 61 10 19

Other comprehensive income before minority interest 5,577 5,726 4,343

Change in minority interest 1 77 (84)

Total $ 5,578 $ 5,803 $ 4,259

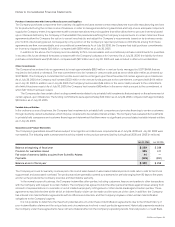

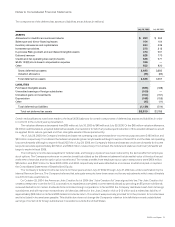

The Company consolidates its investment in a venture fund managed by SOFTBANK as it is the primary beneciary as dened under

FIN 46(R). As a result, the change in the unrealized gains and losses on the investments in the venture fund are recorded as a component

of other comprehensive income and is reected as a change in minority interest.

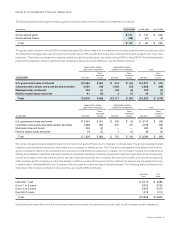

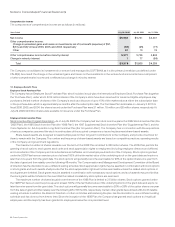

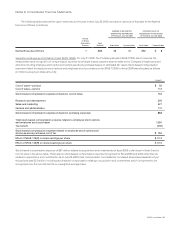

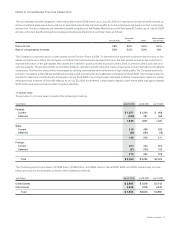

10. Employee Benefit Plans

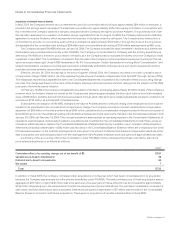

Employee Stock Purchase Plan

The Company has an Employee Stock Purchase Plan, which includes its sub-plan, the International Employee Stock Purchase Plan (together,

the “Purchase Plan”), under which 321.4 million shares of the Company’s stock have been reserved for issuance. Eligible employees may

purchase a limited number of shares of the Company’s stock at a discount of up to 15% of the market value at either the subscription date

or the purchase date, which is approximately six months after the subscription date. The Purchase Plan terminates on January 3, 2010. In

scal 2006, 2005, and 2004, the shares issued under the Purchase Plan were 21 million, 19 million, and 26 million shares, respectively. At

July 29, 2006, 99 million shares were available for issuance under the Purchase Plan.

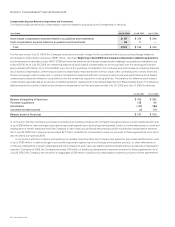

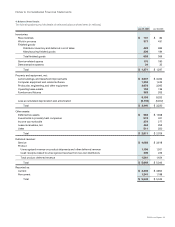

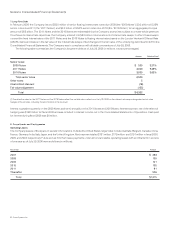

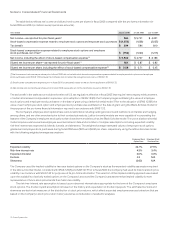

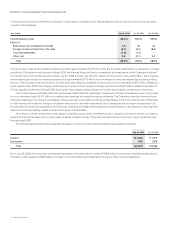

Employee Stock Incentive Plans

Stock Incentive Plan Program Description As of July 29, 2006, the Company had four stock incentive plans: the 2005 Stock Incentive Plan (the

“2005 Plan”), the 1996 Stock Incentive Plan (the “1996 Plan”), the 1997 Supplemental Stock Incentive Plan (the “Supplemental Plan”), and the

Cisco Systems, Inc. SA Acquisition Long-Term Incentive Plan (the “Acquisition Plan”). The Company has, in connection with the acquisitions

of various companies, assumed the stock incentive plans of the acquired companies or issued replacement share-based awards.

Share-based awards are designed to reward employees for their long-term contributions to the Company and provide incentives for

them to remain with the Company. The number and frequency of share-based awards are based on competitive practices, operating results

of the Company, and government regulations.

The maximum number of shares issuable over the term of the 2005 Plan is limited to 350 million shares. The 2005 Plan permits the

granting of stock options, stock grants, stock units and stock appreciation rights to employees (including employee directors and ofcers)

and consultants of the Company and its subsidiaries and afliates, and nonemployee directors of the Company. Stock options granted

under the 2005 Plan have an exercise price of at least 100% of the fair market value of the underlying stock on the grant date and expire no

later than nine years from the grant date. The stock options will generally become exercisable for 20% of the option shares one year from

the date of grant and then ratably over the following 48 months. The Compensation and Management Development Committee of the Board

of Directors has the discretion to use a different vesting schedule. Stock appreciation rights may be awarded in combination with stock options

or stock grants and such awards shall provide that the stock appreciation rights will not be exercisable unless the related stock options or

stock grants are forfeited. Stock grants may be awarded in combination with nonstatutory stock options, and such awards may provide that

the stock grants will be forfeited in the event that the related nonstatutory stock options are exercised.

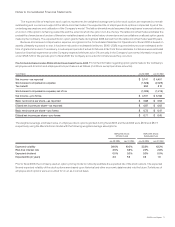

The maximum number of shares issuable over the term of the 1996 Plan is limited to 2.5 billion shares. Stock options granted under

the 1996 Plan have an exercise price equal of at least 100% of the fair market value of the underlying stock on the grant date and expire no

later than nine years from the grant date. The stock options will generally become exercisable for 20% or 25% of the option shares one year

from the date of grant and then ratably over the following 48 or 36 months, respectively. Certain other grants have utilized a 60-month ratable

vesting schedule. In addition, the Board of Directors, or other committee administering the plan, has the discretion to use a different vesting

schedule and has done so from time to time. Since the inception of the 1996 Plan, the Company has granted stock options to virtually all

employees, and the majority has been granted to employees below the vice president level.

Notes to Consolidated Financial Statements