Cisco 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Cisco Systems, Inc.

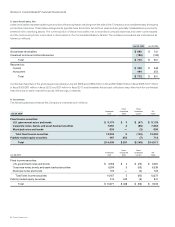

Minority Interest The Company consolidates its investment in a venture fund managed by SOFTBANK Corp. and its afliates (“SOFTBANK”).

As of July 29, 2006, minority interest of $6 million represents SOFTBANK’s share of the venture fund.

Use of Estimates The preparation of nancial statements and related disclosures in conformity with accounting principles generally accepted

in the United States requires management to make estimates and judgments that affect the amounts reported in the Consolidated Financial

Statements and accompanying notes. Estimates are used for revenue recognition, allowance for doubtful accounts and sales returns,

allowance for inventory and liability for purchase commitments with contract manufacturers and suppliers, warranty costs, stock-based

compensation expense, investment impairments, goodwill impairments, income taxes, and loss contingencies, among others. The actual

results experienced by the Company may differ materially from management’s estimates.

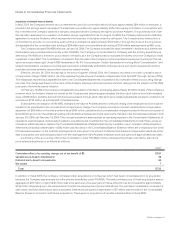

Stock-Based Compensation Expense On July 31, 2005, the Company adopted Statement of Financial Accounting Standards No. 123

(revised 2004), “Share-Based Payment,” (“SFAS 123(R)”) which requires the measurement and recognition of compensation expense for all

share-based payment awards made to employees and directors including employee stock options and employee stock purchases related

to the Employee Stock Purchase Plan (“employee stock purchases”) based on estimated fair values. SFAS 123(R) supersedes the Company’s

previous accounting under Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”) beginning

in scal 2006. In March 2005, the Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin No. 107 (“SAB 107”) relating

to SFAS 123(R). The Company has applied the provisions of SAB 107 in its adoption of SFAS 123(R).

The Company adopted SFAS 123(R) using the modied prospective transition method, which requires the application of the accounting

standard as of July 31, 2005, the rst day of the Company’s scal year 2006. The Company’s Consolidated Financial Statement for scal

2006 reects the impact of SFAS 123(R). In accordance with the modied prospective transition method, the Company’s Consolidated

Financial Statements for prior scal years have not been restated to reect, and do not include, the impact of SFAS 123(R). Stock-based

compensation expense recognized under SFAS 123(R) for scal 2006 was $1.1 billion, which consisted of stock-based compensation

expense related to employee stock options and employee stock purchases of $1.0 billion, and stock-based compensation expense related

to acquisitions and investments of $87 million. For scal 2005 and scal 2004, stock-based compensation expense of $154 million and

$244 million, respectively, was related to acquisitions and investments which the Company had been recognizing under previous accounting

standards. There was no stock-based compensation expense related to employee stock options and employee stock purchases recognized

during scal 2005 and scal 2004. See Note 10 to the Consolidated Financial Statements for additional information.

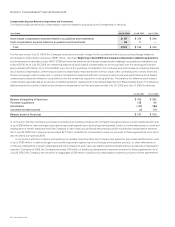

SFAS 123(R) requires companies to estimate the fair value of share-based payment awards on the date of grant using an option-pricing

model. The value of awards that are ultimately expected to vest is recognized as expense over the requisite service periods in the Company’s

Consolidated Statements of Operations. Prior to the adoption of SFAS 123(R), the Company accounted for stock-based awards to employees

and directors using the intrinsic value method in accordance with APB 25 as allowed under SFAS 123. Under the intrinsic value method, no

stock-based compensation expense had been recognized in the Company’s Consolidated Statement of Operations, other than as related

to acquisitions and investments, because the exercise price of the Company’s stock options granted to employees and directors equaled

the fair market value of the underlying stock at the date of grant.

Stock-based compensation expense recognized in the Company’s Consolidated Statement of Operations for scal 2006 included

compensation expense for share-based payment awards granted prior to, but not yet vested as of July 30, 2005 based on the grant date

fair value estimated in accordance with the pro forma provisions of SFAS 123 and compensation expense for the share-based payment

awards granted subsequent to July 30, 2005 based on the grant date fair value estimated in accordance with the provisions of SFAS 123(R).

In conjunction with the adoption of SFAS 123(R), the Company changed its method of attributing the value of stock-based compensation to

expense from the accelerated multiple-option approach to the straight-line single-option method. Compensation expense for all share-based

payment awards granted on or prior to July 30, 2005 will continue to be recognized using the accelerated multiple-option approach while

compensation expense for all share-based payment awards granted subsequent to July 30, 2005 is recognized using the straight-line

single-option method. Because stock-based compensation expense recognized in the Consolidated Statement of Operations for scal

2006 is based on awards ultimately expected to vest, it has been reduced for estimated forfeitures. SFAS 123(R) requires forfeitures to be

estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. In the

Company’s pro forma information required under SFAS 123 for the periods prior to scal 2006, the Company accounted for forfeitures as

they occurred.

Notes to Consolidated Financial Statements