Cisco 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 2006 Annual Report 23

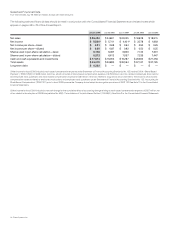

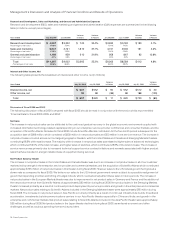

Investment Impairments

Our publicly traded equity securities are reected in the Consolidated Balance Sheets at a fair value of $712 million as of July 29, 2006,

compared with $941 million as of July 30, 2005. See Note 6 to the Consolidated Financial Statements. We recognize an impairment charge

when the declines in the fair values of our publicly traded equity securities below their cost basis are judged to be other-than-temporary.

The ultimate value realized on these equity securities, to the extent unhedged, is subject to market price volatility until they are sold. We

consider various factors in determining whether we should recognize an impairment charge, including the length of time and extent to which

the fair value has been less than our cost basis, the nancial condition and near-term prospects of the investee, and our intent and ability to

hold the investment for a period of time sufcient to allow for any anticipated recovery in market value. Our ongoing consideration of these

factors could result in additional impairment charges in the future, which could adversely affect our net income. Our impairment charge on

investments in publicly held companies was $5 million in scal 2005. There were no impairment charges on investments in publicly held

companies in scal 2006 or scal 2004.

We also have investments in privately held companies, some of which are in the startup or development stages. As of July 29, 2006, our

investments in privately held companies were $574 million, compared with $421 million as of July 30, 2005, and were included in other assets.

See Note 4 to the Consolidated Financial Statements. We monitor these investments for impairment and make appropriate reductions in

carrying values if we determine an impairment charge is required, based primarily on the nancial condition and near-term prospects of

these companies. These investments are inherently risky because the markets for the technologies or products these companies are

developing are typically in the early stages and may never materialize. Our impairment charges on investments in privately held companies

were $15 million, $39 million, and $112 million during scal 2006, 2005, and 2004, respectively.

Goodwill Impairments

Our methodology for allocating the purchase price relating to purchase acquisitions is determined through established valuation techniques

in the high-technology communications industry. Goodwill is measured as the excess of the cost of acquisition over the sum of the amounts

assigned to tangible and identiable intangible assets acquired less liabilities assumed. We perform goodwill impairment tests on an annual

basis and between annual tests in certain circumstances for each reporting unit. The goodwill recorded in the Consolidated Balance Sheets

as of July 29, 2006 and July 30, 2005 was $9.2 billion and $5.3 billion, respectively. In response to changes in industry and market conditions,

we could be required to strategically realign our resources and consider restructuring, disposing of, or otherwise exiting businesses, which

could result in an impairment of goodwill. Beginning in scal 2006, the reportable segments were changed to the following theaters: United

States and Canada; European Markets; Emerging Markets; Asia Pacic; and Japan. As a result, we reallocated goodwill to these reportable

segments. There was no impairment of goodwill in scal 2006, 2005, and 2004.

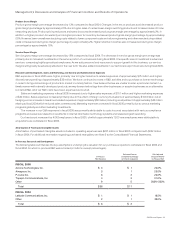

Income Taxes

We are subject to income taxes in both the United States and numerous foreign jurisdictions. Signicant judgment is required in evaluating

our tax positions and determining our provision for income taxes.

During the ordinary course of business, there are many transactions and calculations for which the ultimate tax determination is uncertain.

We establish reserves for tax-related uncertainties based on estimates of whether, and the extent to which, additional taxes and interest will

be due. These reserves are established when, despite our belief that our tax return positions are fully supportable, we believe that certain

positions are likely to be challenged and may not be fully sustained on review by tax authorities. We adjust these reserves in light of changing

facts and circumstances, such as the closing of a tax audit or the renement of an estimate. Although we believe our reserves are reasonable,

no assurance can be given that the nal tax outcome of these matters will not be different from that which is reected in our historical income

tax provisions and accruals. To the extent that the nal tax outcome of these matters is different than the amounts recorded, such differences

will impact the provision for income taxes in the period in which such determination is made. The provision for income taxes includes the

impact of reserve provisions and changes to reserves that are considered appropriate, as well as the related net interest.

Signicant judgment is also required in determining any valuation allowance recorded against deferred tax assets. In assessing the

need for a valuation allowance, we consider all available evidence including past operating results, estimates of future taxable income, and

the feasibility of tax planning strategies. In the event that we change our determination as to the amount of deferred tax assets that can be

realized, we will adjust our valuation allowance with a corresponding impact to the provision for income taxes in the period in which such

determination is made.

Management’s Discussion and Analysis of Financial Condition and Results of Operations