Cisco 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

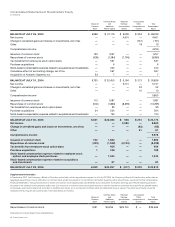

52 Cisco Systems, Inc.

The fair value of Scientic-Atlanta stock options assumed was determined using a lattice-binomial model. The use of the lattice-binomial

model and method of determining the variables is consistent with the Company’s valuation of stock options in accordance with SFAS 123(R).

See Note 10 to the Consolidated Financial Statements. Under the purchase method of accounting, the total purchase price as shown in the

table above is allocated to the tangible and identiable intangible assets acquired and liabilities assumed based on their estimated fair

values. The purchase price was allocated using the information currently available. As a result, the Company may continue to adjust the

preliminary purchase price allocation after obtaining more information regarding, among other things, asset valuations, liabilities assumed,

and revisions of preliminary estimates. The purchase price allocation will be nalized in scal 2007.

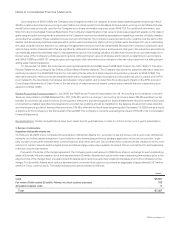

The Company allocated the purchase price to tangible assets, liabilities assumed, and identiable intangible assets acquired, as well

as in-process research and development, based on their estimated fair values. The excess of the purchase price over the aggregate fair

values was recorded as goodwill. The fair value assigned to identiable intangible assets acquired is determined using the income approach,

which discounts expected future cash ows to present value using estimates and assumptions determined by management. The acquired

goodwill was assigned to each of the reportable segments. Purchased intangibles are amortized on a straight-line basis over their respective

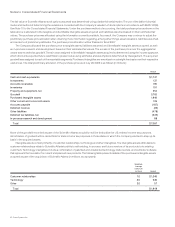

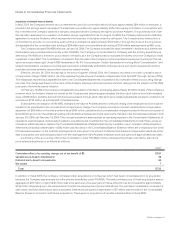

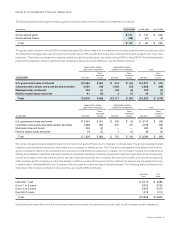

useful lives. The total preliminary allocation of the purchase price as of July 29, 2006 is as follows (in millions):

Amount

Cash and cash equivalents $ 1,747

Investments 137

Accounts receivable 195

Inventories 191

Property and equipment, net 254

Goodwill 3,762

Purchased intangible assets 1,949

Other current and noncurrent assets 106

Accounts payable (187)

Deferred revenue (32)

Other liabilities (478)

Deferred tax liabilities, net (645)

In-process research and development 88

Total $ 7,087

None of the goodwill recorded as part of the Scientic-Atlanta acquisition will be deductible for U.S. federal income tax purposes.

Amortization of goodwill will be deductible for state income tax purposes in those states in which the Company elected to step up its

basis in the acquired assets.

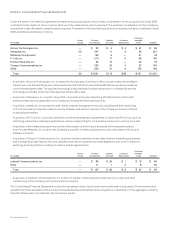

Intangible assets consist primarily of customer relationships, technology and other intangibles. The intangible assets attributable to

customer relationships relate to Scientic-Atlanta’s ability to sell existing, in-process, and future versions of its products to its existing

customers. Technology intangibles include a combination of patented and unpatented technology, trade secrets, and computer software

that represent the foundation for current and planned new products. The following table presents details of the purchased intangible assets

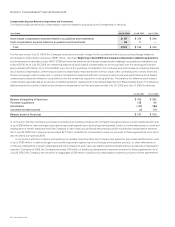

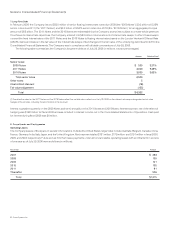

acquired as part of the acquisition of Scientic-Atlanta (in millions, except years):

Weighted-

Average

Useful Life

(in Years) Amount

Customer relationships 7.0 $ 1,346

Technology 3.5 546

Other 2.0 57

Total $ 1,949

Notes to Consolidated Financial Statements